- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

China Electronics Huada Technology Company Limited (HKG:85) Looks Inexpensive After Falling 25% But Perhaps Not Attractive Enough

The China Electronics Huada Technology Company Limited (HKG:85) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

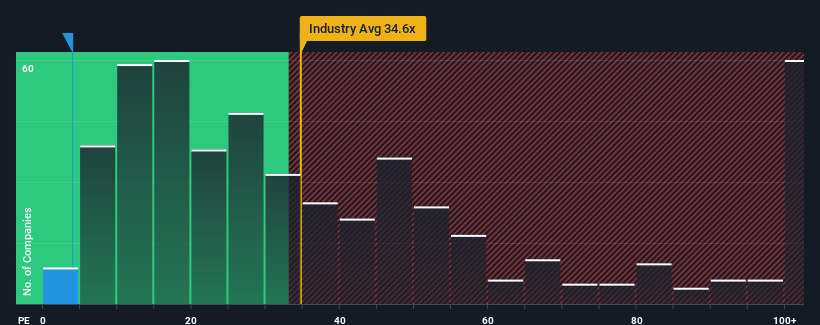

After such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may consider China Electronics Huada Technology as a highly attractive investment with its 3.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

China Electronics Huada Technology has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for China Electronics Huada Technology

How Is China Electronics Huada Technology's Growth Trending?

In order to justify its P/E ratio, China Electronics Huada Technology would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why China Electronics Huada Technology is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From China Electronics Huada Technology's P/E?

Having almost fallen off a cliff, China Electronics Huada Technology's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of China Electronics Huada Technology revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Electronics Huada Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026