As global markets continue to reach record highs, driven by a mix of domestic policy shifts and geopolitical developments, investors are increasingly focused on identifying companies with strong growth potential and solid insider ownership. In this context, stocks with high insider ownership often reflect confidence from those closest to the business, making them appealing choices for those looking to navigate the current economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 43.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 116.0% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's review some notable picks from our screened stocks.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Aiko Solar Energy Co., Ltd. is involved in the research, manufacture, and sale of crystalline silicon solar cells and has a market cap of CN¥28.79 billion.

Operations: Shanghai Aiko Solar Energy Co., Ltd. generates revenue primarily through the research, manufacturing, and sales activities related to crystalline silicon solar cells.

Insider Ownership: 18.2%

Earnings Growth Forecast: 114.0% p.a.

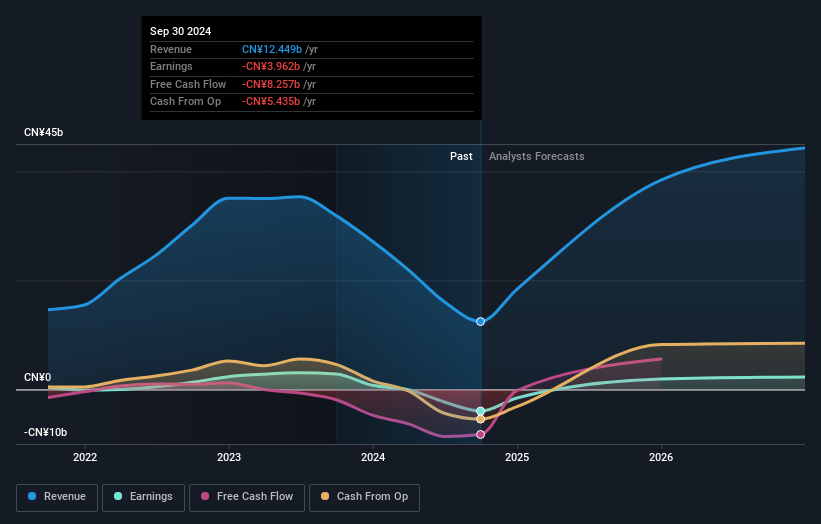

Shanghai Aiko Solar Energy Ltd. faces challenges with a significant net loss of CNY 2.83 billion for the first nine months of 2024, contrasting sharply with last year's profit. Despite this, the company is trading at a substantial discount to its estimated fair value and has high forecasted revenue growth of over 50% annually, surpassing market averages. While profitability is expected within three years, its volatile share price and debt coverage issues remain concerns for investors.

- Take a closer look at Shanghai Aiko Solar EnergyLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Shanghai Aiko Solar EnergyLtd is priced lower than what may be justified by its financials.

C*Core Technology (SHSE:688262)

Simply Wall St Growth Rating: ★★★★★☆

Overview: C*Core Technology Co., Ltd. is a chip design company in China that provides IP authorization, chip customization, and independent chip and module products, with a market cap of CN¥11.73 billion.

Operations: C*Core Technology Co., Ltd. generates revenue through its offerings in IP authorization, chip customization, and independent chip and module products in the Chinese market.

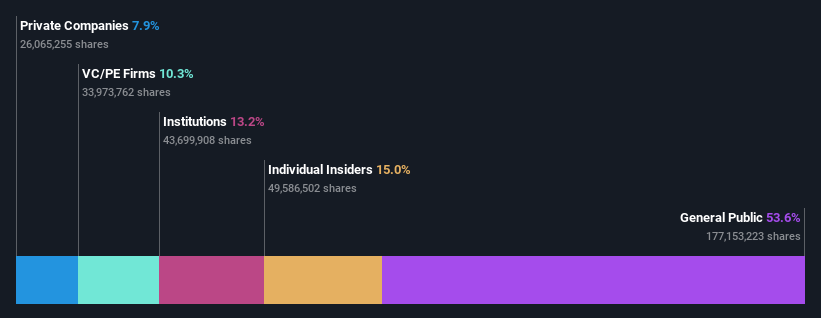

Insider Ownership: 15%

Earnings Growth Forecast: 105.7% p.a.

C*Core Technology exhibits strong revenue growth potential, with forecasts suggesting a 40.1% annual increase, significantly outpacing the broader market. Despite reporting a net loss of CNY 127.31 million for the first nine months of 2024, insider ownership remains high, aligning management interests with shareholders. The company is expected to achieve profitability within three years, although its share price has shown high volatility recently. Recent share buybacks indicate confidence in future prospects despite current financial challenges.

- Click here and access our complete growth analysis report to understand the dynamics of C*Core Technology.

- In light of our recent valuation report, it seems possible that C*Core Technology is trading beyond its estimated value.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ganfeng Lithium Group Co., Ltd. is a company that manufactures and sells lithium products across Mainland China, South Korea, Europe, the rest of Asia, North America, and internationally with a market cap of CN¥76.77 billion.

Operations: Revenue segments (in millions of CN¥):

Insider Ownership: 27%

Earnings Growth Forecast: 66.5% p.a.

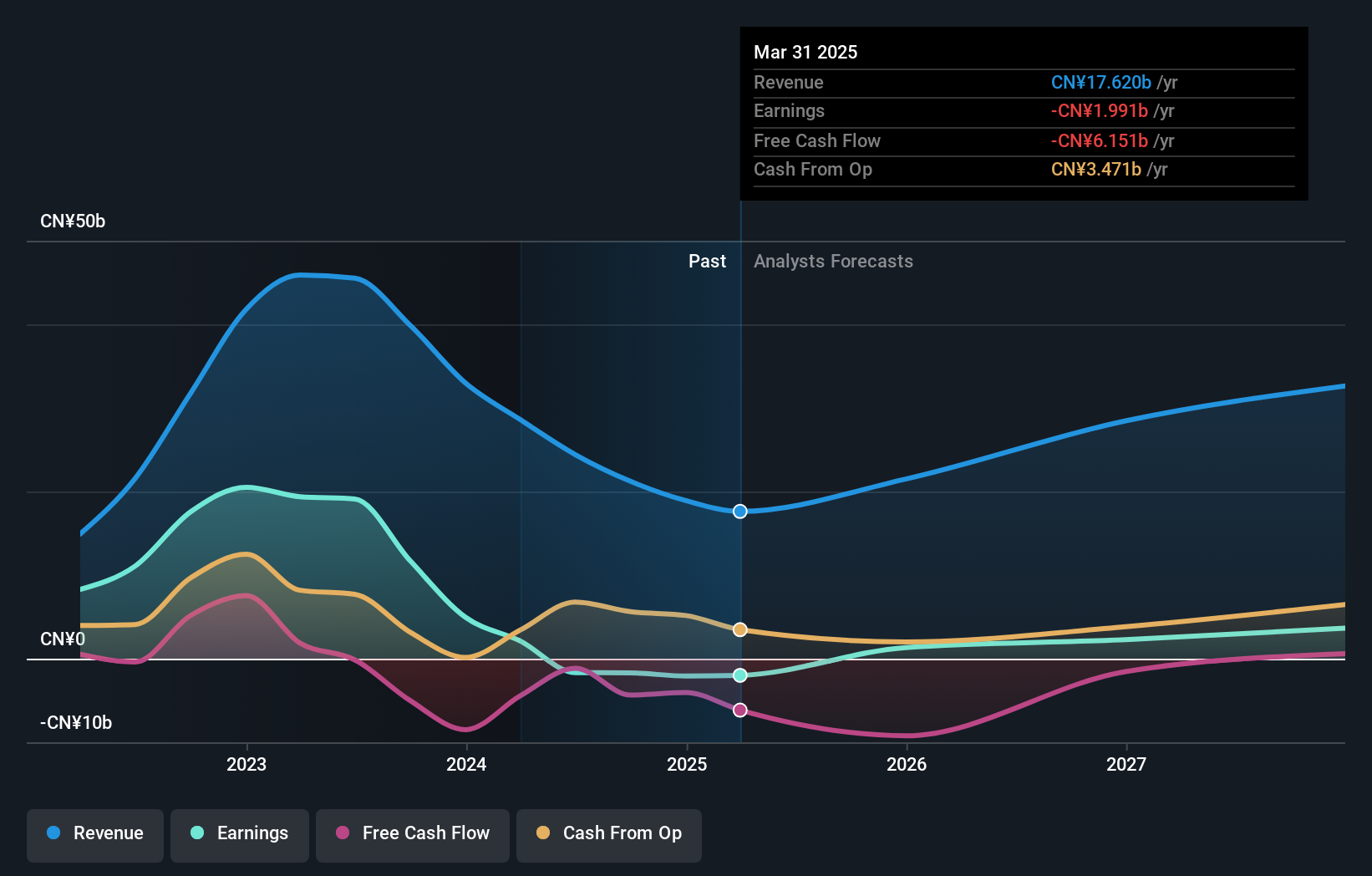

Ganfeng Lithium Group's insider ownership aligns management interests with shareholders, although recent financial performance has been challenging. The company reported a net loss of CNY 640.39 million for the first nine months of 2024, down from a net income last year, amid declining sales. Despite this, earnings are forecast to grow significantly at 66.45% annually and become profitable within three years, outpacing average market growth expectations in China.

- Delve into the full analysis future growth report here for a deeper understanding of Ganfeng Lithium Group.

- Our comprehensive valuation report raises the possibility that Ganfeng Lithium Group is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Gain an insight into the universe of 1516 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002460

Ganfeng Lithium Group

Manufactures and sells lithium products in Mainland China, South Korea, Europe, Rest of Asia, North America, and internationally.

Reasonable growth potential second-rate dividend payer.