- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

Exploring High Growth Tech Stocks in Asia June 2025

Reviewed by Simply Wall St

As global markets continue to react to economic indicators and geopolitical developments, the Asian tech sector stands out with its potential for high growth, particularly as investors remain optimistic about artificial intelligence advancements and regional stimulus measures. In this dynamic environment, identifying promising tech stocks involves considering factors such as innovation in AI, resilience against trade tensions, and strategic partnerships that align with current market trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| ALTEOGEN | 54.36% | 69.84% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We'll examine a selection from our screener results.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company focused on enterprise resource planning, with a market capitalization of approximately HK$45.68 billion.

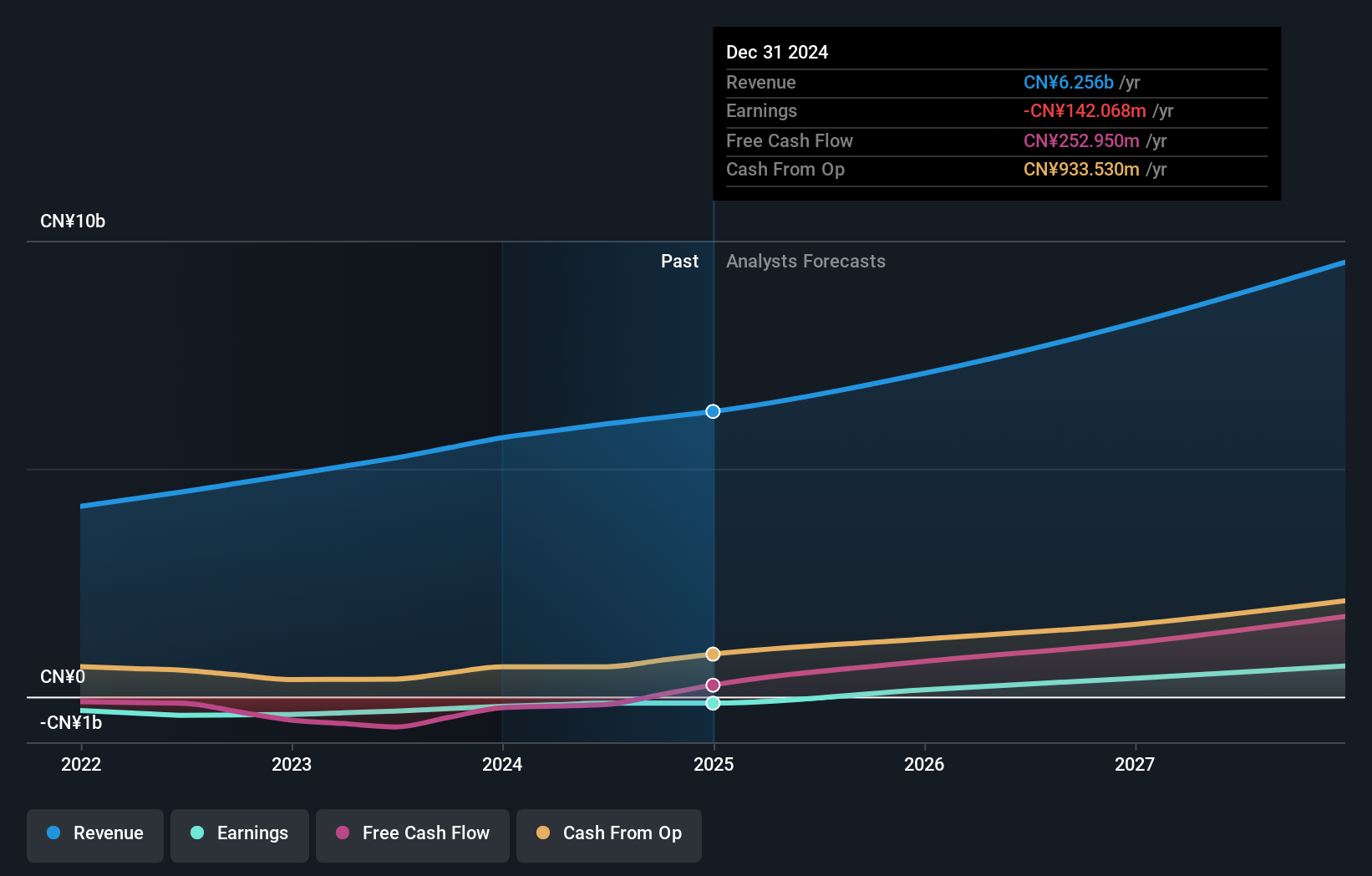

Operations: Kingdee International Software Group derives its revenue primarily from two segments: the ERP business, generating CN¥1.15 billion, and the Cloud Services business, contributing CN¥5.11 billion.

Kingdee International Software Group, positioned in the competitive landscape of Asian tech, demonstrates resilience and potential despite its current unprofitable status. With a reported revenue increase to CNY 6.26 billion from CNY 5.68 billion last year, the company is navigating through its financial challenges by focusing on innovation and market expansion—evidenced by a significant reduction in net loss from CNY 209.89 million to CNY 142.07 million annually. The firm's commitment to R&D is pivotal for future growth, especially as it transitions towards profitability with an expected annual profit growth of 38.44%. This strategic emphasis on development aligns with industry trends towards enhanced software solutions and could position Kingdee favorably in the burgeoning tech sector of Asia.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market capitalization of approximately HK$17.02 billion.

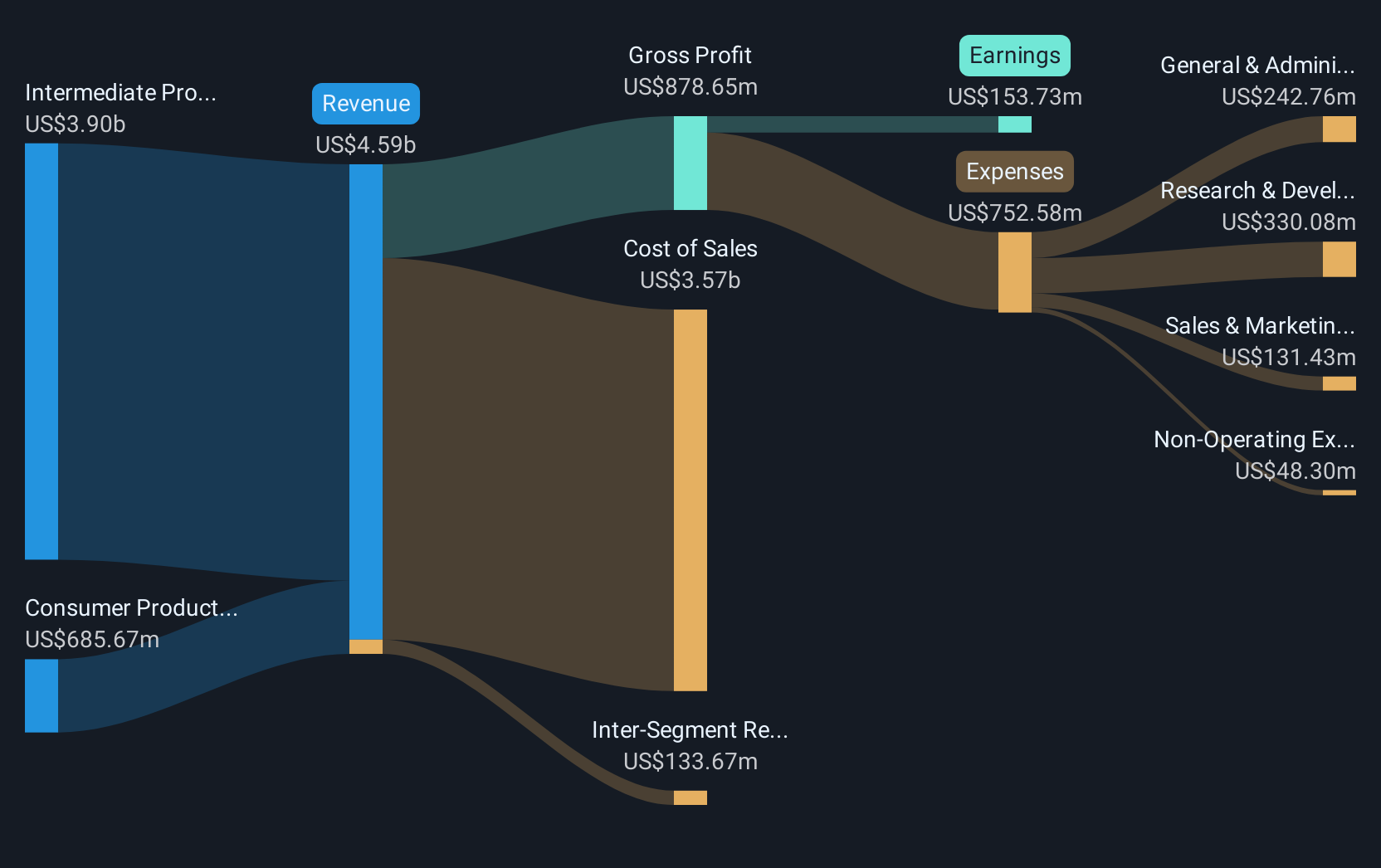

Operations: The company generates revenue primarily from Consumer Products and Intermediate Products, with the latter contributing significantly more at $3.90 billion compared to $685.67 million for Consumer Products.

FIT Hon Teng has shown a robust performance with a notable increase in annual revenue to $4.45 billion, up from $4.20 billion the previous year, and an enhanced net income of $153.73 million, rising from $128.97 million. This growth is complemented by an earnings growth forecast of 23.6% per year, outpacing the Hong Kong market's average of 10.4%. The company's strategic focus on R&D is evident as it aligns with industry shifts towards advanced technological solutions, ensuring its competitiveness in the dynamic tech landscape of Asia.

- Click here to discover the nuances of FIT Hon Teng with our detailed analytical health report.

Examine FIT Hon Teng's past performance report to understand how it has performed in the past.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wiwynn Corporation specializes in the research, development, design, testing, and sales of semiconductor products and peripheral equipment globally with a market cap of NT$458.10 billion.

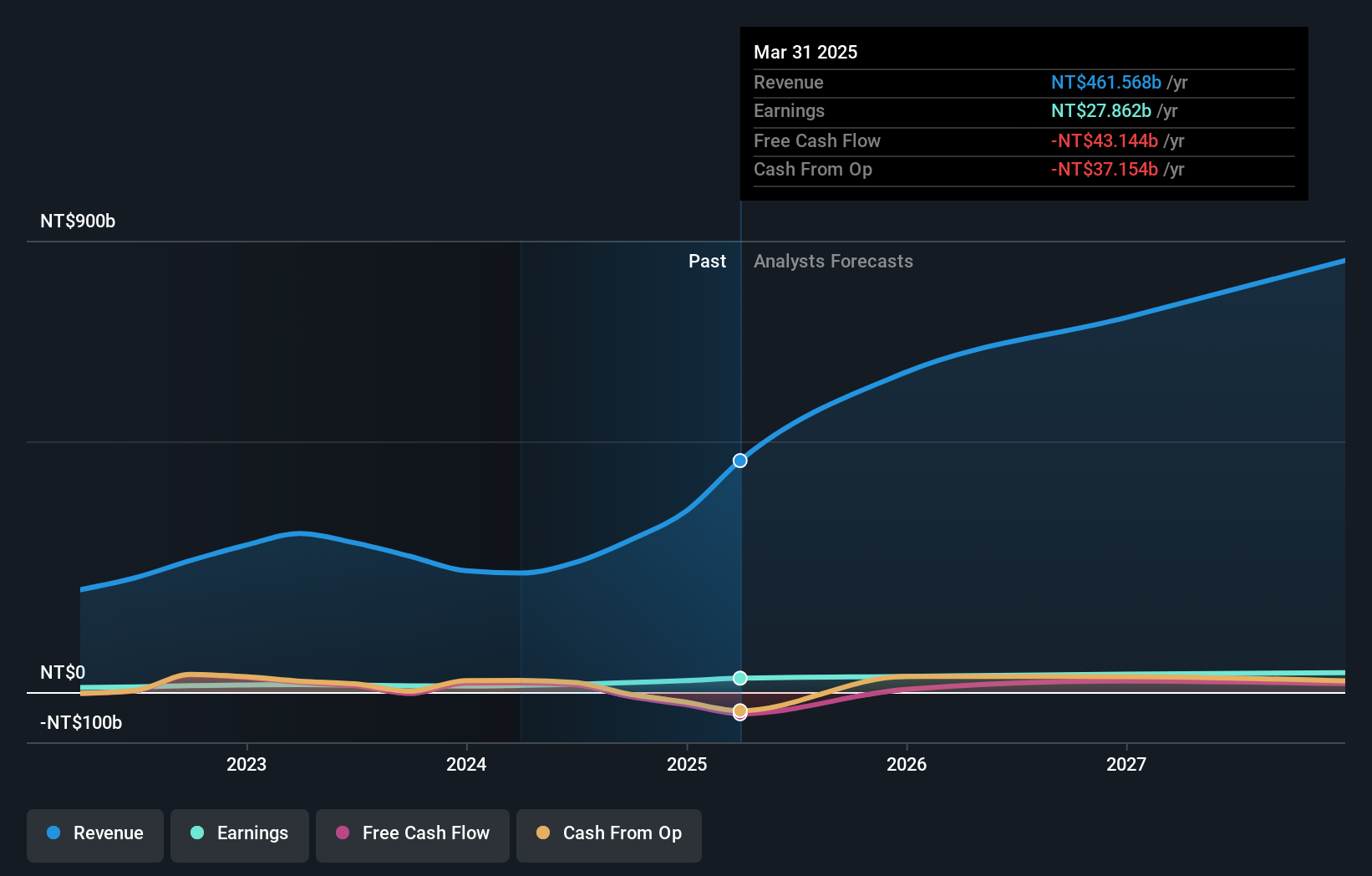

Operations: The company generates revenue primarily from the computer hardware segment, amounting to NT$461.57 billion.

Wiwynn has demonstrated a robust trajectory in the tech sector, particularly with its recent unveiling of advanced AI servers and cooling solutions at Computex 2025. The company's strategic collaboration with Wistron and Fabric8Labs underscores its commitment to innovation, especially in high-performance computing environments where thermal management is critical. This focus on cutting-edge technology is reflected in Wiwynn’s impressive financial performance, with first-quarter sales soaring to TWD 170.66 billion from TWD 69.63 billion year-over-year, and net income more than doubling to TWD 9.79 billion. These developments not only enhance Wiwynn's product offerings but also position it well within the rapidly evolving AI infrastructure landscape, promising continued growth in a competitive market.

- Delve into the full analysis health report here for a deeper understanding of Wiwynn.

Gain insights into Wiwynn's historical performance by reviewing our past performance report.

Seize The Opportunity

- Dive into all 489 of the Asian High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion