- South Korea

- /

- Telecom Services and Carriers

- /

- KOSE:A030200

Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and record-high stock indexes, investors are closely watching for opportunities that can offer stability and income in uncertain times. In this context, dividend stocks stand out as a potential choice for those seeking to balance growth with consistent returns, particularly when market volatility is on the rise.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KT Corporation offers integrated telecommunications and platform services both in Korea and internationally, with a market cap of ₩11.50 trillion.

Operations: KT Corporation's revenue is derived from its integrated telecommunications and platform services offered domestically and internationally.

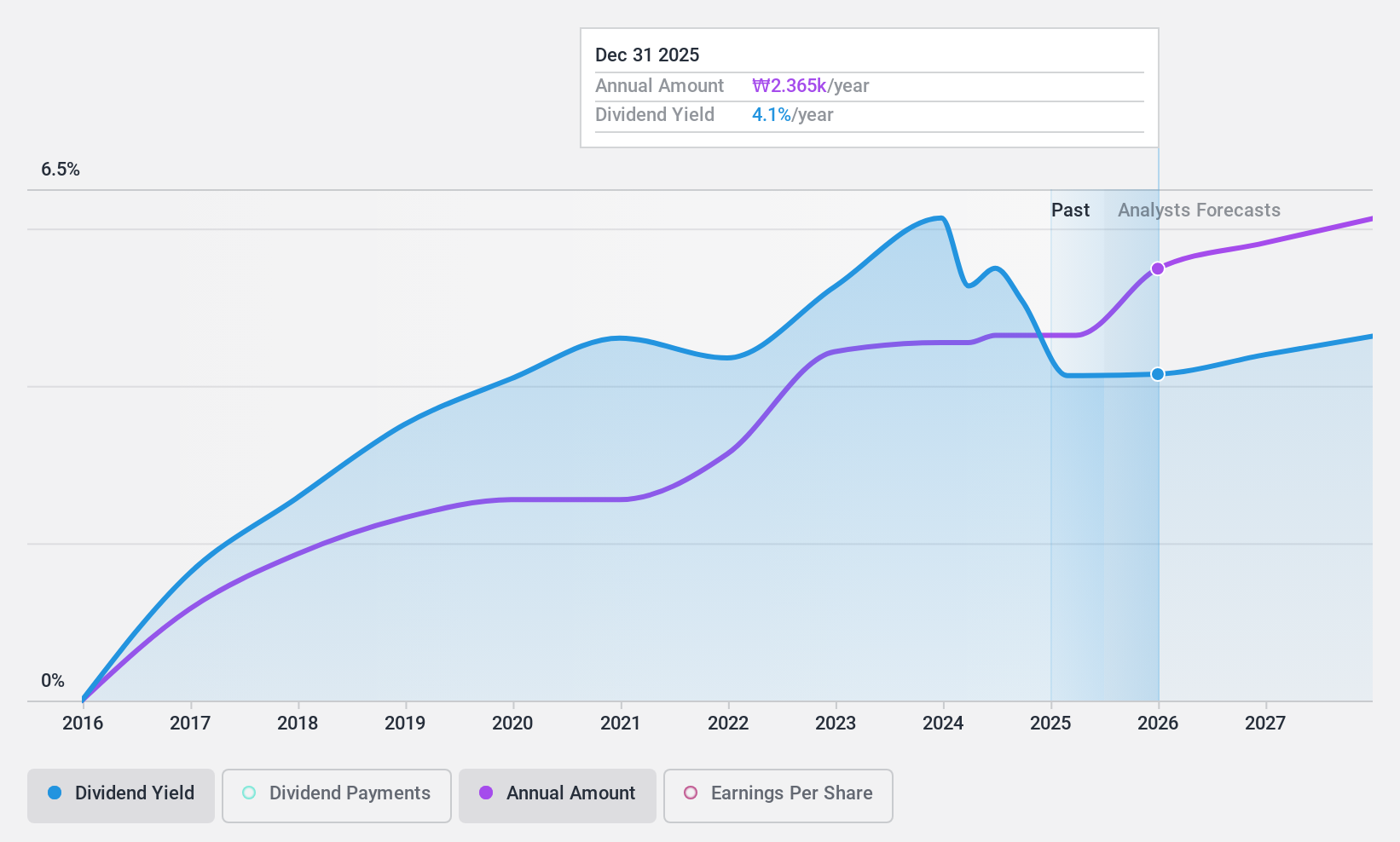

Dividend Yield: 4.3%

KT Corporation's dividend yield of 4.27% is among the top 25% in the KR market, yet its sustainability is questionable due to a high payout ratio of 97.7%, indicating dividends aren't well covered by earnings. However, cash flows cover dividends with a low cash payout ratio of 26.4%. The company's recent share repurchase program aims to enhance shareholder value, alongside confirmed quarterly dividends and projected revenue over ₩28 trillion for 2025.

- Unlock comprehensive insights into our analysis of KT stock in this dividend report.

- According our valuation report, there's an indication that KT's share price might be on the cheaper side.

Hallenstein Glasson Holdings (NZSE:HLG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hallenstein Glasson Holdings Limited, along with its subsidiaries, operates as a retailer of men's and women's clothing in New Zealand and Australia, with a market cap of NZ$510 million.

Operations: Hallenstein Glasson Holdings Limited generates revenue through its segments: Hallensteins (NZ$108.36 million), Glassons Australia (NZ$219.44 million), and Glassons New Zealand (NZ$120.30 million).

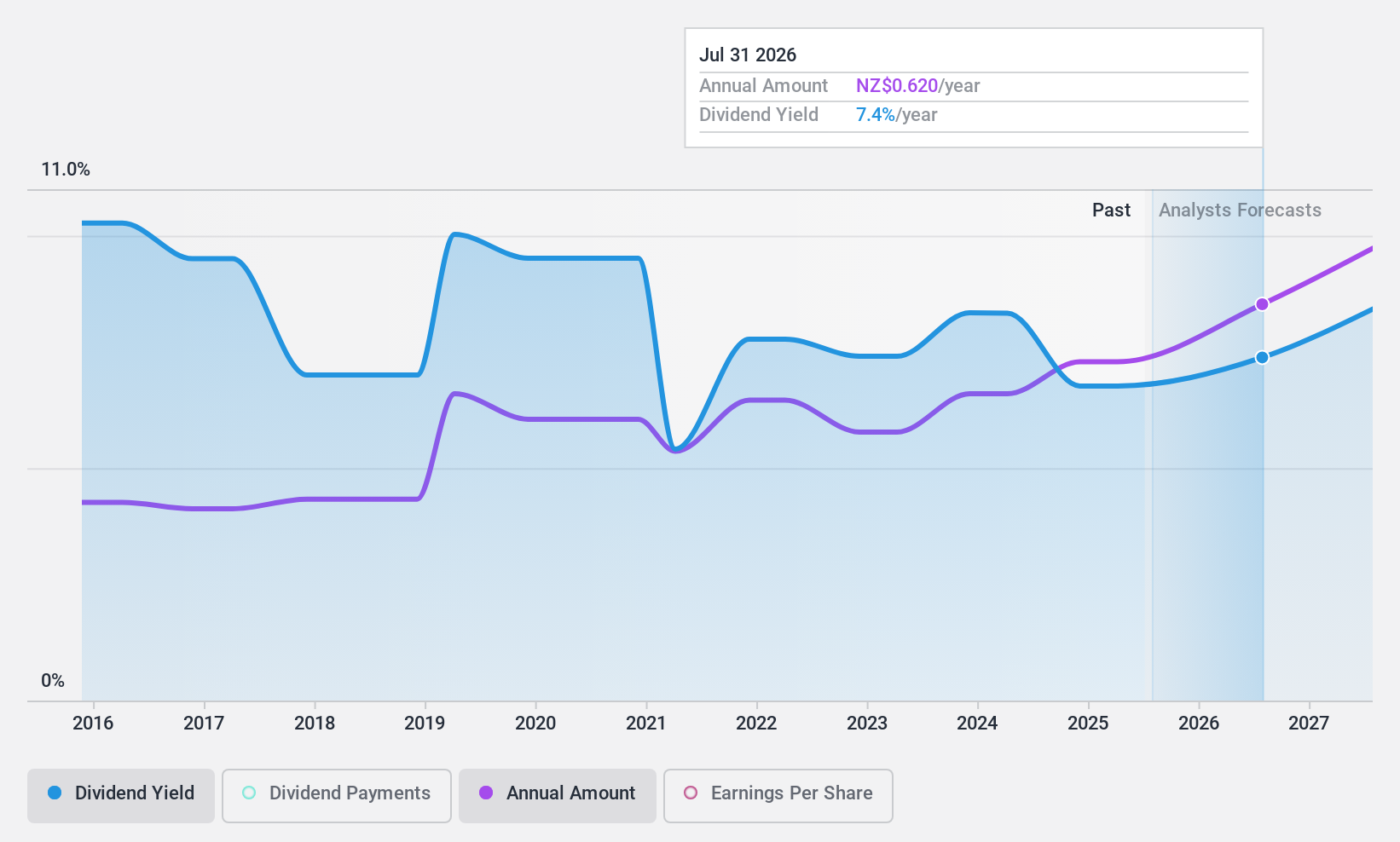

Dividend Yield: 6%

Hallenstein Glasson Holdings offers a reliable dividend yield of 6.02%, supported by a sustainable cash payout ratio of 45.6%. While the earnings payout ratio is higher at 87.3%, dividends remain well-covered and have shown stability over the past decade, with consistent growth and minimal volatility. The stock trades at an attractive valuation, significantly below its estimated fair value, providing potential upside for investors seeking both income and value in their portfolios.

- Click to explore a detailed breakdown of our findings in Hallenstein Glasson Holdings' dividend report.

- Our valuation report here indicates Hallenstein Glasson Holdings may be undervalued.

China Electronics Huada Technology (SEHK:85)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Electronics Huada Technology Company Limited is an investment holding company focused on the design, development, and sale of integrated circuit chips in the People's Republic of China, with a market cap of HK$2.86 billion.

Operations: The company's revenue primarily comes from its integrated circuit chip design and sales segment, generating HK$2.57 billion.

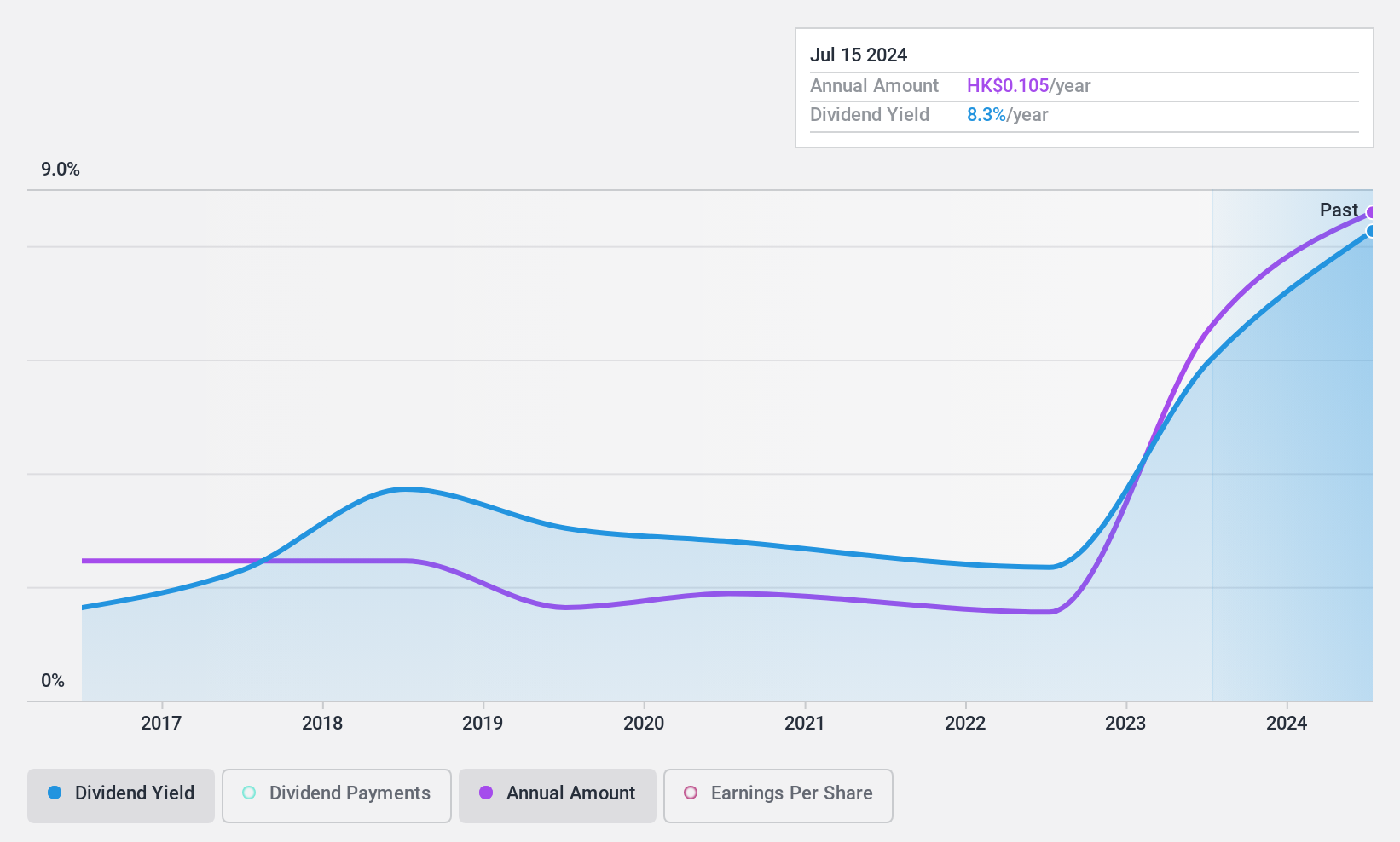

Dividend Yield: 7.4%

China Electronics Huada Technology's dividend yield of 7.45% is slightly below the top 25% in Hong Kong, but dividends are well-covered by earnings (48.1%) and cash flow (37.6%). Despite past volatility and unreliability, dividends have grown over the last decade. The stock's price-to-earnings ratio of 6.5x suggests it may be undervalued compared to the market average of 10.2x, offering potential value for investors seeking income opportunities.

- Dive into the specifics of China Electronics Huada Technology here with our thorough dividend report.

- Upon reviewing our latest valuation report, China Electronics Huada Technology's share price might be too optimistic.

Seize The Opportunity

- Delve into our full catalog of 1974 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030200

KT

Provides integrated telecommunications and platform services in South Korea, rest of Asia, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives