- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

Optimistic Investors Push Semiconductor Manufacturing International Corporation (HKG:981) Shares Up 31% But Growth Is Lacking

Despite an already strong run, Semiconductor Manufacturing International Corporation (HKG:981) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 244% in the last year.

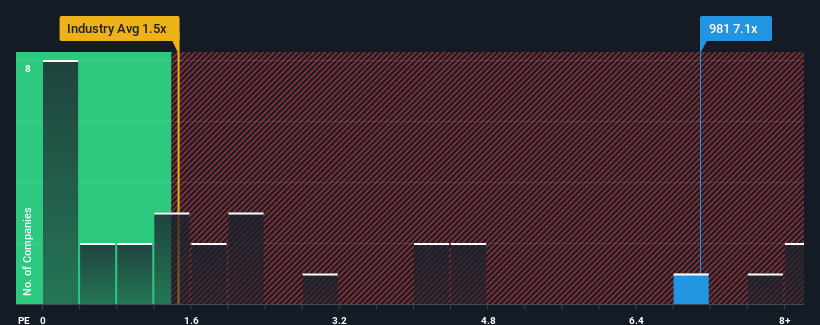

Since its price has surged higher, when almost half of the companies in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Semiconductor Manufacturing International as a stock not worth researching with its 7.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Semiconductor Manufacturing International

What Does Semiconductor Manufacturing International's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Semiconductor Manufacturing International has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Semiconductor Manufacturing International's future stacks up against the industry? In that case, our free report is a great place to start.How Is Semiconductor Manufacturing International's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Semiconductor Manufacturing International's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 18% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Semiconductor Manufacturing International's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Semiconductor Manufacturing International's P/S Mean For Investors?

Shares in Semiconductor Manufacturing International have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Semiconductor Manufacturing International's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Semiconductor Manufacturing International you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives