Shareholders May Find It Hard To Justify Increasing Famous Tech International Holdings Limited's (HKG:8100) CEO Compensation For Now

Key Insights

- Famous Tech International Holdings to hold its Annual General Meeting on 9th of May

- Salary of HK$1.19m is part of CEO Siu Cheong Lau's total remuneration

- The total compensation is similar to the average for the industry

- Over the past three years, Famous Tech International Holdings' EPS grew by 16% and over the past three years, the total loss to shareholders 50%

The underwhelming share price performance of Famous Tech International Holdings Limited (HKG:8100) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 9th of May. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Famous Tech International Holdings

How Does Total Compensation For Siu Cheong Lau Compare With Other Companies In The Industry?

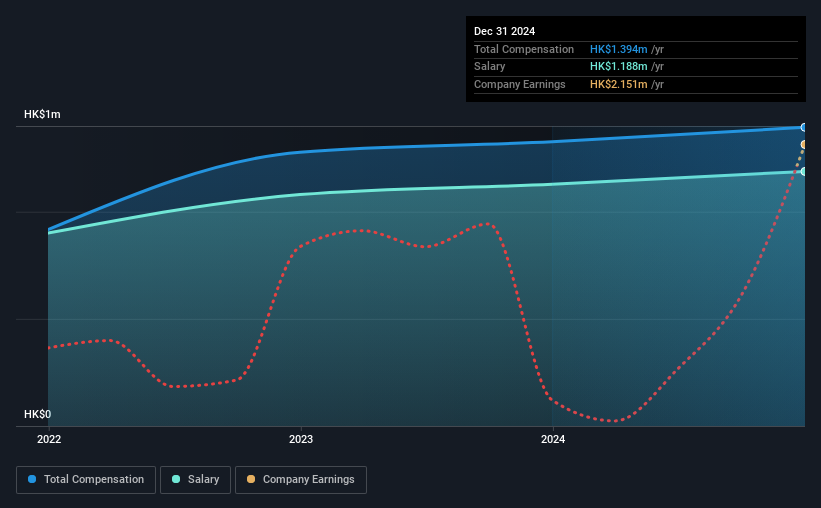

According to our data, Famous Tech International Holdings Limited has a market capitalization of HK$84m, and paid its CEO total annual compensation worth HK$1.4m over the year to December 2024. That's a modest increase of 5.1% on the prior year. In particular, the salary of HK$1.19m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Software industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.4m. This suggests that Famous Tech International Holdings remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$1.2m | HK$1.1m | 85% |

| Other | HK$206k | HK$198k | 15% |

| Total Compensation | HK$1.4m | HK$1.3m | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. According to our research, Famous Tech International Holdings has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Famous Tech International Holdings Limited's Growth Numbers

Over the past three years, Famous Tech International Holdings Limited has seen its earnings per share (EPS) grow by 16% per year. It achieved revenue growth of 13% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Famous Tech International Holdings Limited Been A Good Investment?

Few Famous Tech International Holdings Limited shareholders would feel satisfied with the return of -50% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Famous Tech International Holdings that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8100

Famous Tech International Holdings

An investment holding company, engages in the research, development, and distribution of personal computer performance software, anti-virus software, mobile phone applications, and toolbar advertisements.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success