- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Growth Tech Stocks In Hong Kong October 2024

Reviewed by Simply Wall St

As global markets react to China's recent stimulus measures, the Hong Kong market has experienced a notable uplift, with the Hang Seng Index gaining 13%. This positive sentiment provides an opportune backdrop for high-growth tech stocks in Hong Kong, which may benefit from increased investor interest and favorable economic conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.59% | 54.56% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

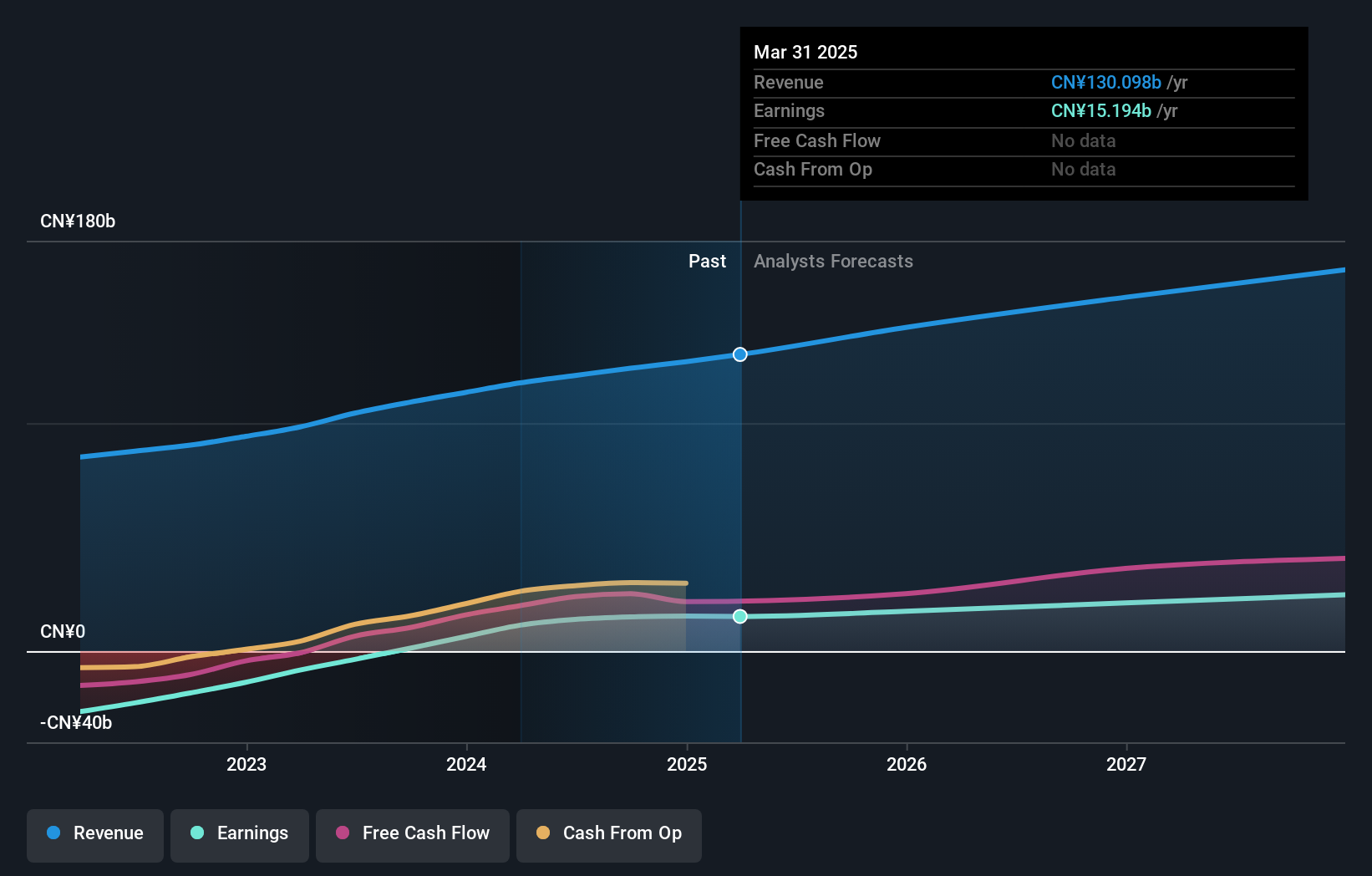

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in China with a market cap of HK$246.70 billion.

Operations: Kuaishou Technology generates revenue primarily from its domestic operations, amounting to CN¥117.32 billion, while its overseas segment contributes CN¥3.57 billion. The company focuses on providing live streaming and online marketing services in China.

Kuaishou Technology, a player in Hong Kong's tech scene, has shown remarkable financial and operational growth. In the recent quarter, sales surged to CNY 30.98 billion from CNY 27.74 billion year-over-year, with net income skyrocketing to CNY 3.98 billion from CNY 1.48 billion, reflecting a robust profit growth of approximately 169%. This performance is underscored by an aggressive R&D strategy that earmarks substantial resources towards innovation—R&D expenses have consistently aligned with revenue increases, maintaining a strategic balance to fuel further advancements without undermining profitability. Moreover, Kuaishou's recent enhancements in its AI-driven platforms like Kling AI highlight its commitment to leading-edge technology; these platforms not only enhance user engagement through improved video generation capabilities but also strategically position Kuaishou in competitive tech markets globally.

- Take a closer look at Kuaishou Technology's potential here in our health report.

Gain insights into Kuaishou Technology's past trends and performance with our Past report.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company involved in the enterprise resource planning business with a market capitalization of approximately HK$34.27 billion.

Operations: Kingdee International Software Group generates revenue primarily from its Cloud Service Business and ERP Business, with the Cloud Service segment contributing significantly more at CN¥4.86 billion compared to CN¥1.13 billion from the ERP segment. The company's market capitalization stands at approximately HK$34.27 billion.

Kingdee International Software Group, navigating through a challenging landscape, has reported a narrowing of its net loss to CNY 217.85 million from CNY 283.54 million year-over-year, indicating some operational improvements despite ongoing losses. The firm's commitment to innovation is evident in its R&D spending, which has been crucial in supporting its strategy to pivot more towards cloud-based solutions—a move reflecting broader industry trends towards SaaS models. However, with revenue growth projected at 13.9% annually, Kingdee is striving to outpace the Hong Kong market average of 7.3%, yet it faces hurdles in profitability and share price volatility that could impact future performance. As the company aims for profitability within three years amidst a forecasted earnings growth of 45.85% per year, these developments could potentially reshape its competitive stance in the tech sector.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in China and internationally, with a market capitalization of approximately HK$4.29 trillion.

Operations: Tencent generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company's diverse portfolio spans digital content, financial technology solutions, and targeted advertising platforms across domestic and international markets.

Tencent Holdings, amidst a dynamic tech landscape in Hong Kong, has demonstrated robust financial health with a significant uptick in net income to CNY 47.63 billion from CNY 26.17 billion year-over-year for Q2 2024, underscoring an impressive growth trajectory. The firm's commitment to innovation is underscored by its R&D expenses which are strategically aligned with its revenue growth forecasts of 8% per year—slightly above the Hong Kong market average of 7.3%. Moreover, Tencent's earnings are expected to climb by approximately 12.8% annually, reflecting not only its operational efficiency but also its adeptness at capitalizing on emerging market trends and consumer demands within the Interactive Media and Services sector. This performance is pivotal as it navigates through competitive pressures and evolving industry standards, positioning itself well for sustained future growth.

- Navigate through the intricacies of Tencent Holdings with our comprehensive health report here.

Review our historical performance report to gain insights into Tencent Holdings''s past performance.

Next Steps

- Investigate our full lineup of 45 SEHK High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.