Market Participants Recognise Inspur Digital Enterprise Technology Limited's (HKG:596) Earnings Pushing Shares 29% Higher

Inspur Digital Enterprise Technology Limited (HKG:596) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 90%.

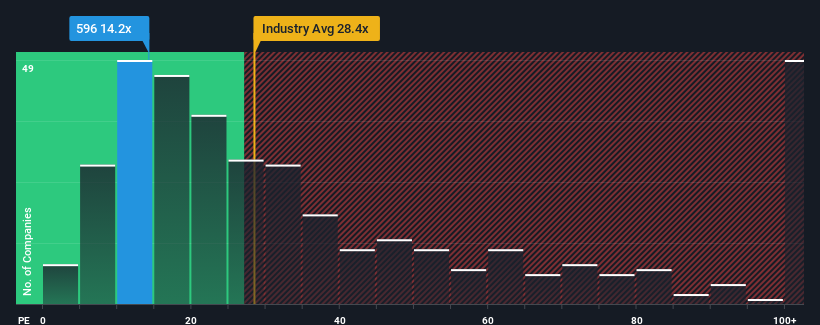

After such a large jump in price, Inspur Digital Enterprise Technology's price-to-earnings (or "P/E") ratio of 14.2x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Inspur Digital Enterprise Technology certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Inspur Digital Enterprise Technology

Does Growth Match The High P/E?

Inspur Digital Enterprise Technology's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 84% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 37% each year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

In light of this, it's understandable that Inspur Digital Enterprise Technology's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Inspur Digital Enterprise Technology's P/E

The strong share price surge has got Inspur Digital Enterprise Technology's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Inspur Digital Enterprise Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Inspur Digital Enterprise Technology that you should be aware of.

You might be able to find a better investment than Inspur Digital Enterprise Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:596

Inspur Digital Enterprise Technology

An investment holding company, engages in management software development, cloud services, and sale of Internet of Things (IoT) solutions in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success