- Hong Kong

- /

- Semiconductors

- /

- SEHK:2533

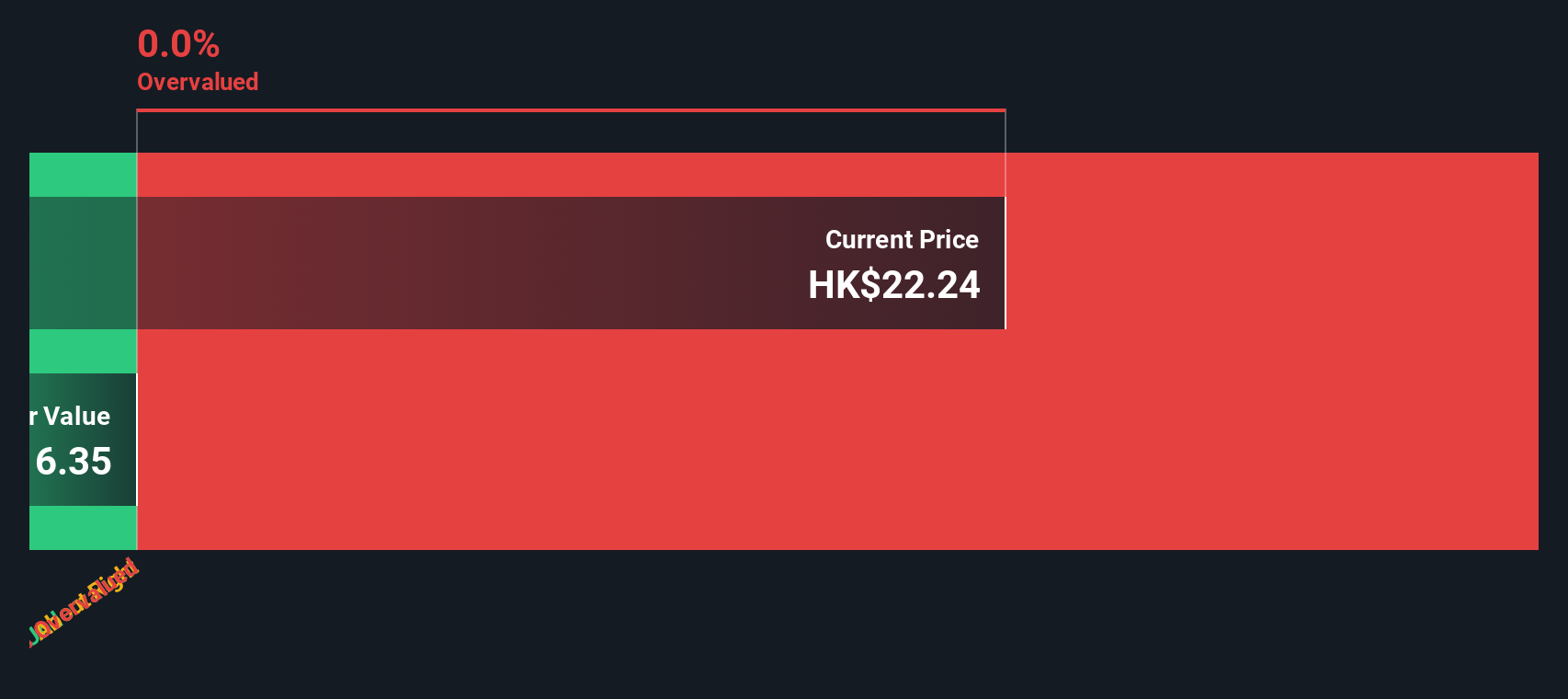

Assessing Black Sesame (SEHK:2533) Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Price-to-Sales of 21.9x: Is it justified?

Black Sesame International Holding is currently valued at a price-to-sales (P/S) ratio of 21.9x. This level signals the market places a high premium on its future prospects relative to its current sales. This figure appears expensive when compared to the estimated fair P/S ratio of 8x and to peers in the Hong Kong semiconductor sector, where the industry P/S average is 1.8x.

The price-to-sales multiple is an important metric for technology firms like Black Sesame International Holding, which may not yet be profitable but are expected to deliver substantial sales growth. Investors rely on this ratio to evaluate how much they are paying for every unit of revenue, especially in sectors where earnings are negative or volatile.

Despite strong revenue growth forecasts, Black Sesame’s elevated P/S ratio suggests the market may be anticipating significant future expansion or notable margin improvement. However, relative to sector benchmarks, this premium may be difficult to justify unless the company can deliver exceptional performance beyond current projections.

Result: Fair Value of $20.48 (OVERVALUED)

See our latest analysis for Black Sesame International Holding.However, persistent net losses and the stock’s steep premium could trigger volatility if revenue growth stalls or if market sentiment shifts unexpectedly.

Find out about the key risks to this Black Sesame International Holding narrative.Another View: What Does Our DCF Model Say?

Looking at the SWS DCF model, there is not enough information to produce a fair value estimate for Black Sesame International Holding. Without this perspective, critical questions remain about whether the high price multiple truly reflects the company’s fundamentals or if investors are reaching too far on optimism.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Black Sesame International Holding Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Black Sesame International Holding research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying open to new opportunities beyond a single stock. If you want to strengthen your portfolio and spot what others might miss, start here:

- Uncover hidden value by targeting companies trading beneath their true worth with undervalued stocks based on cash flows.

- Maximize your income stream by selecting stocks offering attractive payouts through dividend stocks with yields > 3%.

- Catch the next wave of innovation by focusing on disruptors shaping our connected world with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Sesame International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2533

Black Sesame International Holding

An investment holding company, provides autonomous driving system on chip (SoC) and SoC based solutions.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives