- China

- /

- Entertainment

- /

- SZSE:300031

Asian Growth Companies With High Insider Ownership For May 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing trade tensions and mixed economic signals, Asia's growth companies are capturing attention with their robust potential and strategic insider ownership. In such an environment, stocks with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTour Group (SZSE:002707) | 23.5% | 40.9% |

| M31 Technology (TPEX:6643) | 30.8% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's uncover some gems from our specialized screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of approximately ₩18.99 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to approximately ₩102.85 million.

Insider Ownership: 25.9%

ALTEOGEN demonstrates strong growth potential with earnings forecasted to grow 71.24% annually, significantly outpacing the Korean market's average. Revenue is also expected to increase by 54.9% per year, indicating robust expansion prospects. The stock is currently trading at a substantial discount of 50.8% below its estimated fair value, suggesting potential upside for investors. Despite high non-cash earnings, insider activity in recent months remains undisclosed, which may warrant further investigation for prospective investors.

- Click here and access our complete growth analysis report to understand the dynamics of ALTEOGEN.

- Our comprehensive valuation report raises the possibility that ALTEOGEN is priced higher than what may be justified by its financials.

Chinasoft International (SEHK:354)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chinasoft International Limited, along with its subsidiaries, offers IT solutions, IT outsourcing, and training services across several countries including China and the United States, with a market cap of approximately HK$13.37 billion.

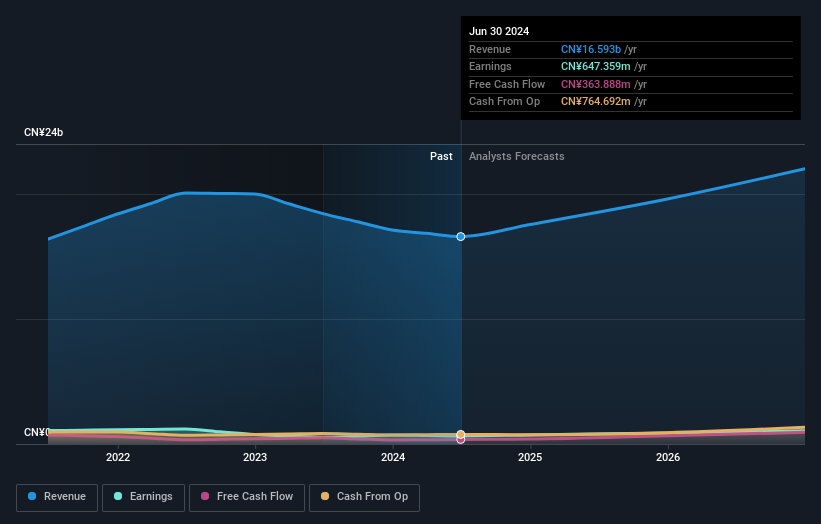

Operations: The company's revenue is primarily derived from its Technology Professional Services Group, contributing CN¥14.77 billion, and its Internet Information Technology Services Group, which adds CN¥2.18 billion.

Insider Ownership: 10%

Chinasoft International is poised for growth with earnings expected to rise significantly at 22.8% annually, outpacing the Hong Kong market. Recent strategic alliances, such as the joint venture with ManagePay Systems in Malaysia, highlight its expanding influence in smart transportation and IoT sectors. The company's technological advancements, like the M-Robots OS for collaborative robotics, underscore its innovation capacity. Despite a recent decline in net income to CNY 512.93 million, Chinasoft trades below estimated fair value by 17.3%.

- Unlock comprehensive insights into our analysis of Chinasoft International stock in this growth report.

- Our valuation report here indicates Chinasoft International may be undervalued.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

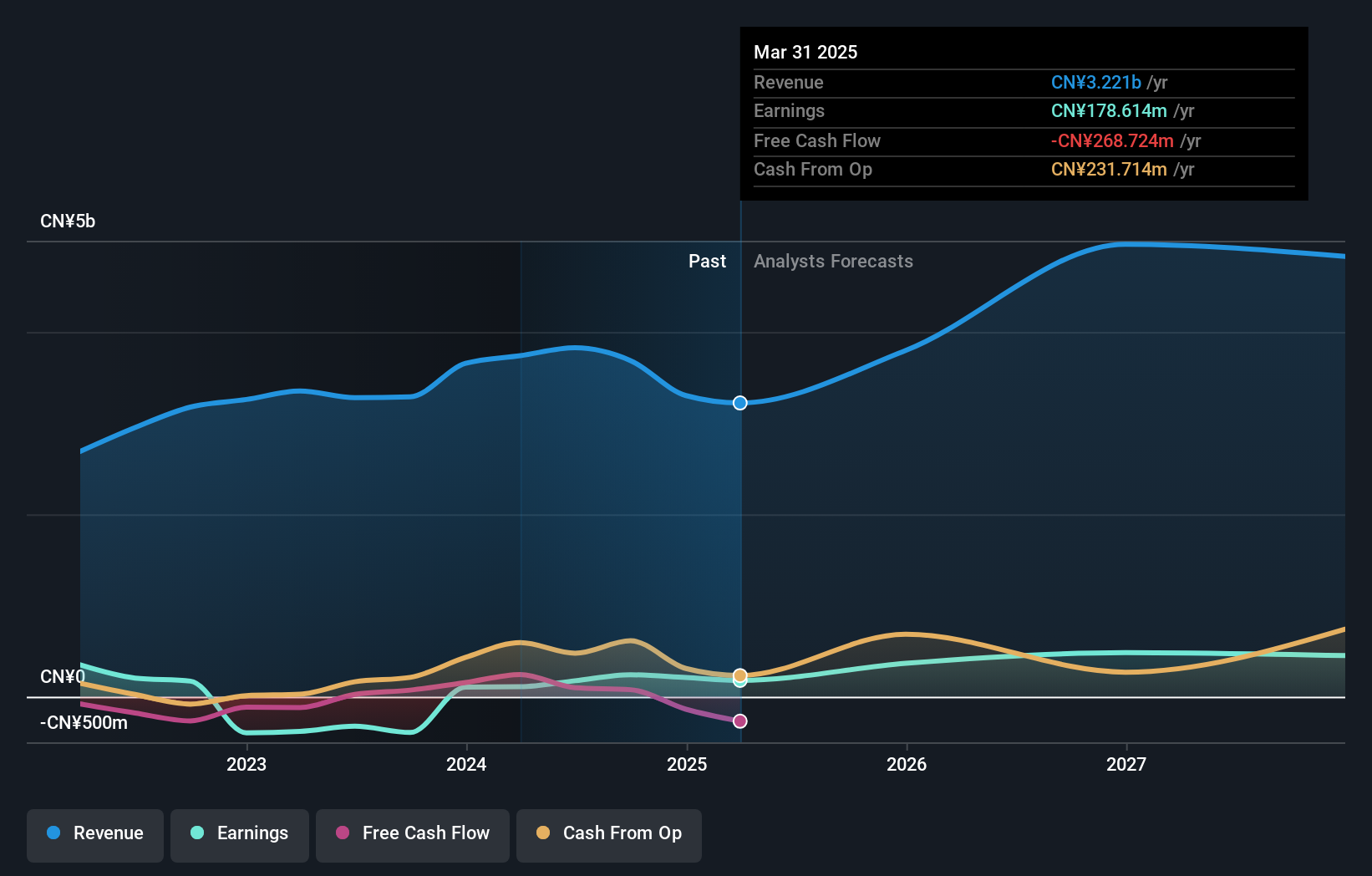

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and internationally, with a market cap of CN¥10.80 billion.

Operations: Wuxi Boton Technology's revenue is derived from its industrial bulk material handling and mobile Internet operations, serving both domestic and international markets.

Insider Ownership: 21.7%

Wuxi Boton Technology demonstrates growth potential with earnings forecasted to increase by 25.81% annually, surpassing the Chinese market's average. Despite recent volatility in share price and a drop in Q1 2025 revenue to CNY 758.73 million from CNY 839.46 million, the company's annual net income nearly doubled last year to CNY 209.93 million, reflecting strong financial performance amid challenges. The company recently affirmed its dividend distribution for shareholders, maintaining investor confidence.

- Get an in-depth perspective on Wuxi Boton Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Wuxi Boton Technology valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 625 companies by clicking here.

- Curious About Other Options? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Wuxi Boton Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuxi Boton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300031

Wuxi Boton Technology

Engages in the industrial bulk material handling and mobile Internet businesses in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives