- China

- /

- Medical Equipment

- /

- SZSE:300888

December 2024's Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

As global markets continue to reach new heights, with major indices like the Dow Jones and S&P 500 hitting record intraday highs, investors are keenly observing the impact of geopolitical shifts and domestic policies on market sentiment. In this climate of robust gains yet underlying uncertainties, identifying stocks that may be trading below their fair value can offer potential opportunities for those looking to balance risk with potential reward.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| DO & CO (WBAG:DOC) | €160.00 | €317.78 | 49.6% |

| Stille (OM:STIL) | SEK220.00 | SEK437.81 | 49.7% |

| Mobvista (SEHK:1860) | HK$8.00 | HK$15.99 | 50% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.25 | HK$54.31 | 49.8% |

| Charter Hall Group (ASX:CHC) | A$15.72 | A$31.22 | 49.6% |

| EQL Pharma (OM:EQL) | SEK77.00 | SEK153.58 | 49.9% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩125600.00 | ₩249514.81 | 49.7% |

| Hesai Group (NasdaqGS:HSAI) | US$8.18 | US$16.30 | 49.8% |

Let's explore several standout options from the results in the screener.

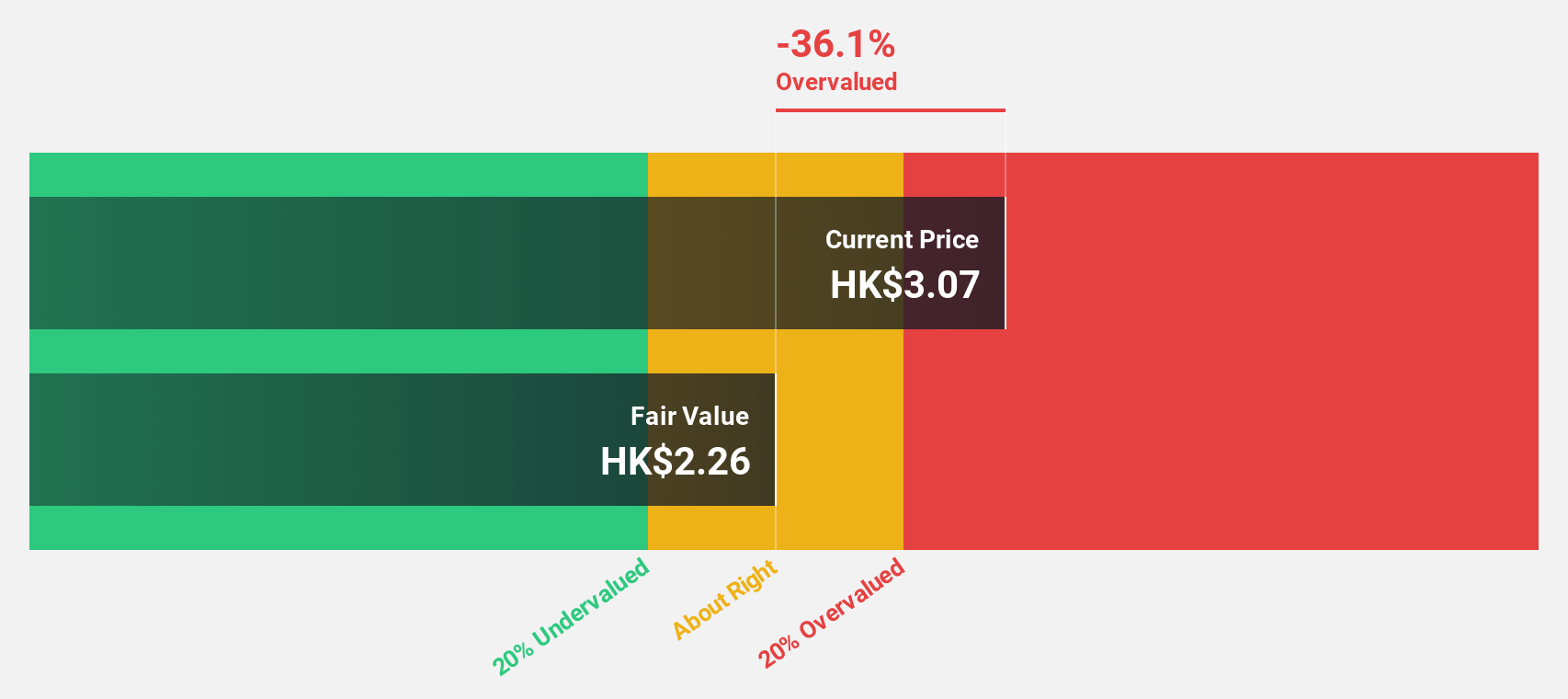

Digital China Holdings (SEHK:861)

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market capitalization of approximately HK$6.31 billion.

Operations: The company's revenue is primarily derived from three segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion).

Estimated Discount To Fair Value: 36.6%

Digital China Holdings is trading at HK$3.77, significantly below its estimated fair value of HK$5.94, indicating it is highly undervalued based on cash flows. While the company's revenue growth of 9.8% annually outpaces the Hong Kong market average, its return on equity remains low at 7.6%. Despite this, the firm is expected to become profitable within three years and demonstrates good relative value compared to peers and industry standards.

- Our expertly prepared growth report on Digital China Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Digital China Holdings here with our thorough financial health report.

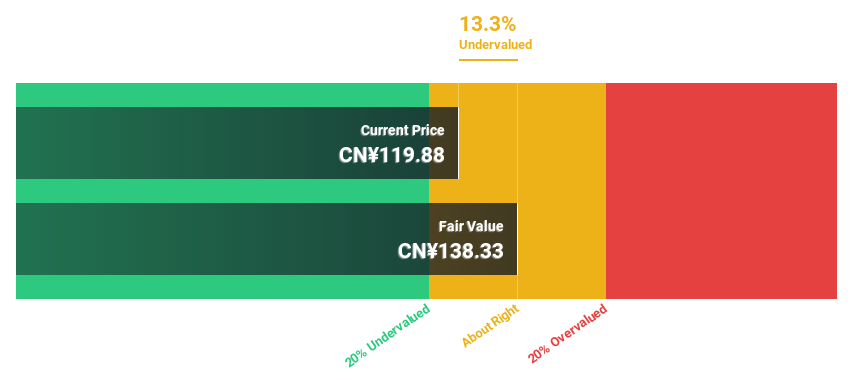

Beijing Huafeng Test & Control TechnologyLtd (SHSE:688200)

Overview: Beijing Huafeng Test & Control Technology Co., Ltd. operates in the field of test and control technology, with a market capitalization of approximately CN¥15.64 billion.

Operations: The company generates revenue primarily from the manufacturing of special equipment for semiconductor devices, amounting to CN¥793.33 million.

Estimated Discount To Fair Value: 16.6%

Beijing Huafeng Test & Control Technology Ltd. trades at CN¥115.62, below its estimated fair value of CN¥138.59, reflecting undervaluation based on cash flows. Recent earnings show a revenue increase to CNY 621.2 million and net income growth to CNY 213.09 million year-over-year, despite stable earnings per share. Forecasts predict substantial annual profit growth of 33.9% and revenue expansion of 25.9%, outpacing market averages, though return on equity remains modest at 13%.

- Our growth report here indicates Beijing Huafeng Test & Control TechnologyLtd may be poised for an improving outlook.

- Take a closer look at Beijing Huafeng Test & Control TechnologyLtd's balance sheet health here in our report.

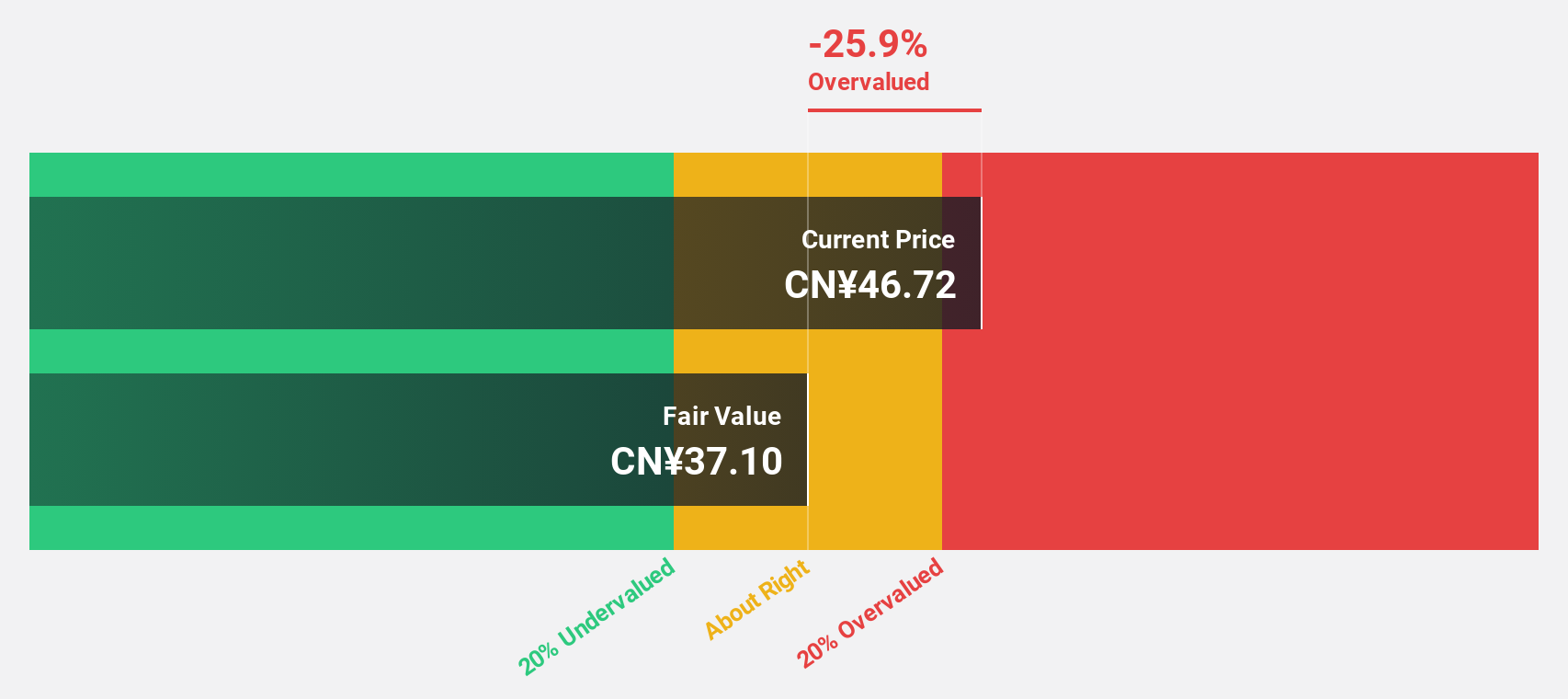

Winner Medical (SZSE:300888)

Overview: Winner Medical Co., Ltd. focuses on the R&D, manufacture, and marketing of cotton-based medical dressings and disposables in China, with a market cap of CN¥20.36 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 20.3%

Winner Medical is trading at CN¥34.97, significantly below its estimated fair value of CN¥43.89, indicating undervaluation based on cash flows. Despite a forecasted earnings growth of 71.91% per year and revenue expansion outpacing the Chinese market, recent financials show a decline in net income to CN¥552.97 million from CN¥2,147.77 million last year. The dividend yield of 2.29% is not well supported by earnings or free cash flow, and return on equity is expected to remain low at 8.4%.

- The growth report we've compiled suggests that Winner Medical's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Winner Medical.

Turning Ideas Into Actions

- Embark on your investment journey to our 920 Undervalued Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winner Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300888

Winner Medical

Engages in the research and development, manufacture, and marketing of cotton-based medical dressings and medical disposables, and consumer products in China.

Undervalued with excellent balance sheet.