- Hong Kong

- /

- Semiconductors

- /

- SEHK:3800

Why Investors Shouldn't Be Surprised By GCL Technology Holdings Limited's (HKG:3800) 36% Share Price Surge

GCL Technology Holdings Limited (HKG:3800) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.4% over the last year.

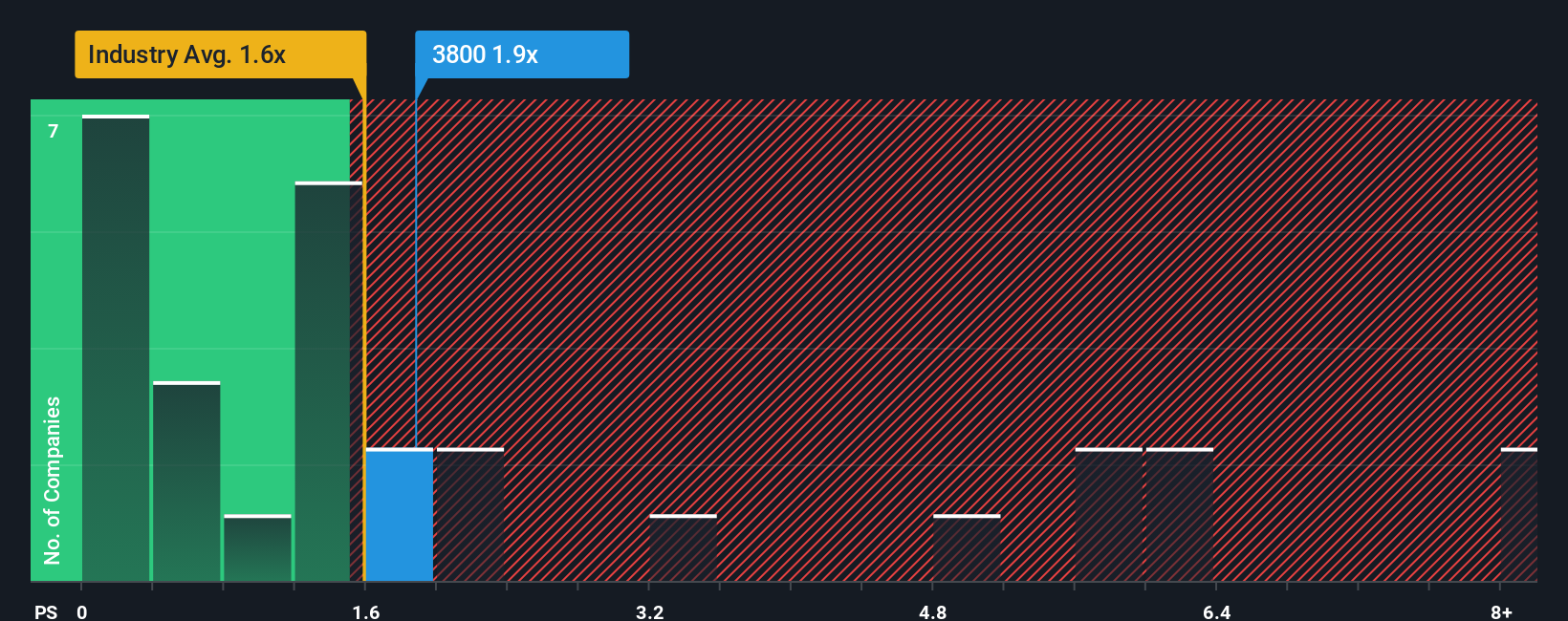

Even after such a large jump in price, it's still not a stretch to say that GCL Technology Holdings' price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in Hong Kong, where the median P/S ratio is around 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for GCL Technology Holdings

What Does GCL Technology Holdings' Recent Performance Look Like?

GCL Technology Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on GCL Technology Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, GCL Technology Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 10% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 20% each year, which is not materially different.

In light of this, it's understandable that GCL Technology Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does GCL Technology Holdings' P/S Mean For Investors?

GCL Technology Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that GCL Technology Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for GCL Technology Holdings with six simple checks on some of these key factors.

If you're unsure about the strength of GCL Technology Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3800

GCL Technology Holdings

Manufactures and sells polysilicon and wafers products in the People’s Republic of China and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.