Does Sinosoft Technology Group (HKG:1297) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Sinosoft Technology Group Limited (HKG:1297) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Sinosoft Technology Group

What Is Sinosoft Technology Group's Net Debt?

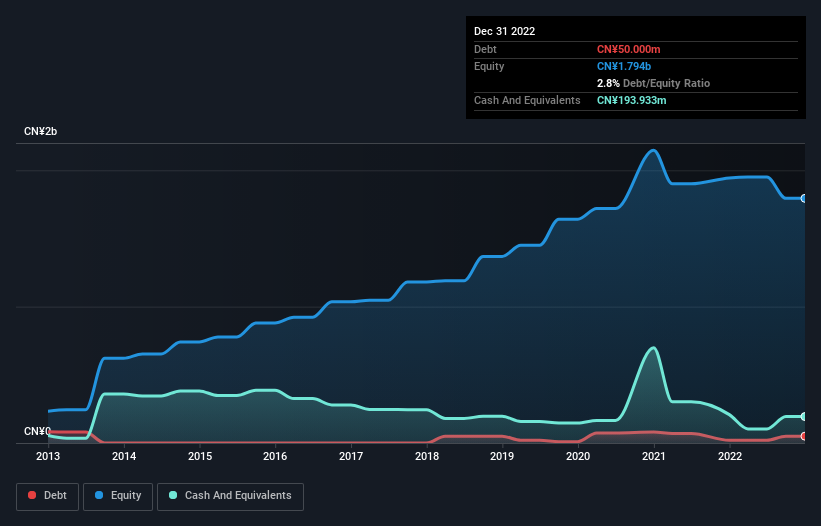

As you can see below, at the end of December 2022, Sinosoft Technology Group had CN¥50.0m of debt, up from CN¥20.0m a year ago. Click the image for more detail. But it also has CN¥193.9m in cash to offset that, meaning it has CN¥143.9m net cash.

How Strong Is Sinosoft Technology Group's Balance Sheet?

The latest balance sheet data shows that Sinosoft Technology Group had liabilities of CN¥236.2m due within a year, and liabilities of CN¥88.9m falling due after that. Offsetting this, it had CN¥193.9m in cash and CN¥1.25b in receivables that were due within 12 months. So it actually has CN¥1.12b more liquid assets than total liabilities.

This surplus liquidity suggests that Sinosoft Technology Group's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Sinosoft Technology Group has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Sinosoft Technology Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Sinosoft Technology Group had a loss before interest and tax, and actually shrunk its revenue by 2.4%, to CN¥572m. That's not what we would hope to see.

So How Risky Is Sinosoft Technology Group?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Sinosoft Technology Group had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CN¥14m and booked a CN¥153m accounting loss. Given it only has net cash of CN¥143.9m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Sinosoft Technology Group you should be aware of, and 1 of them doesn't sit too well with us.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1297

Sinosoft Technology Group

Sinosoft Technology Group Limited, an investment holding company, provides application software products and solutions in the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives