Computer And Technologies Holdings' (HKG:46) Dividend Is Being Reduced To HK$0.055

Computer And Technologies Holdings Limited (HKG:46) has announced that on 18th of September, it will be paying a dividend ofHK$0.055, which a reduction from last year's comparable dividend. The dividend yield of 6.6% is still a nice boost to shareholder returns, despite the cut.

See our latest analysis for Computer And Technologies Holdings

Computer And Technologies Holdings Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment made up 74% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, EPS could fall by 3.3% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 102%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

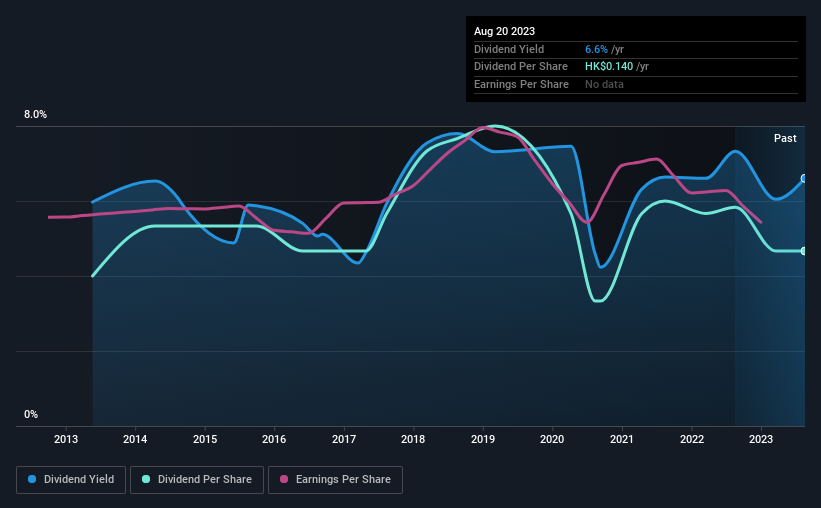

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of HK$0.12 in 2013 to the most recent total annual payment of HK$0.14. This means that it has been growing its distributions at 1.6% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

The Dividend's Growth Prospects Are Limited

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. In the last five years, Computer And Technologies Holdings' earnings per share has shrunk at approximately 3.3% per annum. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for Computer And Technologies Holdings you should be aware of, and 1 of them makes us a bit uncomfortable. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:46

Computer And Technologies Holdings

An investment holding company, provides information technology (IT) solutions for enterprises, multinational corporations, and government organizations in Hong Kong, Mainland China, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion