Enterprise Development Holdings Limited's (HKG:1808) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Enterprise Development Holdings Limited (HKG:1808) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 224% in the last twelve months.

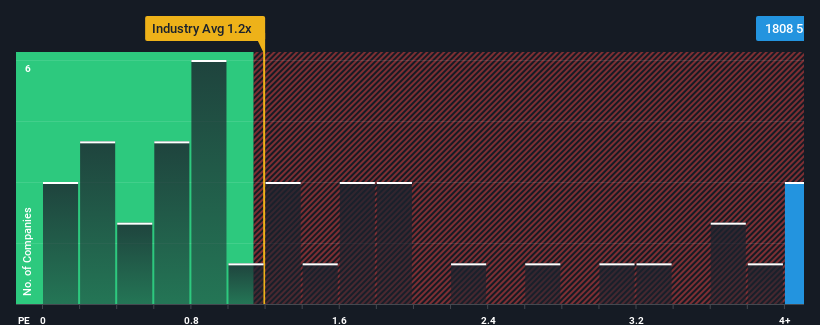

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Software industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Enterprise Development Holdings as a stock not worth researching with its 5.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Enterprise Development Holdings

What Does Enterprise Development Holdings' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Enterprise Development Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Enterprise Development Holdings' earnings, revenue and cash flow.How Is Enterprise Development Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Enterprise Development Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 203% gain to the company's top line. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 22% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Enterprise Development Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Enterprise Development Holdings' P/S

Enterprise Development Holdings' shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Enterprise Development Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Enterprise Development Holdings is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Enterprise Development Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Development Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1808

Enterprise Development Holdings

An investment holding company, engages in the provision of integrated business software and hardware solutions in the People’s Republic of China, Thailand, and Hong Kong.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives