- Hong Kong

- /

- Semiconductors

- /

- SEHK:650

Revenues Tell The Story For Productive Technologies Company Limited (HKG:650) As Its Stock Soars 30%

Productive Technologies Company Limited (HKG:650) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 50% in the last twelve months.

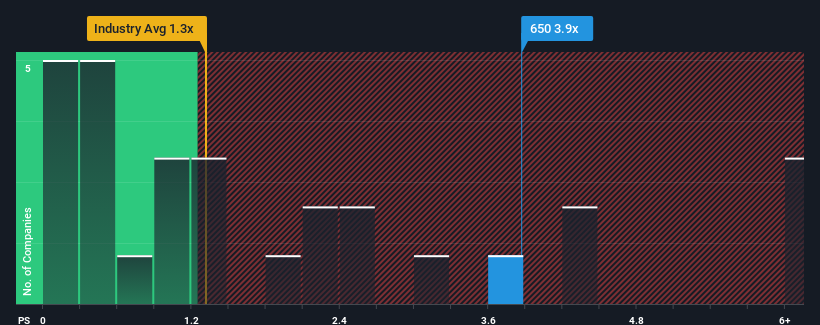

After such a large jump in price, when almost half of the companies in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Productive Technologies as a stock not worth researching with its 3.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Productive Technologies

What Does Productive Technologies' Recent Performance Look Like?

For instance, Productive Technologies' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Productive Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Productive Technologies?

In order to justify its P/S ratio, Productive Technologies would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Even so, admirably revenue has lifted 230% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 17% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Productive Technologies' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Productive Technologies' P/S Mean For Investors?

Shares in Productive Technologies have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Productive Technologies maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Productive Technologies, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:650

Productive Technologies

An investment holding company, engages in the manufacturing of equipment applied in semiconductor and solar power businesses in the People’s Republic of China.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives