As of October 2025, Asian markets have shown resilience, with significant gains in technology-focused shares and an overall positive sentiment despite some economic challenges. For investors looking to explore opportunities beyond the major indices, penny stocks remain a compelling area of interest. Although the term "penny stocks" may seem outdated, it continues to represent smaller or newer companies that can offer unique growth potential when backed by strong financials and strategic direction.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.97 | HK$2.42B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.88 | THB1.21B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.17 | SGD474.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.095 | SGD49.73M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$2.94B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.30 | THB8.69B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 952 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$9.87 billion.

Operations: The company's revenue is derived from its Structural Heart Diseases Business (CN¥527.87 million), Peripheral Vascular Diseases Business (CN¥762.08 million), and Cardiac Pacing and Electrophysiology Business (CN¥37.63 million).

Market Cap: HK$9.87B

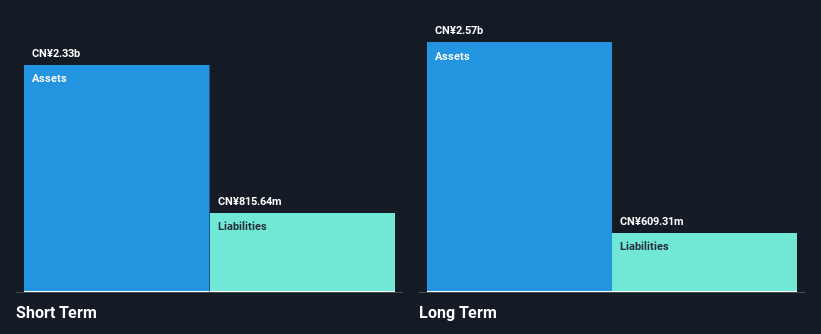

LifeTech Scientific's financial health is bolstered by its short-term assets of CN¥2.6 billion, which comfortably cover both short and long-term liabilities, indicating strong liquidity. Despite a significant one-off loss impacting recent earnings, the company remains debt-free, alleviating concerns over interest coverage. However, profitability has declined with net profit margins dropping to 5.4% from 19.4% last year. Recent approval for an innovative congenital heart defect occluder could enhance its product portfolio and market position in medical devices, potentially offsetting negative earnings growth trends observed over the past year and five years respectively.

- Jump into the full analysis health report here for a deeper understanding of LifeTech Scientific.

- Learn about LifeTech Scientific's historical performance here.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company that offers e-commerce solutions both online and offline in China, Japan, and Canada, with a market cap of HK$6.28 billion.

Operations: The company generates revenue from its operations in Japan, amounting to CN¥0.61 million.

Market Cap: HK$6.28B

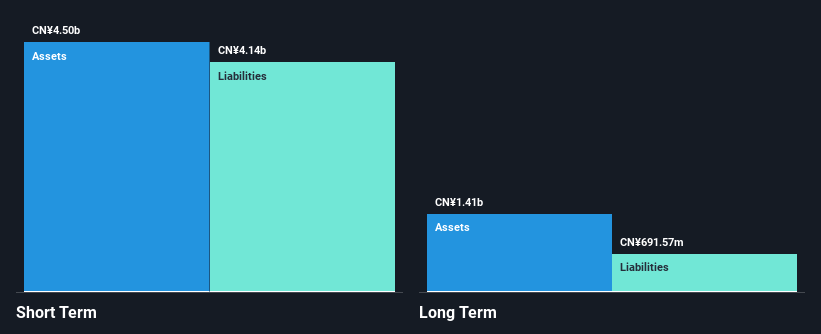

Youzan Technology has shown a significant turnaround by reporting a net income of CN¥72.74 million for the first half of 2025, compared to a loss in the previous year, driven by increased revenue and operational efficiency. The company's liquidity is robust, with short-term assets exceeding both short and long-term liabilities. Despite past volatility in its share price, Youzan's strategic buyback of over 331 million shares reflects confidence in its valuation. While still unprofitable on an annual basis, it maintains a positive cash flow with enough runway for over three years, supported by experienced management and board members.

- Get an in-depth perspective on Youzan Technology's performance by reading our balance sheet health report here.

- Examine Youzan Technology's earnings growth report to understand how analysts expect it to perform.

CSE Global (SGX:544)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CSE Global Limited is an investment holding company that provides integrated industrial automation, information technology, and intelligent transport solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa; it has a market cap of SGD561.01 million.

Operations: The company generates revenue from three primary segments: Automation (SGD193.85 million), Communications (SGD246.50 million), and Electrification (SGD432.82 million).

Market Cap: SGD561.01M

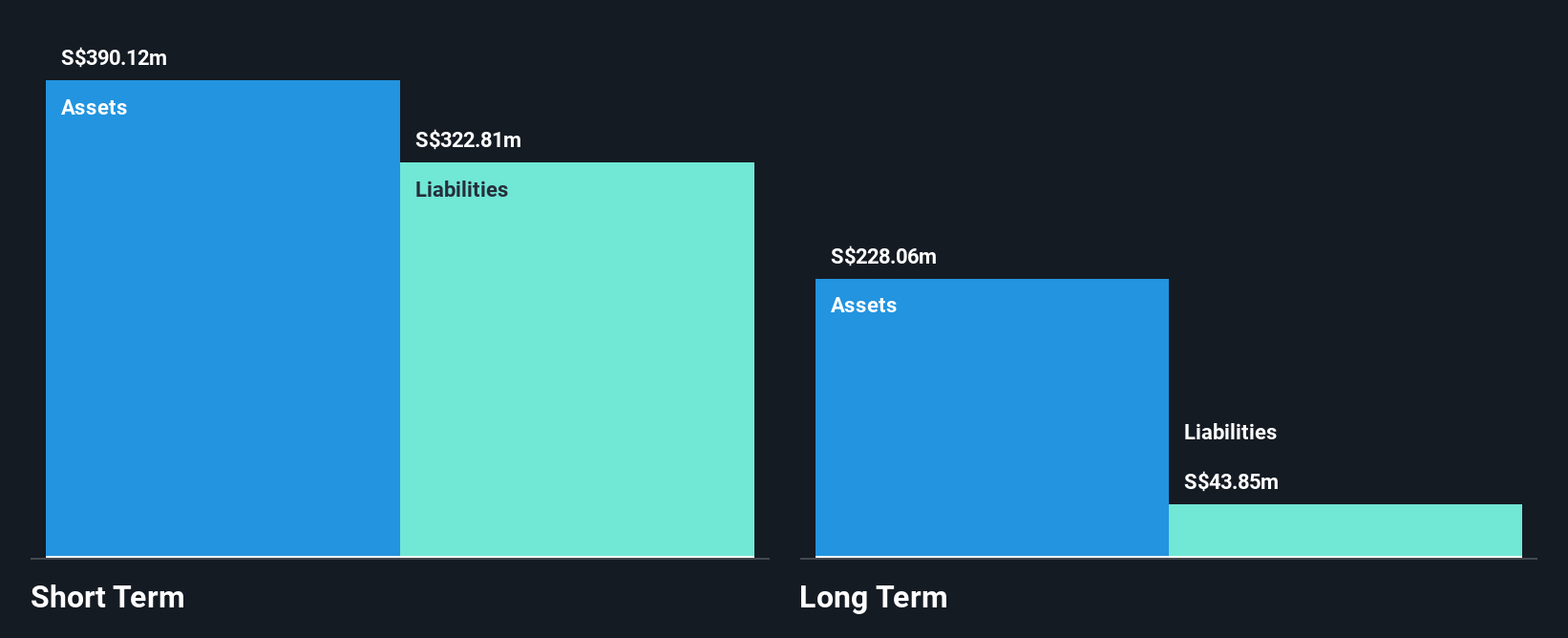

CSE Global Limited's financial health is supported by strong liquidity, with short-term assets of SGD390.1 million exceeding both short-term and long-term liabilities. The company's earnings have shown modest growth, with net income rising to SGD16.3 million for the first half of 2025, up from SGD15.02 million a year ago. Despite this growth, operating cash flow remains negative, raising concerns about debt coverage. Recent contract wins in the U.S., valued at approximately S$59.3 million, highlight potential revenue expansion opportunities in the data centre market. However, dividend sustainability is questionable due to insufficient free cash flows covering payouts.

- Click here and access our complete financial health analysis report to understand the dynamics of CSE Global.

- Evaluate CSE Global's prospects by accessing our earnings growth report.

Key Takeaways

- Access the full spectrum of 952 Asian Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8083

Youzan Technology

An investment holding company, provides online and offline e-commerce solutions in the People’s Republic of China, Japan, and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives