Do Enterprise Development Holdings' (HKG:1808) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Enterprise Development Holdings (HKG:1808), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Enterprise Development Holdings' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Enterprise Development Holdings grew its EPS from CN¥0.033 to CN¥0.30, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

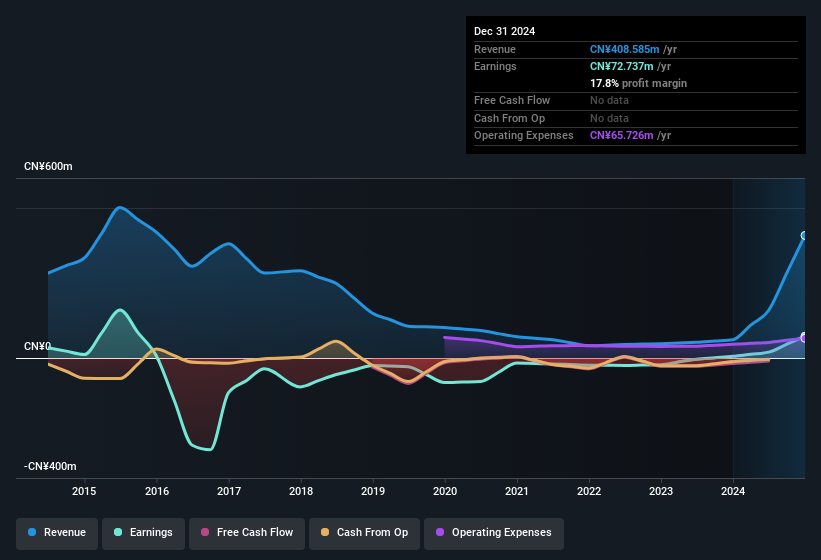

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Enterprise Development Holdings shareholders is that EBIT margins have grown from -32% to -4.8% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

View our latest analysis for Enterprise Development Holdings

Enterprise Development Holdings isn't a huge company, given its market capitalisation of HK$1.0b. That makes it extra important to check on its balance sheet strength.

Are Enterprise Development Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Enterprise Development Holdings is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In other words, the company insider, Wing Cheng, acquired CN¥32m worth of shares over the previous 12 months at an average price of around CN¥2.09. It doesn't get much better than that, in terms of large investments from insiders.

Should You Add Enterprise Development Holdings To Your Watchlist?

Enterprise Development Holdings' earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over Enterprise Development Holdings could be in your best interest. Before you take the next step you should know about the 2 warning signs for Enterprise Development Holdings that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Enterprise Development Holdings, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Development Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1808

Enterprise Development Holdings

An investment holding company, engages in the provision of integrated business software and hardware solutions in the People’s Republic of China, Thailand, and Hong Kong.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives