As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, Asian stock markets are drawing attention for their potential resilience and opportunities. In this environment, identifying undervalued stocks requires a keen eye on fundamentals and market conditions that could reveal hidden value amid broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.02 | CN¥74.99 | 49.3% |

| Taiyo Yuden (TSE:6976) | ¥2560.00 | ¥5097.13 | 49.8% |

| Puyang Refractories Group (SZSE:002225) | CN¥6.34 | CN¥12.66 | 49.9% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.29 | CN¥46.22 | 49.6% |

| Medy-Tox (KOSDAQ:A086900) | ₩161200.00 | ₩322233.66 | 50% |

| Grand Korea Leisure (KOSE:A114090) | ₩17010.00 | ₩33803.83 | 49.7% |

| cottaLTD (TSE:3359) | ¥428.00 | ¥852.86 | 49.8% |

| BYD (SEHK:1211) | HK$120.40 | HK$236.17 | 49% |

| Astroscale Holdings (TSE:186A) | ¥679.00 | ¥1347.77 | 49.6% |

| ALUX (KOSDAQ:A475580) | ₩11560.00 | ₩22701.67 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

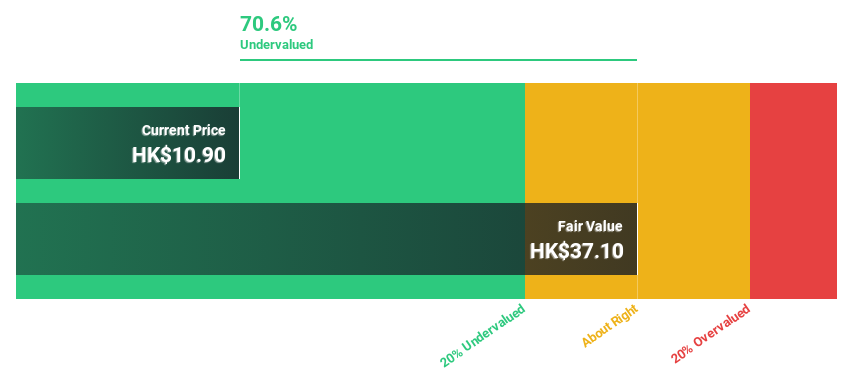

Kingdee International Software Group (SEHK:268)

Overview: Kingdee International Software Group Company Limited is an investment holding company involved in the enterprise resource planning business, with a market capitalization of approximately HK$55.15 billion.

Operations: The company's revenue is primarily derived from its Cloud Services Business, which generated CN¥5.11 billion, and its ERP Business, contributing CN¥1.15 billion.

Estimated Discount To Fair Value: 39.7%

Kingdee International Software Group is trading at HK$15.54, significantly below its estimated fair value of HK$25.76, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow 41.56% annually, and revenue is expected to increase by 13.6% per year, outpacing the Hong Kong market's growth rate of 8.1%. However, its return on equity is projected to remain low at 7.6% in three years.

- Our expertly prepared growth report on Kingdee International Software Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Kingdee International Software Group's balance sheet health report.

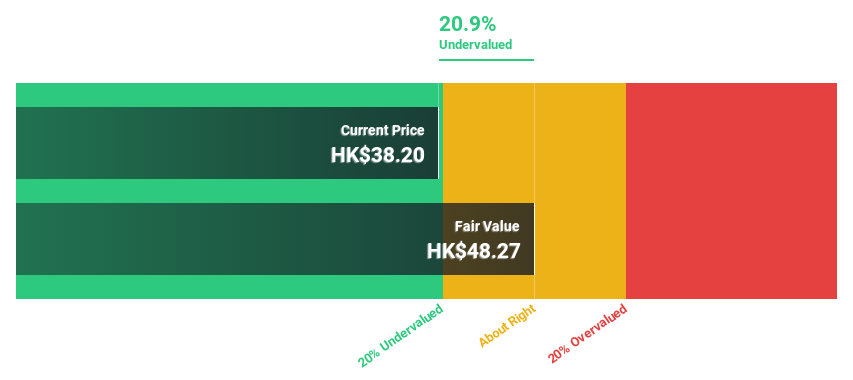

Nongfu Spring (SEHK:9633)

Overview: Nongfu Spring Co., Ltd. is a company that produces and sells packaged drinking water and beverage products primarily in Mainland China, with a market cap of HK$449.30 billion.

Operations: The company's revenue segments include CN¥15.95 billion from water products, CN¥4.08 billion from juice beverage products, CN¥4.93 billion from functional drinks products, and CN¥16.74 billion from ready-to-drink tea products.

Estimated Discount To Fair Value: 21.9%

Nongfu Spring, trading at HK$39.95, is priced 21.9% below its fair value estimate of HK$51.18, highlighting potential undervaluation based on cash flows. Earnings have grown at 21.2% annually over the past five years and are forecast to continue growing at 10.5% per year, outpacing the Hong Kong market's growth rate of 10.4%. Recent board changes and auditor appointments may influence future governance and financial oversight positively.

- Insights from our recent growth report point to a promising forecast for Nongfu Spring's business outlook.

- Click here to discover the nuances of Nongfu Spring with our detailed financial health report.

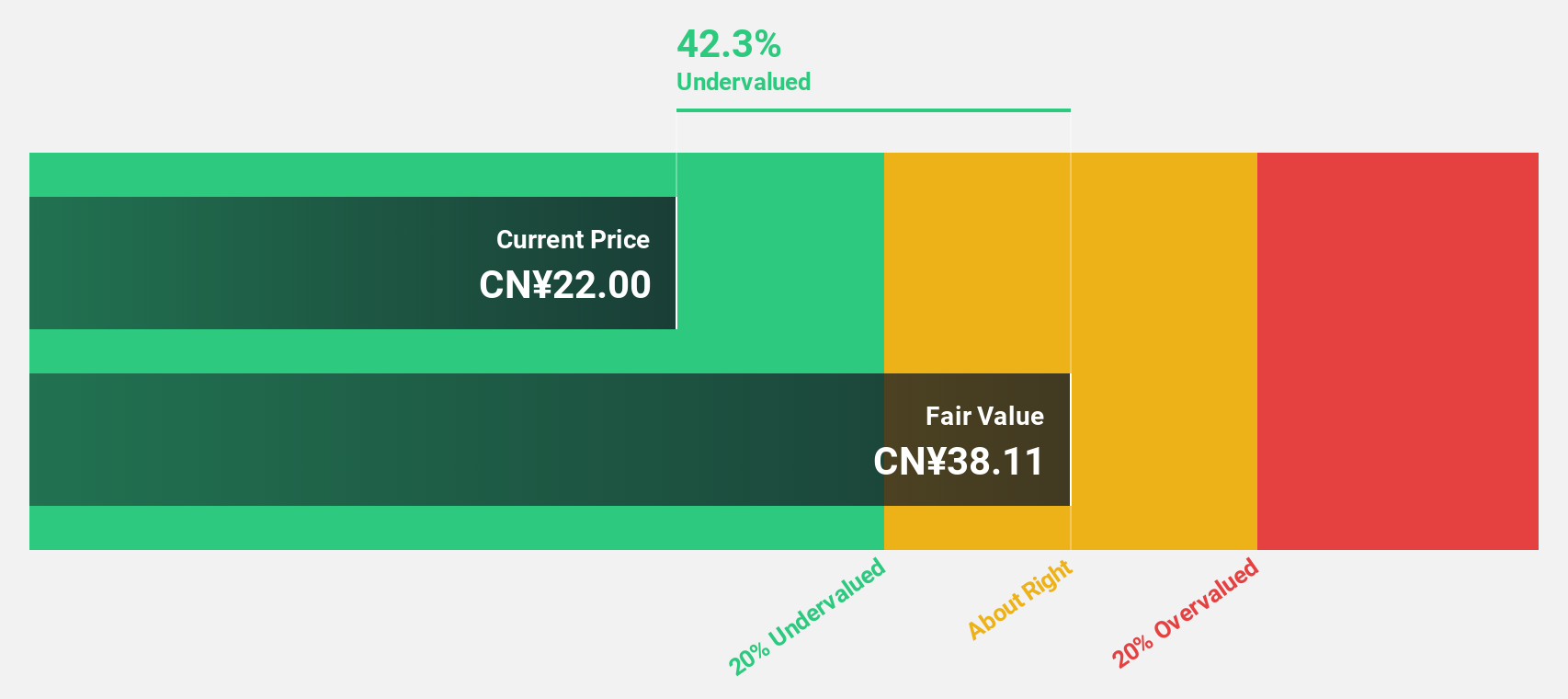

Wuxi Lead Intelligent EquipmentLTD (SZSE:300450)

Overview: Wuxi Lead Intelligent Equipment Co., Ltd. develops, manufactures, and sells intelligent equipment in China with a market cap of CN¥37.52 billion.

Operations: Wuxi Lead Intelligent Equipment Co., Ltd. generates revenue through the development, manufacturing, and sale of intelligent equipment in China.

Estimated Discount To Fair Value: 35%

Wuxi Lead Intelligent Equipment, trading at CN¥24.13, is significantly undervalued with a fair value estimate of CN¥37.15, reflecting strong cash flow potential. Despite recent declines in revenue and net income, earnings are projected to grow substantially by 54.8% annually over the next three years, outpacing the Chinese market's growth rate of 23.4%. However, profit margins have contracted from last year’s levels and one-off items have impacted financial results.

- According our earnings growth report, there's an indication that Wuxi Lead Intelligent EquipmentLTD might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Wuxi Lead Intelligent EquipmentLTD.

Make It Happen

- Reveal the 264 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nongfu Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9633

Nongfu Spring

Produces and sells packaged drinking water and beverage products primarily in Mainland China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives