Linklogis Inc. (HKG:9959) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

Linklogis Inc. (HKG:9959) shares have had a horrible month, losing 28% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 30% in the last year.

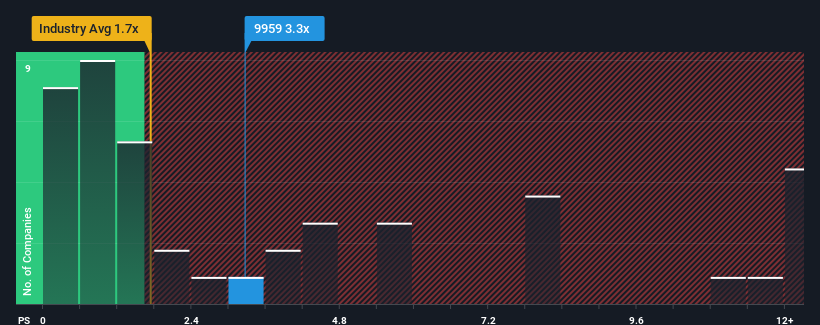

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Software industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider Linklogis as a stock to potentially avoid with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Linklogis

What Does Linklogis' P/S Mean For Shareholders?

Recent times have been advantageous for Linklogis as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Linklogis will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Linklogis would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Still, lamentably revenue has fallen 13% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 22% growth forecast for the broader industry.

In light of this, it's alarming that Linklogis' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

There's still some elevation in Linklogis' P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Linklogis trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Linklogis that you need to take into consideration.

If you're unsure about the strength of Linklogis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9959

Linklogis

An investment holding company, provides supply chain finance technology and data-driven emerging solutions in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives