- Hong Kong

- /

- Diversified Financial

- /

- SEHK:9923

Yeahka (HKG:9923) earnings and shareholder returns have been trending downwards for the last year, but the stock grows 8.7% this past week

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Yeahka Limited (HKG:9923) shareholders over the last year, as the share price declined 40%. That's disappointing when you consider the market declined 7.3%. Yeahka may have better days ahead, of course; we've only looked at a one year period. On the other hand the share price has bounced 8.7% over the last week.

While the stock has risen 8.7% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Yeahka

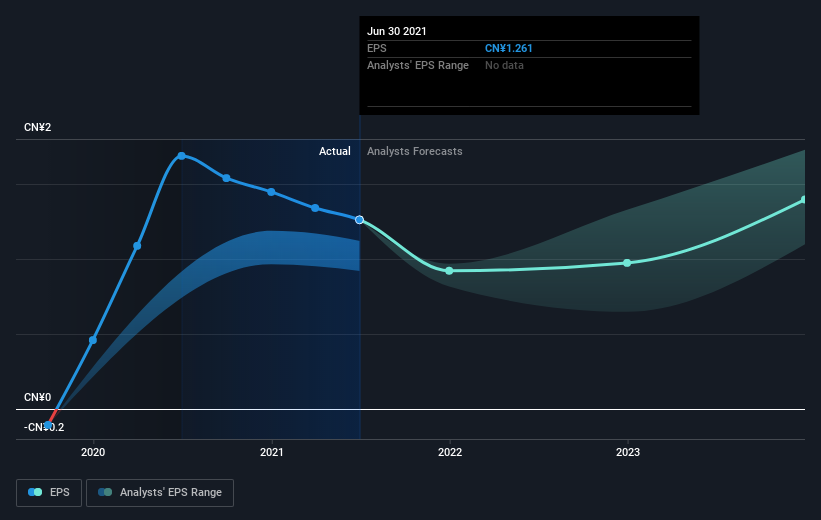

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Yeahka reported an EPS drop of 25% for the last year. This reduction in EPS is not as bad as the 40% share price fall. So it seems the market was too confident about the business, a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Yeahka's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Yeahka shareholders are down 40% for the year, even worse than the market loss of 7.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 0.6%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Yeahka better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Yeahka (including 1 which is a bit concerning) .

But note: Yeahka may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9923

Yeahka

An investment holding company, provides payment and business services to merchants and consumers in the People’s Republic of China.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026