Amidst global market concerns over AI valuations and economic uncertainties, Asian markets have mirrored these sentiments with notable fluctuations. For investors exploring opportunities in smaller or newer companies, penny stocks continue to be a relevant area of interest despite their somewhat outdated terminology. By focusing on those with strong financial foundations, these stocks can offer value and growth potential that larger firms may overlook.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB5.00 | THB3.1B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.44 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.85 | NZ$239.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.445 | SGD166.71M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Mobvoi (SEHK:2438)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mobvoi Inc. is an investment holding company that offers AI software solutions and sells smart devices and accessories both in Mainland China and internationally, with a market cap of HK$944.80 million.

Operations: The company's revenue is derived from its Smart Devices and Other Accessories segment, generating CN¥190.88 million, and AI Software Solutions - AI Enterprise Solutions, which recorded a negative contribution of CN¥5.96 million.

Market Cap: HK$944.8M

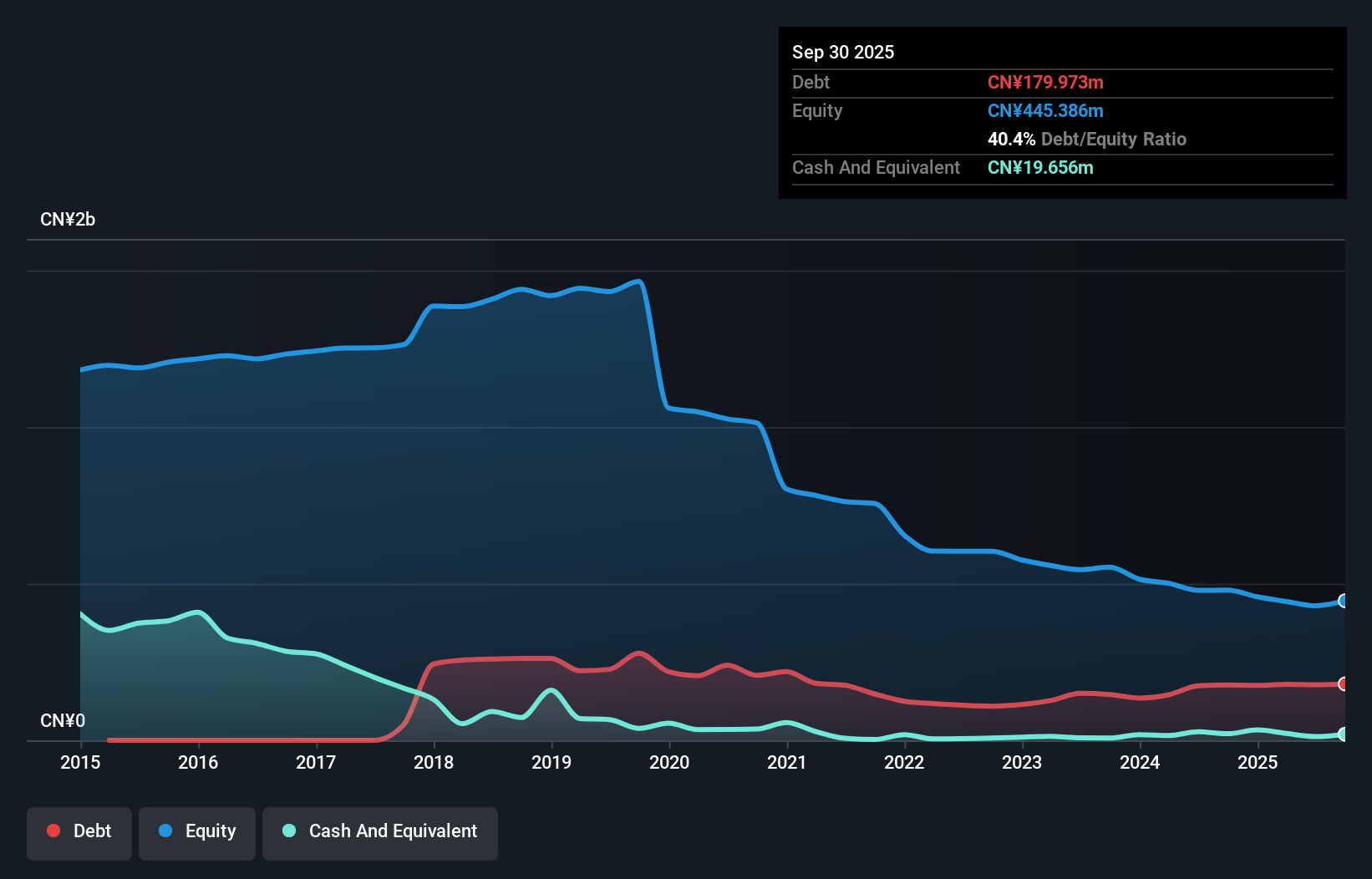

Mobvoi Inc., with a market cap of HK$944.80 million, is navigating the penny stock landscape in Asia by leveraging its AI-driven smart devices and accessories business. Despite being unprofitable and experiencing increased losses over five years, Mobvoi's short-term assets significantly outweigh its liabilities, suggesting financial stability. The company has not diluted shareholders recently and maintains more cash than debt. However, management's limited experience could pose challenges. Mobvoi's recent launch of TicNote Pods—4G-connected AI earbuds—highlights innovation potential that may attract attention despite the company's current volatility and negative return on equity.

- Get an in-depth perspective on Mobvoi's performance by reading our balance sheet health report here.

- Explore historical data to track Mobvoi's performance over time in our past results report.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services with a market cap of HK$2.14 billion.

Operations: The company's revenue is primarily derived from its Investment Holding segment at HK$102.79 million, followed by Asset Management at HK$13.35 million, and Securities (including Investment Banking) at HK$8.89 million.

Market Cap: HK$2.14B

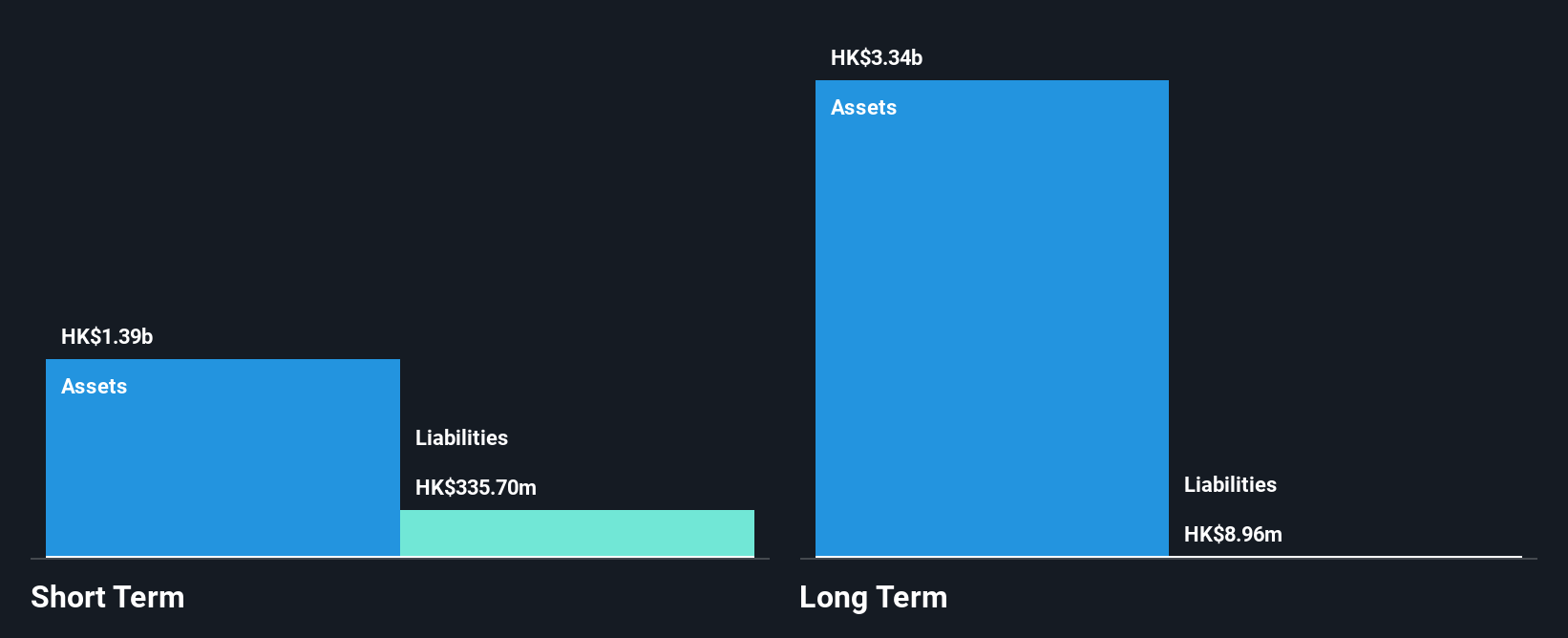

China Vered Financial Holding Corporation Limited, with a market cap of HK$2.14 billion, has recently turned profitable, distinguishing itself in the penny stock sector. The company is debt-free and its short-term assets of HK$3.3 billion comfortably cover both short and long-term liabilities, indicating robust financial health. Its Price-to-Earnings ratio of 2.2x suggests potential undervaluation compared to the broader Hong Kong market average of 12.2x. However, a relatively inexperienced board could present governance challenges despite an experienced management team and stable weekly volatility at 4%. The upcoming earnings release may provide further insights into its financial trajectory.

- Dive into the specifics of China Vered Financial Holding here with our thorough balance sheet health report.

- Gain insights into China Vered Financial Holding's historical outcomes by reviewing our past performance report.

Goldlok Holdings(Guangdong)Ltd (SZSE:002348)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Goldlok Holdings (Guangdong) Co., Ltd. operates in the toys and Internet education sectors in China, with a market capitalization of CN¥4.56 billion.

Operations: Goldlok Holdings (Guangdong) Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥4.56B

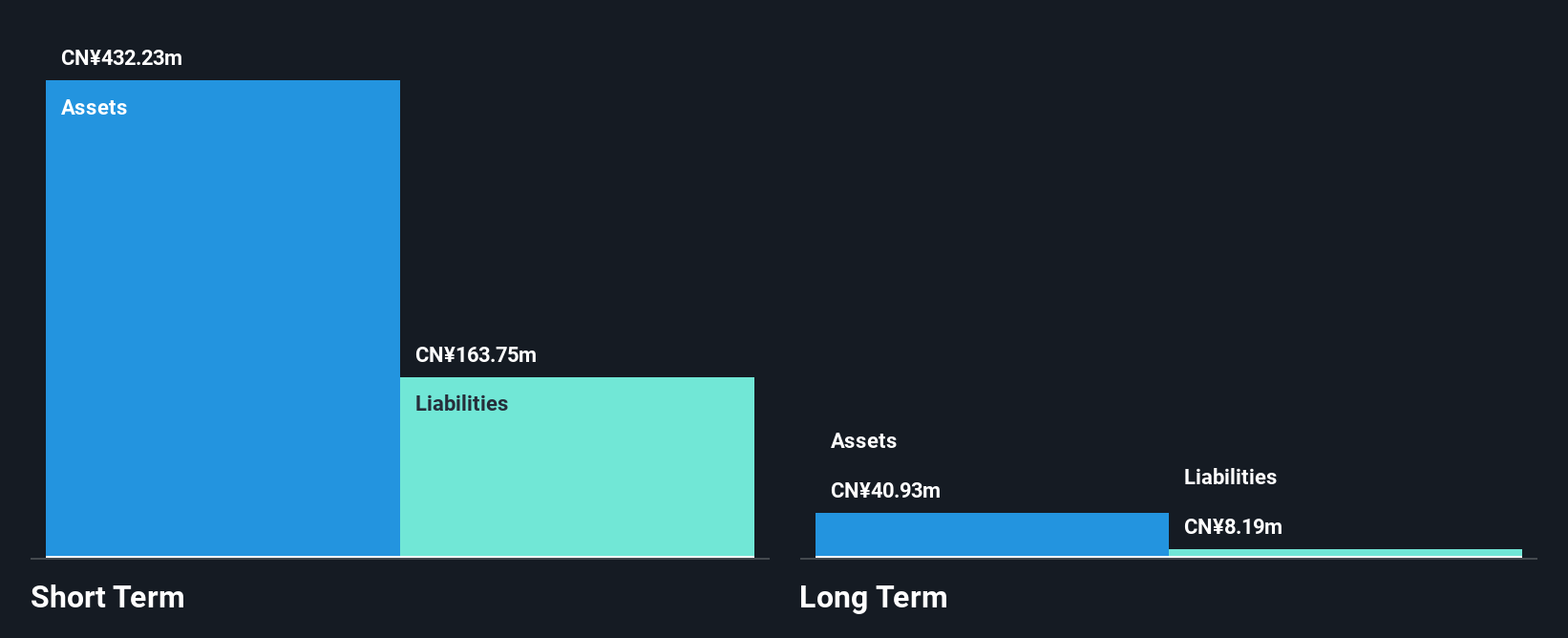

Goldlok Holdings (Guangdong) Co., Ltd., with a market capitalization of CN¥4.56 billion, operates in the toys and Internet education sectors in China. Despite being unprofitable, it has managed to reduce its net loss from CN¥34.24 million to CN¥11.67 million over the past year, reflecting improving financial performance. The company's net debt to equity ratio is satisfactory at 36%, and short-term assets exceed long-term liabilities, though they fall short of covering all short-term liabilities. While its board lacks experience with an average tenure of 2.2 years, Goldlok maintains a stable cash runway for over three years despite ongoing losses.

- Click here to discover the nuances of Goldlok Holdings(Guangdong)Ltd with our detailed analytical financial health report.

- Examine Goldlok Holdings(Guangdong)Ltd's past performance report to understand how it has performed in prior years.

Make It Happen

- Reveal the 958 hidden gems among our Asian Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002348

Goldlok Holdings(Guangdong)Ltd

Engages in the toys and Internet education businesses in China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.