3 Reliable Dividend Stocks Yielding Up To 6.7% For Your Portfolio

Reviewed by Simply Wall St

In a week marked by record highs for major U.S. indices, global markets have shown resilience despite geopolitical tensions and tariff concerns. As investors navigate these dynamic conditions, dividend stocks offer a compelling option for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

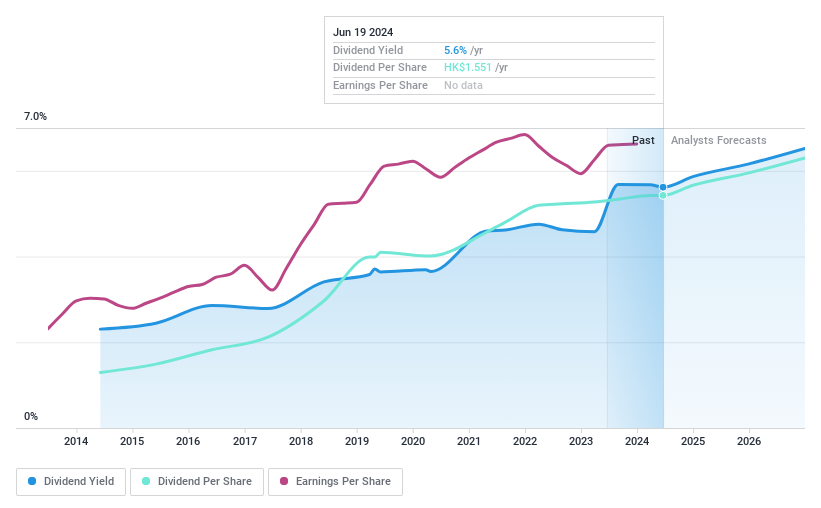

China Resources Land (SEHK:1109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Land Limited is an investment holding company involved in the investment, development, management, and sale of properties in the People’s Republic of China, with a market cap of approximately HK$164.01 billion.

Operations: China Resources Land Limited generates revenue from several key segments, including CN¥216.89 billion from its development property business, CN¥23.92 billion from its investment property business, CN¥15.66 billion from its eco-system elementary business, and CN¥14.74 billion from its asset-light management business.

Dividend Yield: 6.7%

China Resources Land has consistently increased dividend payments over the past decade, maintaining stability with a low payout ratio of 36.9%, suggesting dividends are well-covered by earnings. However, its high cash payout ratio of 90.8% indicates dividends are not well-supported by cash flows, raising sustainability concerns. Recent debt financing agreements totaling CNH 3.5 billion could impact financial flexibility, though trading at a significant discount to fair value may present investment opportunities despite these challenges.

- Get an in-depth perspective on China Resources Land's performance by reading our dividend report here.

- The valuation report we've compiled suggests that China Resources Land's current price could be quite moderate.

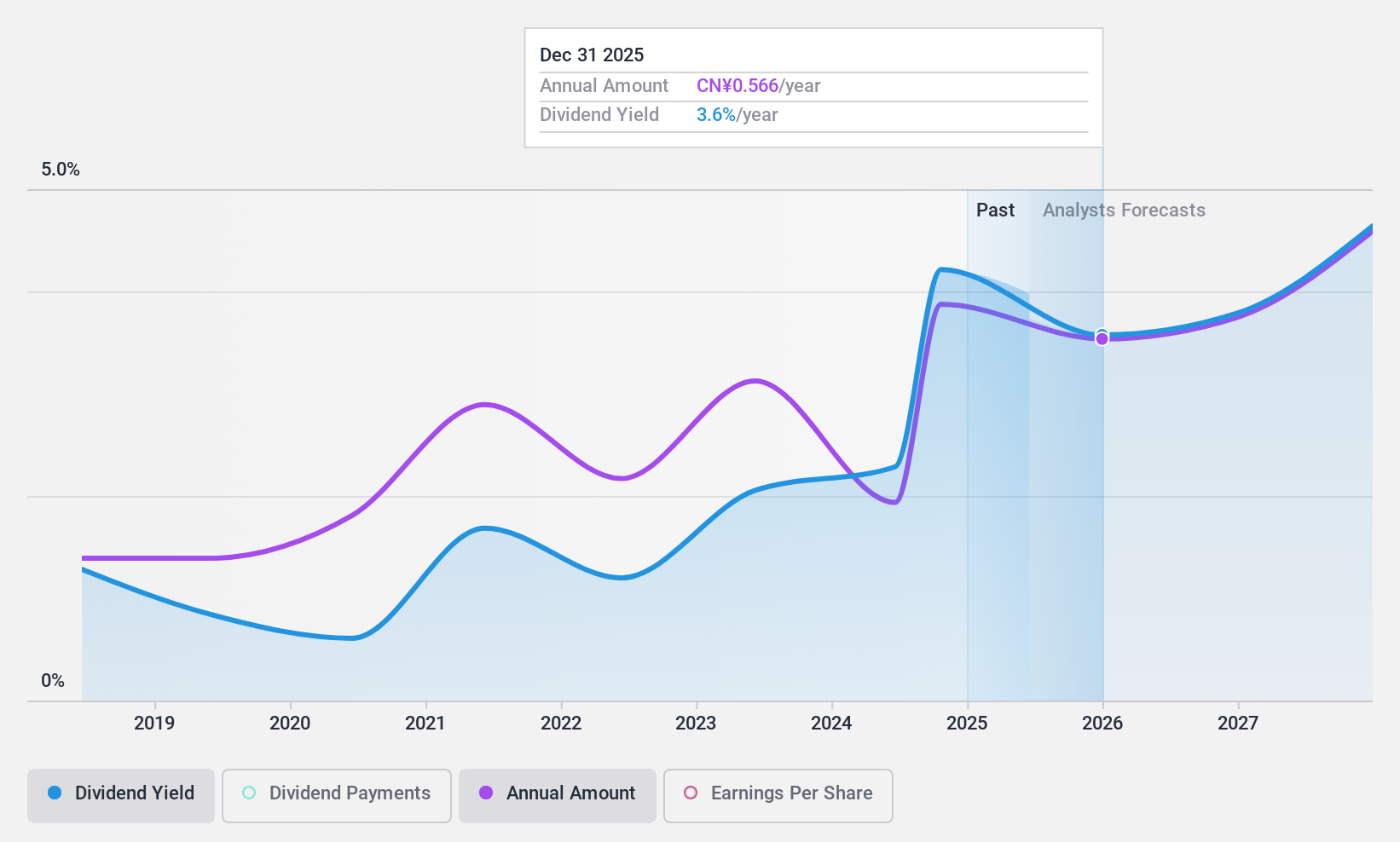

DaShenLin Pharmaceutical Group (SHSE:603233)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DaShenLin Pharmaceutical Group Co., Ltd. manufactures, wholesales, and retails pharmaceutical products in China with a market cap of CN¥17.74 billion.

Operations: DaShenLin Pharmaceutical Group Co., Ltd. generates its revenue through the manufacturing, wholesale, and retail of pharmaceutical products in China.

Dividend Yield: 4%

DaShenLin Pharmaceutical Group's dividend yield of 3.98% ranks in the top 25% in China, though its track record is volatile with payments over six years. The payout ratio of 82.8% suggests earnings cover dividends, while a cash payout ratio of 47.5% indicates strong cash flow support. Despite trading at a significant discount to estimated fair value and recent share buybacks totaling CNY 100.72 million, declining profit margins raise concerns about future dividend stability.

- Unlock comprehensive insights into our analysis of DaShenLin Pharmaceutical Group stock in this dividend report.

- Our valuation report unveils the possibility DaShenLin Pharmaceutical Group's shares may be trading at a discount.

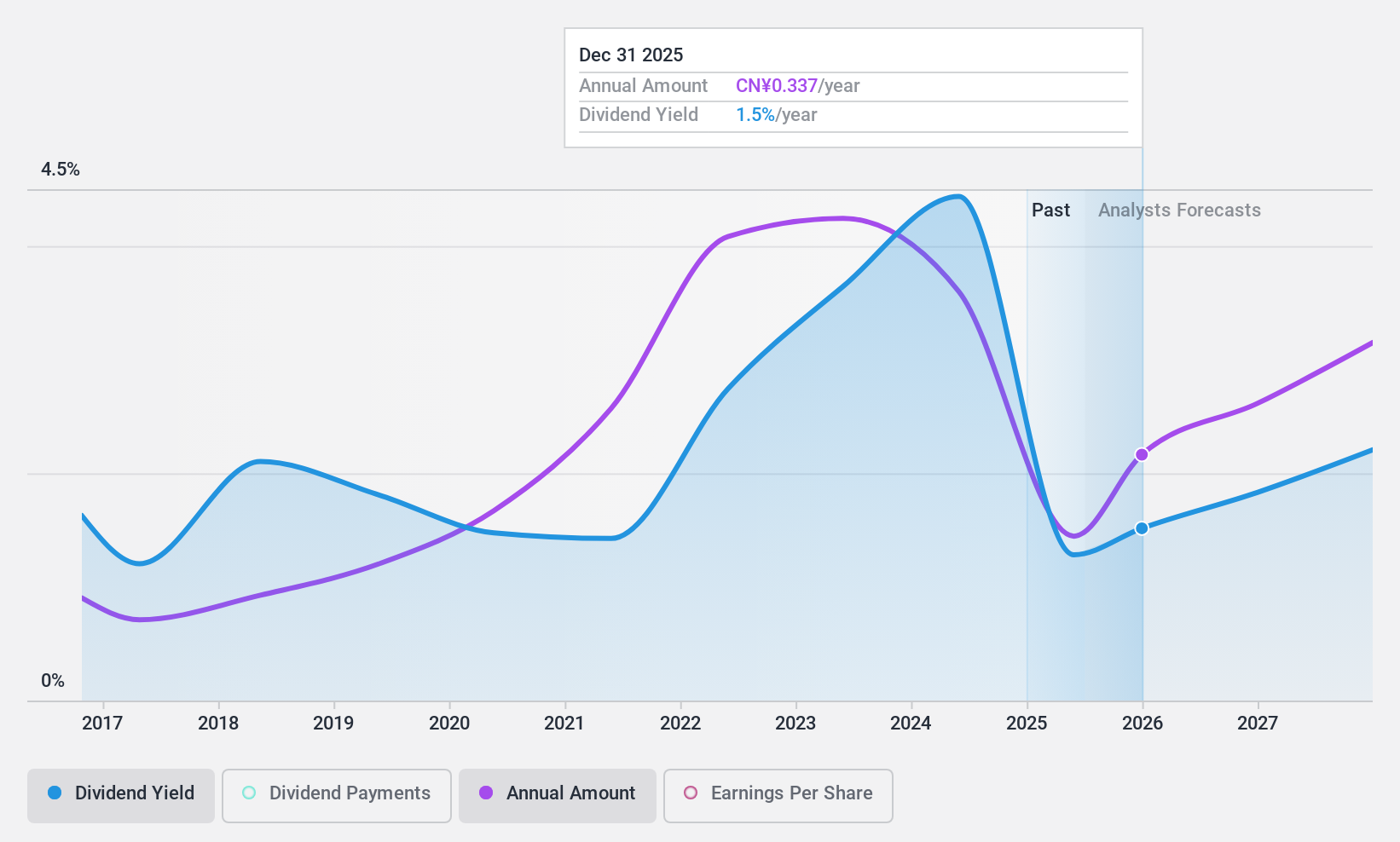

Sinoma Science & TechnologyLtd (SZSE:002080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinoma Science & Technology Co., Ltd. focuses on the research, design, manufacture, and sale of specialty fiber composite materials in China with a market cap of CN¥21.87 billion.

Operations: Sinoma Science & Technology Co., Ltd. generates revenue from its operations in the specialty fiber composite materials sector in China.

Dividend Yield: 4.3%

Sinoma Science & Technology Ltd.'s dividend yield of 4.3% is among the top 25% in China, but its payments have been unreliable over the past decade due to volatility and coverage issues. The company's high payout ratio of 83.5% covers dividends with earnings, yet a cash payout ratio exceeding 500% indicates inadequate cash flow support. Recent executive changes and declining profits—net income dropped to CNY 608.37 million from CNY 1.71 billion—may impact future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Sinoma Science & TechnologyLtd.

- In light of our recent valuation report, it seems possible that Sinoma Science & TechnologyLtd is trading behind its estimated value.

Next Steps

- Delve into our full catalog of 1963 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002080

Sinoma Science & TechnologyLtd

Engages in the research and development, design, manufacture, and sale of specialty fiber composite materials in China.

Excellent balance sheet with reasonable growth potential and pays a dividend.