As Asian markets experience a surge in bullish sentiment, particularly driven by advancements in artificial intelligence and domestic liquidity, investors are keenly observing the impact of these trends on high-growth technology stocks. In such an environment, identifying stocks with robust innovation potential and strong market positioning becomes crucial for those looking to capitalize on emerging opportunities within the tech sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.89% | 44.39% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.75% | 30.67% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Hancom (KOSDAQ:A030520)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hancom Inc. is a company that specializes in developing and selling office software products and solutions both in South Korea and internationally, with a market capitalization of approximately ₩635.33 billion.

Operations: The primary revenue stream for Hancom Inc. comes from its Non-Financial - SW Division, generating ₩185.71 billion. The company also earns from the Non-Financial - Manufacturing Sector and Non-Financial - Other Sectors, contributing ₩90.53 billion and ₩29.82 billion respectively.

Hancom, a player in the Asian tech landscape, showcases a mixed financial tableau with an annual revenue growth rate of 15.6%, slightly below the high-growth benchmark of 20%. Despite this, its earnings are on a robust upward trajectory with an impressive forecast growth of 45.2% per year, outpacing the Korean market's average. The company has also been proactive in channeling funds into innovation; its R&D expenses have been significant, reflecting its commitment to staying competitive in software development. This strategic focus on R&D could be pivotal as Hancom continues to navigate through the challenges posed by one-off losses totaling ₩4.7 billion last year and an overall negative earnings growth recently. With such dynamics at play, Hancom's future prospects hinge on enhancing operational efficiencies and capitalizing on its strong earnings growth forecast.

- Unlock comprehensive insights into our analysis of Hancom stock in this health report.

Assess Hancom's past performance with our detailed historical performance reports.

Baiwang (SEHK:6657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baiwang Co., Ltd. offers enterprise digitalization solutions via its Baiwang Cloud platform in China, with a market capitalization of HK$4.07 billion.

Operations: Baiwang Co., Ltd. generates revenue primarily from its Internet Software & Services segment, amounting to CN¥725.25 million. The company's focus on enterprise digitalization solutions positions it within China's growing technology sector.

Baiwang's recent performance underscores its potential in the high-growth tech sector in Asia, with a notable rebound to profitability this year. After a challenging period, the company reported a significant revenue increase to CNY 347.59 million from CNY 281.55 million year-over-year and turned around its financials from a net loss of CNY 445.51 million to a net gain of CNY 3.72 million. This turnaround is largely attributed to its strategic pivot towards AI and enhanced digitalization solutions, which not only expanded its revenue by nearly 19% annually but also improved gross profit margins significantly from 39.2% to an anticipated range of 45-50%. These figures reflect Baiwang’s successful adaptation and innovation in response to market demands, positioning it well for sustained growth amidst volatile market conditions.

- Take a closer look at Baiwang's potential here in our health report.

Evaluate Baiwang's historical performance by accessing our past performance report.

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions for enterprises in the People’s Republic of China, with a market capitalization of approximately HK$5.73 billion.

Operations: The company generates revenue primarily through its cloud-based human capital management solutions and related professional services, totaling CN¥945.08 million.

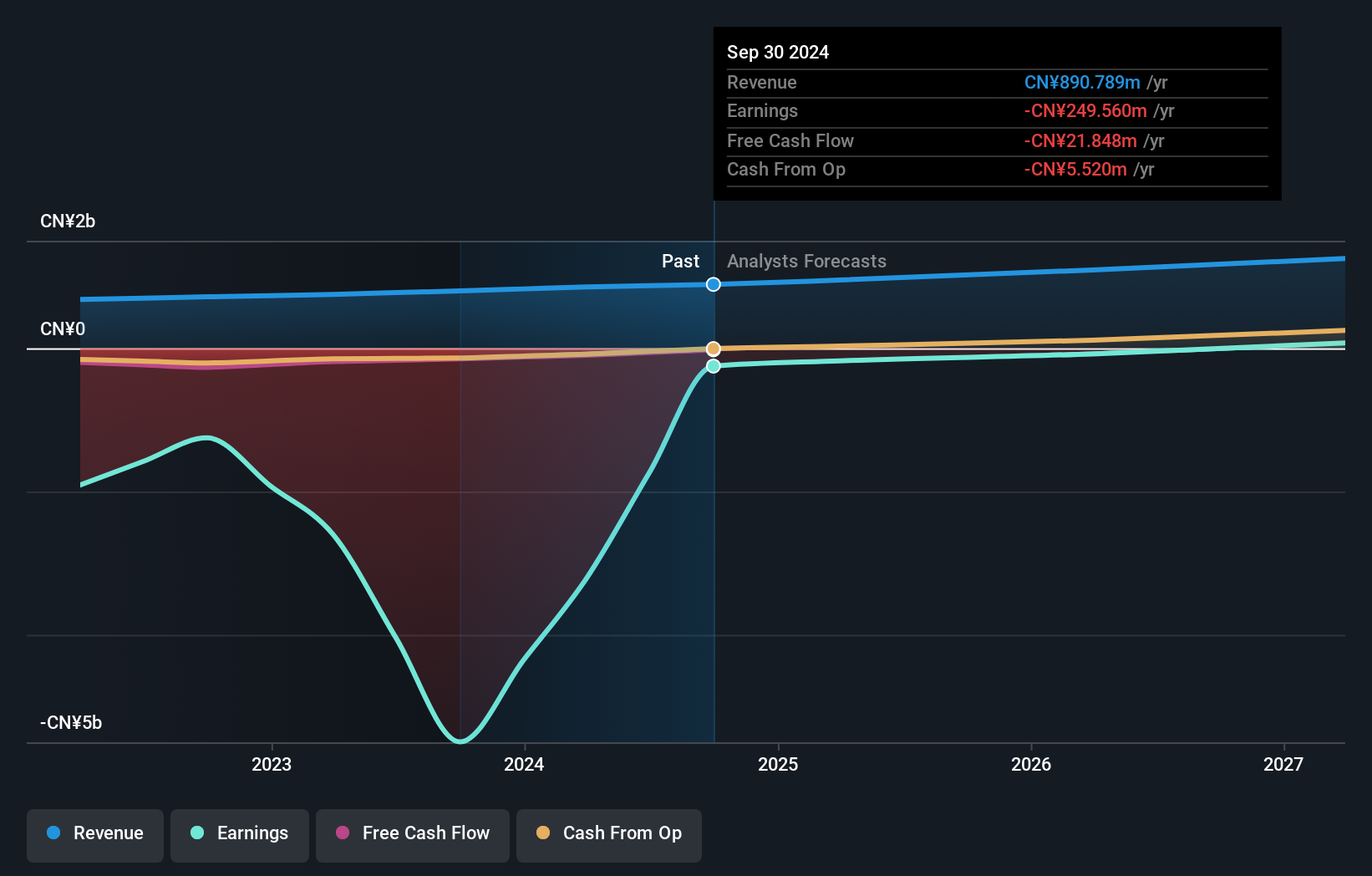

Beisen Holding, navigating through a challenging tech landscape, has demonstrated resilience with its latest financial outcomes. The company's revenue surged by 10.6% to CNY 945.08 million this year from CNY 854.74 million last year, marking a significant recovery from previous losses—shrinking its net loss dramatically to CNY 147.41 million from a steep CNY 3.21 billion. This turnaround is credited to strategic advancements in AI and software solutions tailored for diverse industries, which not only propelled the revenue growth but also set the stage for expected profitability within three years—a forecasted annual profit growth of nearly 99.62%. These developments suggest Beisen is aligning well with market needs and could be poised for robust growth as it leverages technology to refine its offerings further.

- Navigate through the intricacies of Beisen Holding with our comprehensive health report here.

Gain insights into Beisen Holding's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 189 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beisen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9669

Beisen Holding

An investment holding company, provides cloud-based human capital management (HCM) solutions for enterprises in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives