- Hong Kong

- /

- Diversified Financial

- /

- SEHK:818

Hi Sun Technology (China)'s (HKG:818) Earnings Are Growing But Is There More To The Story?

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Hi Sun Technology (China) (HKG:818).

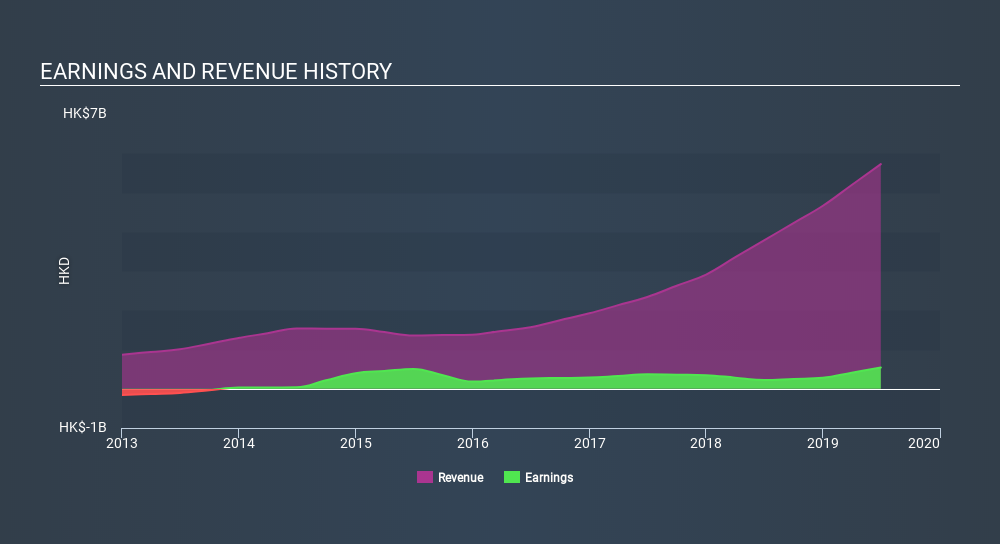

It's good to see that over the last twelve months Hi Sun Technology (China) made a profit of HK$540.2m on revenue of HK$5.72b. One positive is that it has grown both its profit and its revenue, over the last few years.

View our latest analysis for Hi Sun Technology (China)

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Today, we'll discuss Hi Sun Technology (China)'s free cashflow relative to its earnings, and consider what that tells us about the company. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Zooming In On Hi Sun Technology (China)'s Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Hi Sun Technology (China) has an accrual ratio of -0.29 for the year to June 2019. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of HK$1.0b in the last year, which was a lot more than its statutory profit of HK$540.2m. Given that Hi Sun Technology (China) had negative free cash flow in the prior corresponding period, the trailing twelve month resul of HK$1.0b would seem to be a step in the right direction.

Our Take On Hi Sun Technology (China)'s Profit Performance

Happily for shareholders, Hi Sun Technology (China) produced plenty of free cash flow to back up its statutory profit numbers. Based on this observation, we consider it possible that Hi Sun Technology (China)'s statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. So feel free to check out our free graph representing analyst forecasts.

Today we've zoomed in on a single data point to better understand the nature of Hi Sun Technology (China)'s profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:818

Hi Sun Technology (China)

An investment holding company, provides payment and digital services, fintech services, and platform operation and financial solutions in Hong Kong, Mainland China, and internationally.

Good value slight.

Market Insights

Community Narratives