- Hong Kong

- /

- Semiconductors

- /

- SEHK:243

Shareholders In QPL International Holdings (HKG:243) Should Look Beyond Earnings For The Full Story

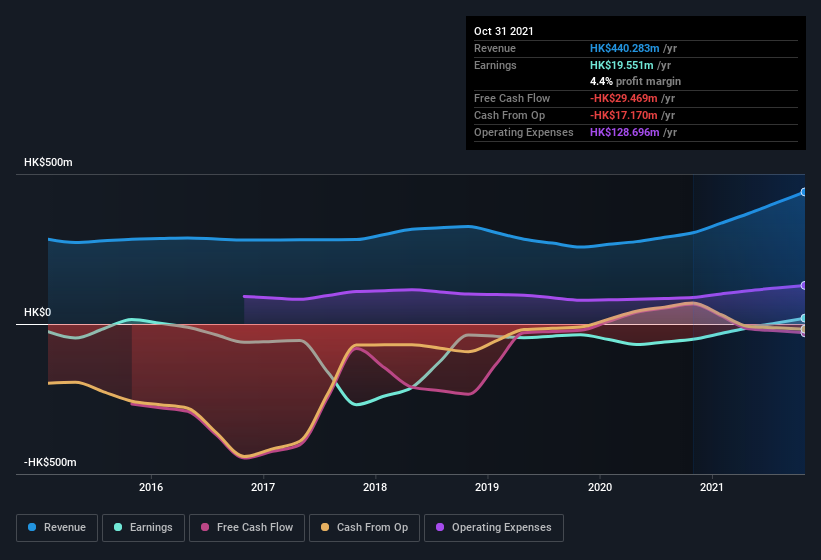

QPL International Holdings Limited (HKG:243) recently released a strong earnings report, and the market responded by raising the share price. However, we think that shareholders should be aware of some other factors beyond the profit numbers.

Check out our latest analysis for QPL International Holdings

Examining Cashflow Against QPL International Holdings' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

QPL International Holdings has an accrual ratio of 0.20 for the year to October 2021. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of HK$29m, in contrast to the aforementioned profit of HK$19.6m. It's worth noting that QPL International Holdings generated positive FCF of HK$67m a year ago, so at least they've done it in the past. Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. The good news for shareholders is that QPL International Holdings' accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of QPL International Holdings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, QPL International Holdings increased the number of shares on issue by 20% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of QPL International Holdings' EPS by clicking here.

A Look At The Impact Of QPL International Holdings' Dilution on Its Earnings Per Share (EPS).

QPL International Holdings was losing money three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a bit of an impact on shareholders.

If QPL International Holdings' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that QPL International Holdings' profit was boosted by unusual items worth HK$50m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that QPL International Holdings' positive unusual items were quite significant relative to its profit in the year to October 2021. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On QPL International Holdings' Profit Performance

In conclusion, QPL International Holdings' weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. On reflection, the above-mentioned factors give us the strong impression that QPL International Holdings'underlying earnings power is not as good as it might seem, based on the statutory profit numbers. If you'd like to know more about QPL International Holdings as a business, it's important to be aware of any risks it's facing. Be aware that QPL International Holdings is showing 4 warning signs in our investment analysis and 1 of those is potentially serious...

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if QPL International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:243

QPL International Holdings

Manufactures and sells integrated circuit lead frames, heatsinks, stiffeners, and related products in the United States, Hong Kong, Europe, the People's Republic of China, the Philippines, Malaysia, Singapore, and Thailand.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives