As global markets continue to navigate a complex landscape marked by geopolitical tensions and economic shifts, small-cap stocks have finally joined their larger counterparts in reaching record highs, as evidenced by the Russell 2000 Index's recent performance. In this dynamic environment, identifying undiscovered gems requires a keen understanding of market trends and the ability to spot companies with robust fundamentals that can thrive despite broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.88% | -13.58% | 13.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai AiyingshiLtd (SHSE:603214)

Simply Wall St Value Rating: ★★★★★☆

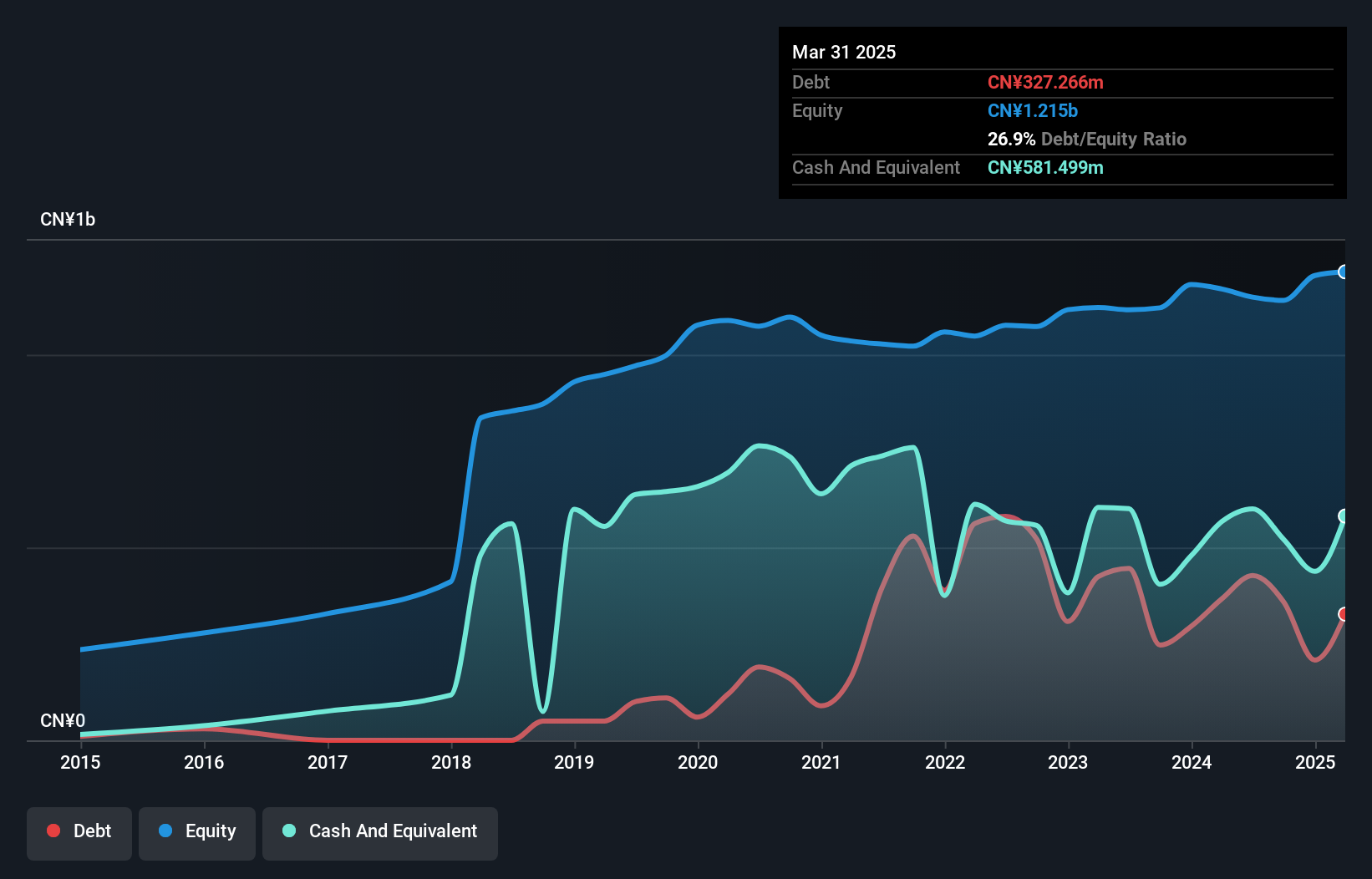

Overview: Shanghai Aiyingshi Co., Ltd operates in China, offering a range of maternal and child products, with a market capitalization of approximately CN¥2.51 billion.

Operations: Shanghai Aiyingshi Co., Ltd generates revenue primarily through the sale of maternal and infant products, with total sales amounting to approximately CN¥3.38 billion.

Shanghai Aiyingshi, a player in the specialty retail sector, is showing promising signs despite its small size. The company reported earnings growth of 20.1% over the past year, outpacing the industry average of -5.5%. With a price-to-earnings ratio of 23.8x, it appears undervalued compared to the broader CN market at 36.3x. However, its financials were affected by a one-off gain of CN¥47 million recently. Notably, Shanghai Aiyingshi has more cash than total debt and positive free cash flow which suggests solid financial health amidst volatile share prices recently observed in the market.

- Get an in-depth perspective on Shanghai AiyingshiLtd's performance by reading our health report here.

Gain insights into Shanghai AiyingshiLtd's past trends and performance with our Past report.

Shenzhen China Bicycle Company (Holdings) (SZSE:000017)

Simply Wall St Value Rating: ★★★★★★

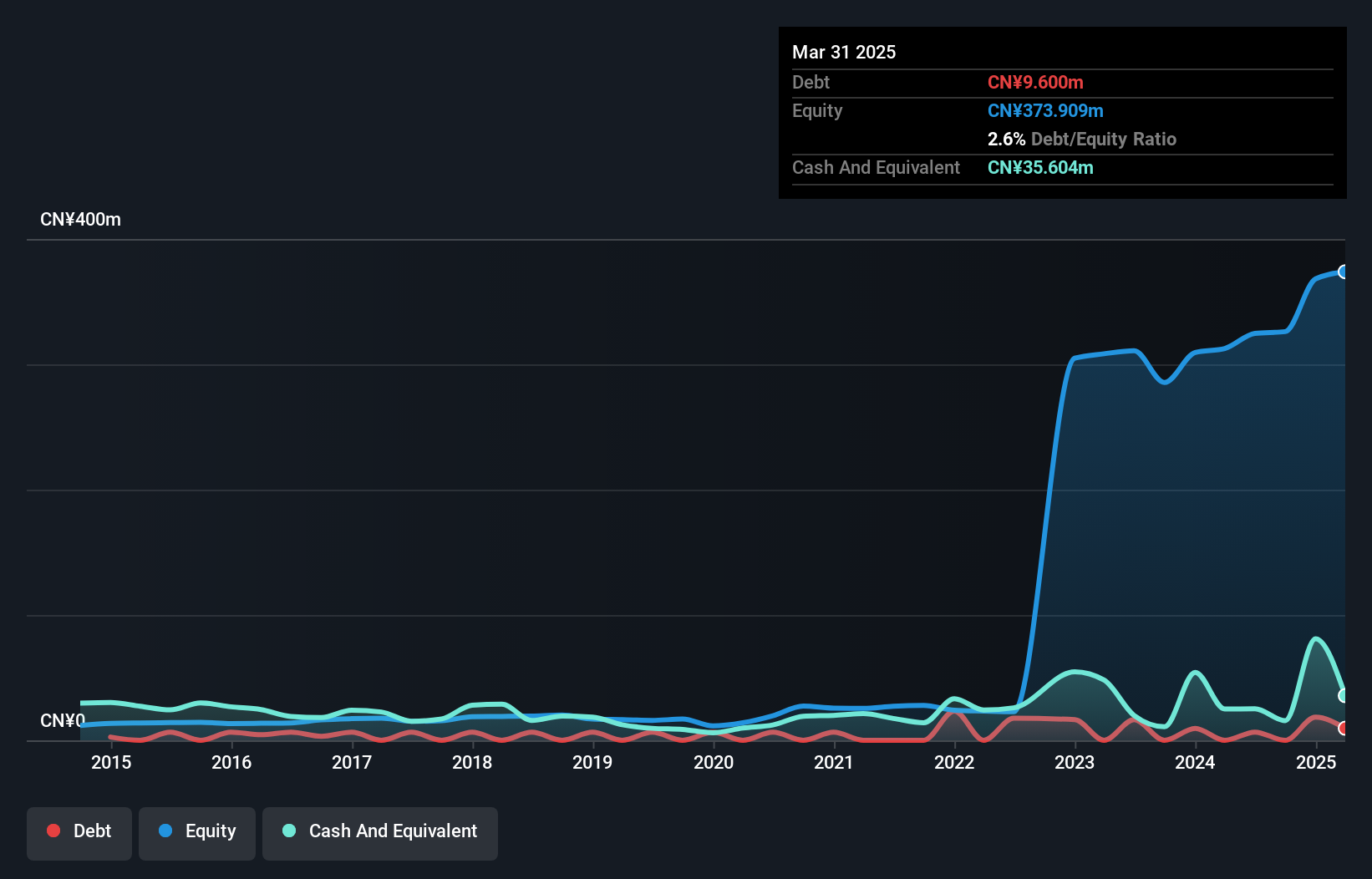

Overview: Shenzhen China Bicycle Company (Holdings) Limited operates in the gold jewelry business with a market capitalization of CN¥3.50 billion.

Operations: The company generates revenue primarily from its gold jewelry business. It has a market capitalization of CN¥3.50 billion.

Shenzhen China Bicycle Company, a niche player in its industry, reported a net income of CNY 7.42 million for the first nine months of 2024, up from CNY 5.05 million the previous year. Despite a drop in sales to CNY 279.46 million from CNY 348.5 million, it maintains high-quality earnings and remains debt-free over the past five years. Basic earnings per share increased to CNY 0.0108 compared to last year's CNY 0.0073, reflecting improved profitability despite revenue challenges. The company is free cash flow positive and has become profitable this year, indicating resilience amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Shenzhen China Bicycle Company (Holdings) stock in this health report.

Understand Shenzhen China Bicycle Company (Holdings)'s track record by examining our Past report.

Medicalsystem Biotechnology (SZSE:300439)

Simply Wall St Value Rating: ★★★★★★

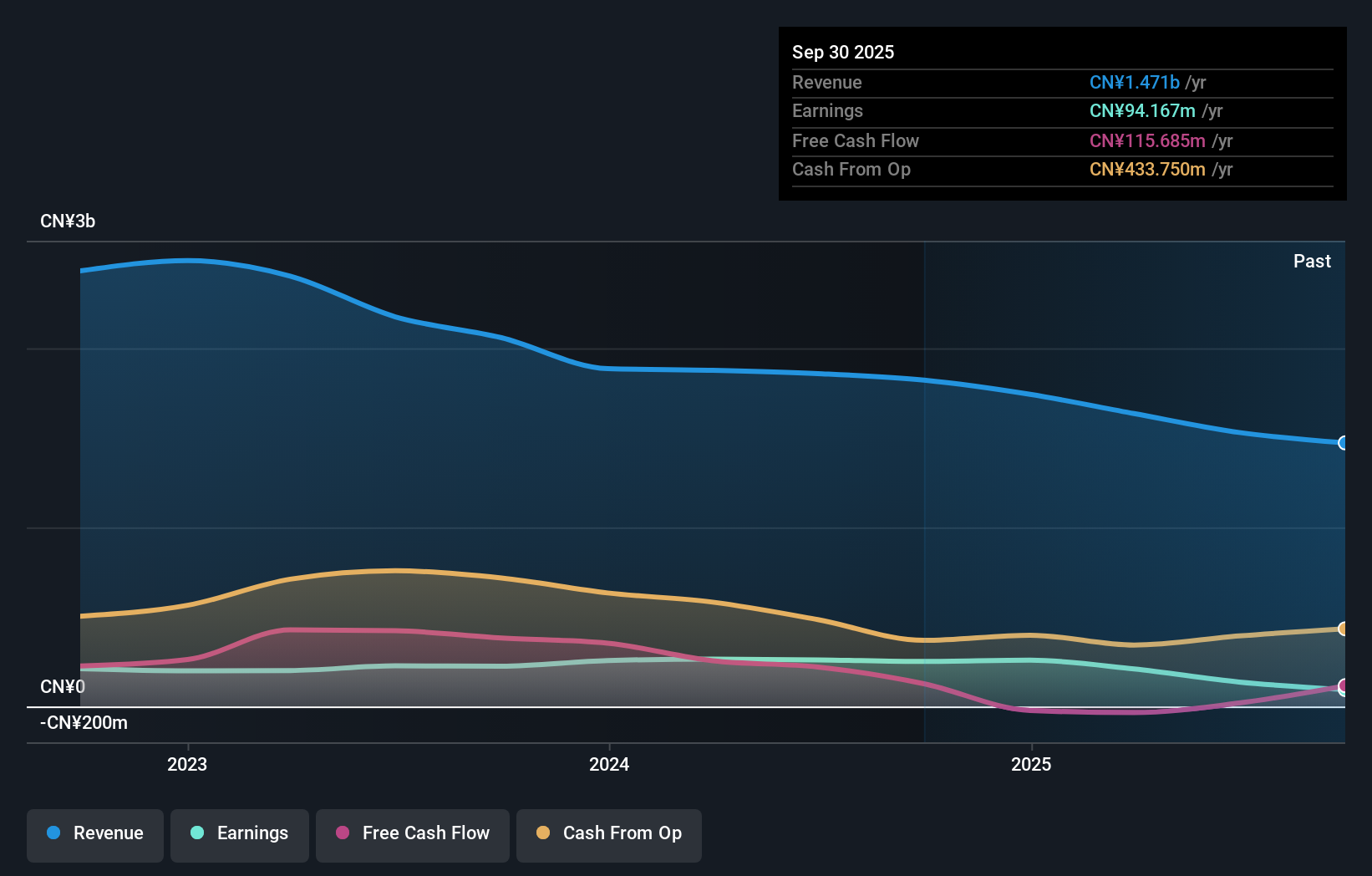

Overview: Medicalsystem Biotechnology Co., Ltd. specializes in providing clinical diagnostics reagents and instruments in China, with a market capitalization of approximately CN¥4.46 billion.

Operations: Medicalsystem Biotechnology generates revenue primarily from the medical machinery industry, amounting to CN¥1.82 billion.

Medicalsystem Biotechnology, a small player in the biotech space, has been showing promising signs of financial health. Over the past year, earnings grew by 11.5%, outpacing the industry's modest 0.08% growth rate. The company's debt-to-equity ratio saw a significant drop from 72.8% to just 1.4% over five years, indicating improved financial stability. Despite a slight dip in net income to CNY 224 million for the first nine months of 2024 compared to CNY 230 million last year, its price-to-earnings ratio at 17.8x remains attractive against the broader CN market's average of 36.3x, suggesting potential undervaluation and room for growth within its sector.

Turning Ideas Into Actions

- Gain an insight into the universe of 4626 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000017

Shenzhen China Bicycle Company (Holdings)

Engages in the gold jewelry business.

Flawless balance sheet with acceptable track record.