AsiaInfo Technologies Limited (HKG:1675) Stock Rockets 52% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, AsiaInfo Technologies Limited (HKG:1675) shares have been powering on, with a gain of 52% in the last thirty days. The last 30 days bring the annual gain to a very sharp 44%.

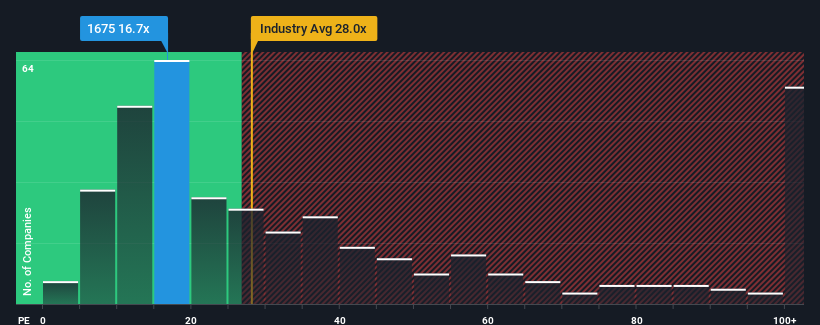

After such a large jump in price, AsiaInfo Technologies may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 16.7x, since almost half of all companies in Hong Kong have P/E ratios under 10x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We've discovered 2 warning signs about AsiaInfo Technologies. View them for free.There hasn't been much to differentiate AsiaInfo Technologies' and the market's earnings growth lately. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for AsiaInfo Technologies

Is There Enough Growth For AsiaInfo Technologies?

There's an inherent assumption that a company should far outperform the market for P/E ratios like AsiaInfo Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 3.0% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 32% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15% per annum, which is not materially different.

With this information, we find it interesting that AsiaInfo Technologies is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On AsiaInfo Technologies' P/E

The strong share price surge has got AsiaInfo Technologies' P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that AsiaInfo Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware AsiaInfo Technologies is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than AsiaInfo Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1675

AsiaInfo Technologies

An investment holding company, offers telecom software products and related services in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026