I Ran A Stock Scan For Earnings Growth And BOE Varitronix (HKG:710) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like BOE Varitronix (HKG:710). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for BOE Varitronix

BOE Varitronix's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that BOE Varitronix grew its EPS from HK$0.035 to HK$0.20, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

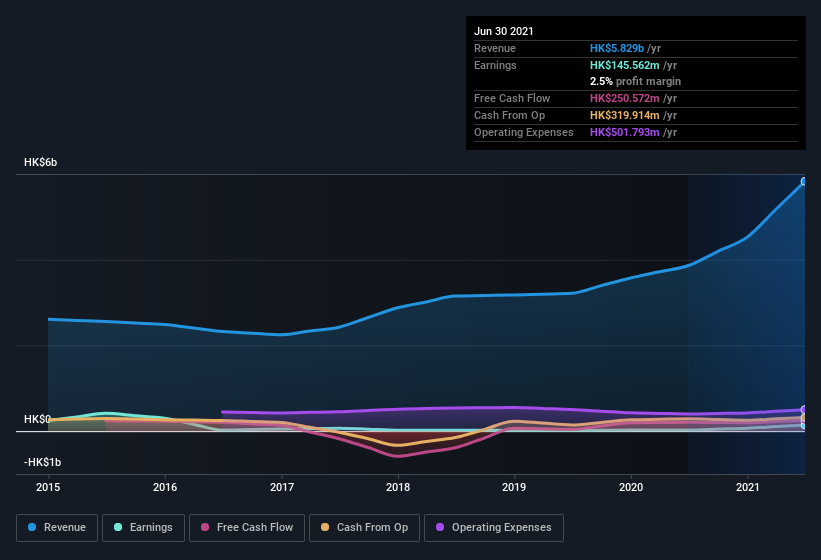

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. BOE Varitronix shareholders can take confidence from the fact that EBIT margins are up from -0.3% to 2.6%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check BOE Varitronix's balance sheet strength, before getting too excited.

Are BOE Varitronix Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

BOE Varitronix top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the HK$857k that CEO & Executive Director Ning Su spent buying shares (at an average price of about HK$3.43).

The good news, alongside the insider buying, for BOE Varitronix bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at HK$506m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Ning Su is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like BOE Varitronix with market caps between HK$3.1b and HK$12b is about HK$3.6m.

The BOE Varitronix CEO received HK$1.9m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does BOE Varitronix Deserve A Spot On Your Watchlist?

BOE Varitronix's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe BOE Varitronix deserves timely attention. Before you take the next step you should know about the 1 warning sign for BOE Varitronix that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of BOE Varitronix, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BOE Varitronix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:710

BOE Varitronix

An investment holding company, designs, manufactures, and sells liquid crystal display and related products in the People’s Republic of China, Europe, the United States, Korea, Japan, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives