- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

### 3 SEHK Growth Stocks With High Insider Ownership And 15% Revenue Growth ###

Reviewed by Simply Wall St

The recent Fed rate cut has sparked optimism across global markets, with Hong Kong's Hang Seng Index gaining over 5% in a holiday-shortened week. This positive sentiment underscores the importance of identifying growth companies that not only show strong revenue performance but also have significant insider ownership, indicating confidence from those closest to the business. In this article, we explore three SEHK-listed growth stocks that boast high insider ownership and impressive 15% revenue growth, aligning well with current market dynamics.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Xiamen Yan Palace Bird's Nest Industry (SEHK:1497) | 26.7% | 23.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

Let's review some notable picks from our screened stocks.

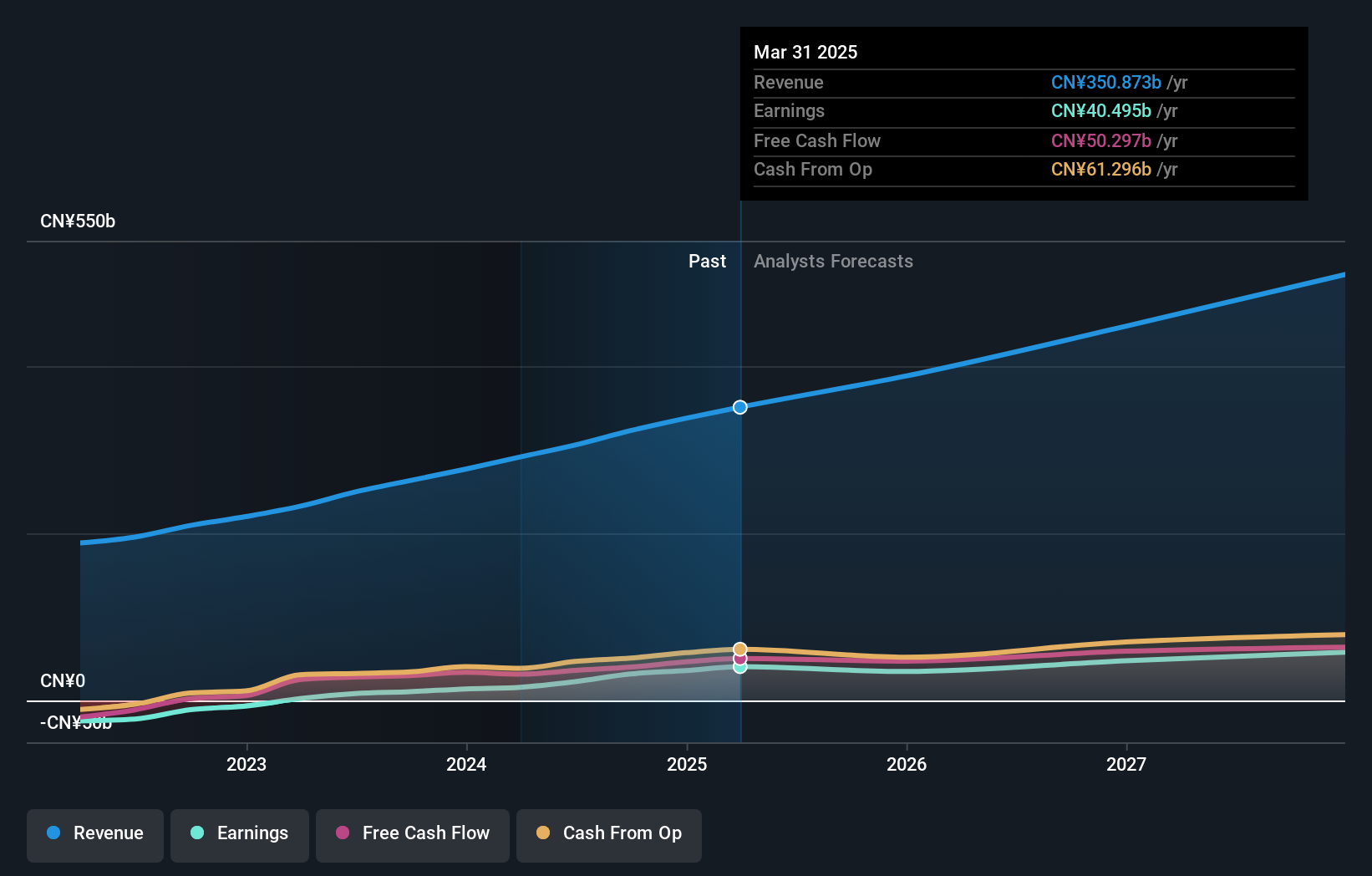

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company in the People’s Republic of China, with a market cap of approximately HK$832.39 billion.

Operations: The company's revenue segments include CN¥228.13 billion from Core Local Commerce and CN¥77.56 billion from New Initiatives.

Insider Ownership: 11.6%

Revenue Growth Forecast: 12.9% p.a.

Meituan's recent performance highlights its strong growth trajectory, with earnings rising 175.5% over the past year and revenue for the first half of 2024 reaching CNY 155.53 billion. Despite trading at a significant discount to its estimated fair value, Meituan has been actively repurchasing shares, completing buybacks worth HKD 7.17 billion in the first half of 2024 alone. Forecasts suggest continued robust annual profit growth of 25.84%, outpacing market averages in Hong Kong.

- Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

- The analysis detailed in our Meituan valuation report hints at an inflated share price compared to its estimated value.

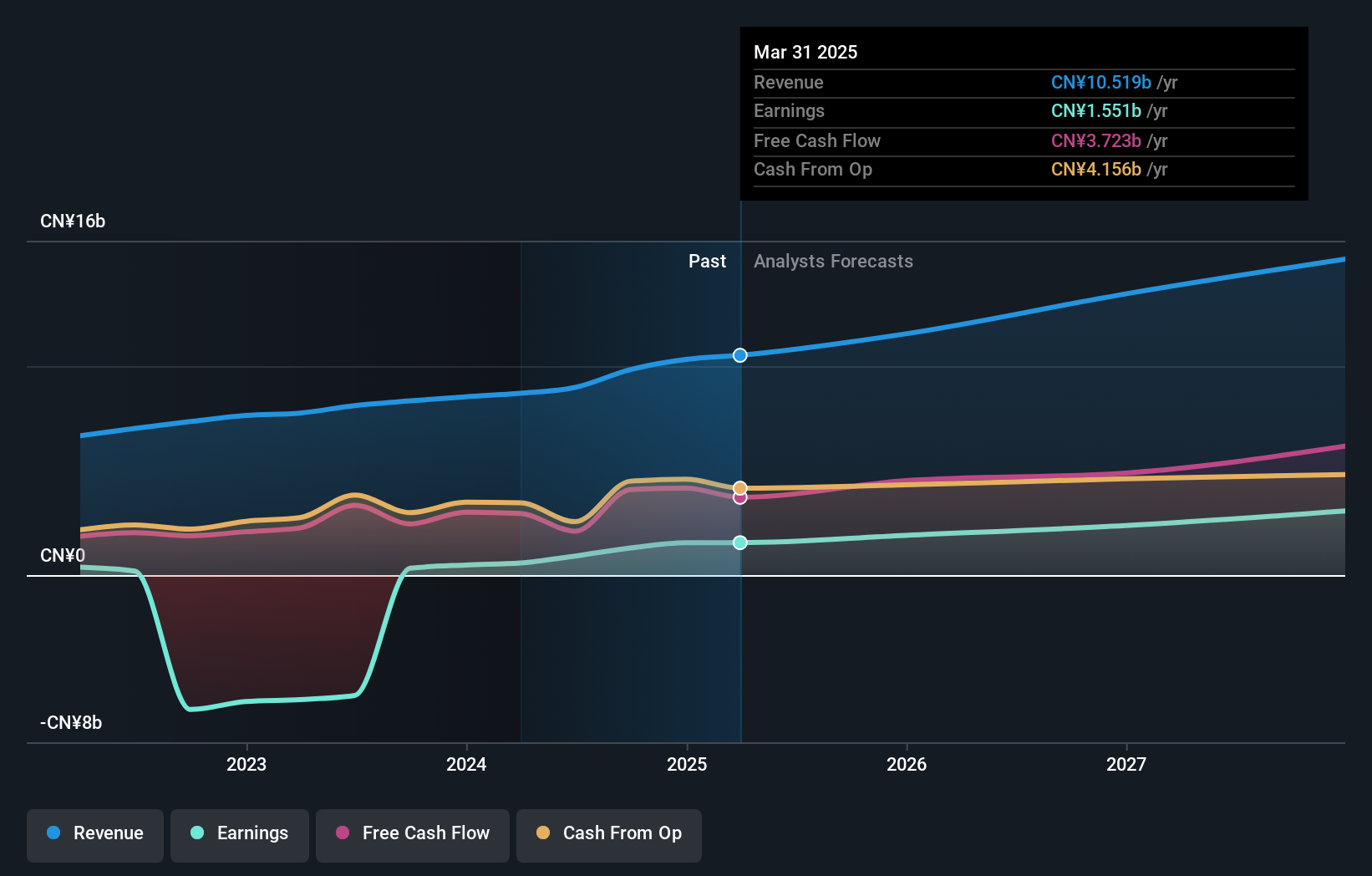

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally with a market cap of HK$30.85 billion.

Operations: The company's revenue segments include Office Software and Services, generating CN¥4.80 billion, and Entertainment Software and Others, contributing CN¥4.18 billion.

Insider Ownership: 20.4%

Revenue Growth Forecast: 12.9% p.a.

Kingsoft has demonstrated substantial growth, with recent earnings for Q2 2024 showing revenue of CNY 2.47 billion and net income of CNY 393.35 million, up significantly from the previous year. The company's earnings are forecast to grow at a robust 24.47% annually, outperforming the Hong Kong market average. Trading at 77.9% below its estimated fair value and with analysts predicting a price rise by 37.6%, Kingsoft presents a compelling growth opportunity despite lower expected revenue growth rates compared to peers.

- Click here to discover the nuances of Kingsoft with our detailed analytical future growth report.

- Our valuation report here indicates Kingsoft may be undervalued.

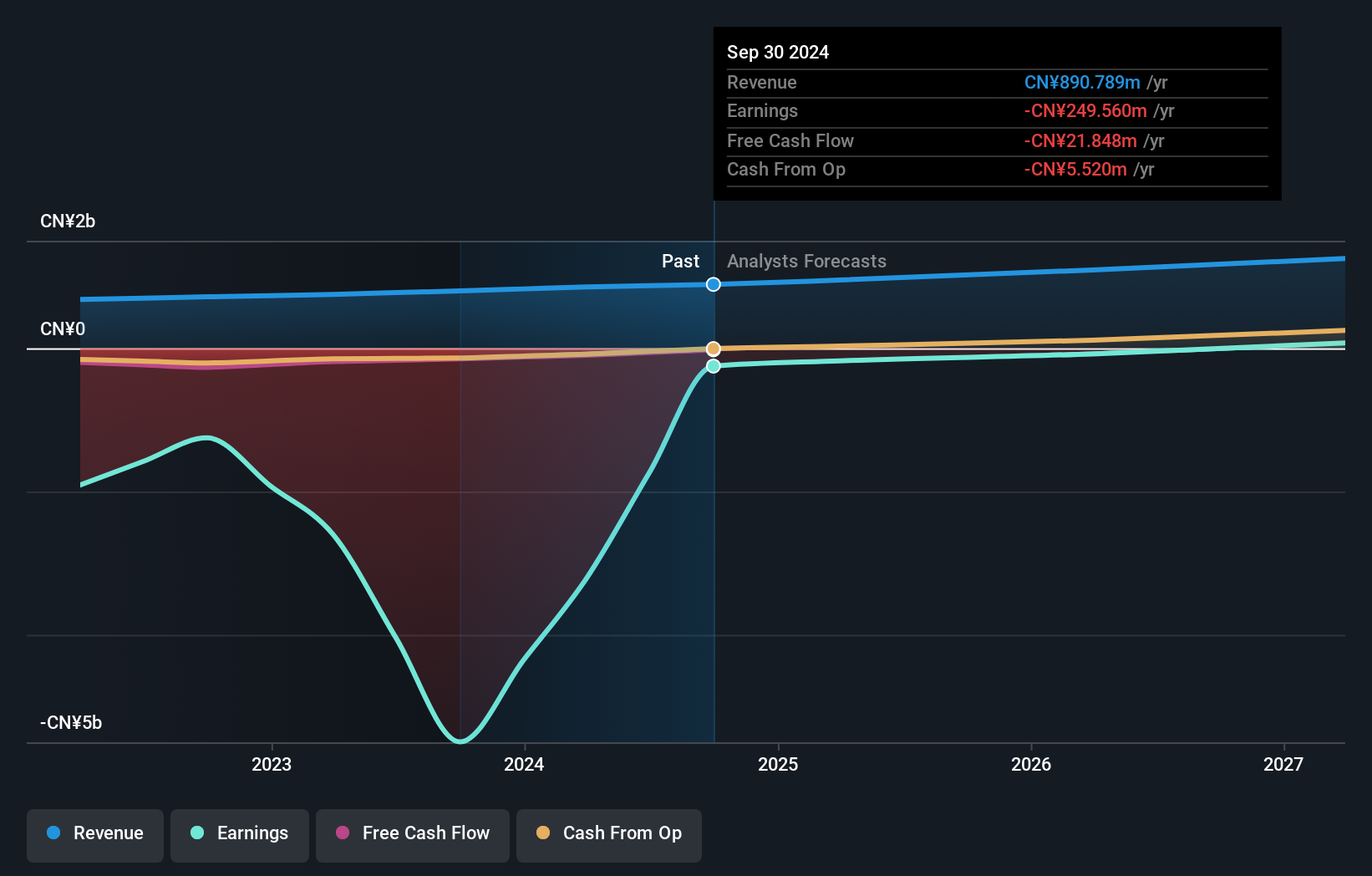

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beisen Holding Limited, with a market cap of HK$2.54 billion, provides cloud-based human capital management solutions for enterprises to recruit, evaluate, manage, develop, and retain talents in the People's Republic of China.

Operations: Revenue from cloud-based human capital management solutions and related professional services amounted to CN¥854.74 million.

Insider Ownership: 31.8%

Revenue Growth Forecast: 15% p.a.

Beisen Holding has shown significant revenue growth, reporting CNY 854.74 million for the year ending March 31, 2024, up from CNY 750.91 million a year ago. Despite a net loss of CNY 3.21 billion, the company is expected to become profitable within three years and outpace market revenue growth at an annual rate of 15%. Insider transactions have been minimal recently but lean towards buying rather than selling.

- Delve into the full analysis future growth report here for a deeper understanding of Beisen Holding.

- Our expertly prepared valuation report Beisen Holding implies its share price may be too high.

Turning Ideas Into Actions

- Embark on your investment journey to our 47 Fast Growing SEHK Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with solid track record.