- Hong Kong

- /

- Semiconductors

- /

- SEHK:1385

Recent 6.0% pullback isn't enough to hurt long-term Shanghai Fudan Microelectronics Group (HKG:1385) shareholders, they're still up 337% over 3 years

It hasn't been the best quarter for Shanghai Fudan Microelectronics Group Company Limited (HKG:1385) shareholders, since the share price has fallen 29% in that time. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 336%. So the recent fall doesn't do much to dampen our respect for the business. The only way to form a view of whether the current price is justified is to consider the merits of the business itself.

Since the long term performance has been good but there's been a recent pullback of 6.0%, let's check if the fundamentals match the share price.

See our latest analysis for Shanghai Fudan Microelectronics Group

SWOT Analysis for Shanghai Fudan Microelectronics Group

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Semiconductor market.

- Annual earnings are forecast to grow faster than the Hong Kong market.

- Good value based on P/E ratio compared to estimated Fair P/E ratio.

- Debt is not well covered by operating cash flow.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Shanghai Fudan Microelectronics Group moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

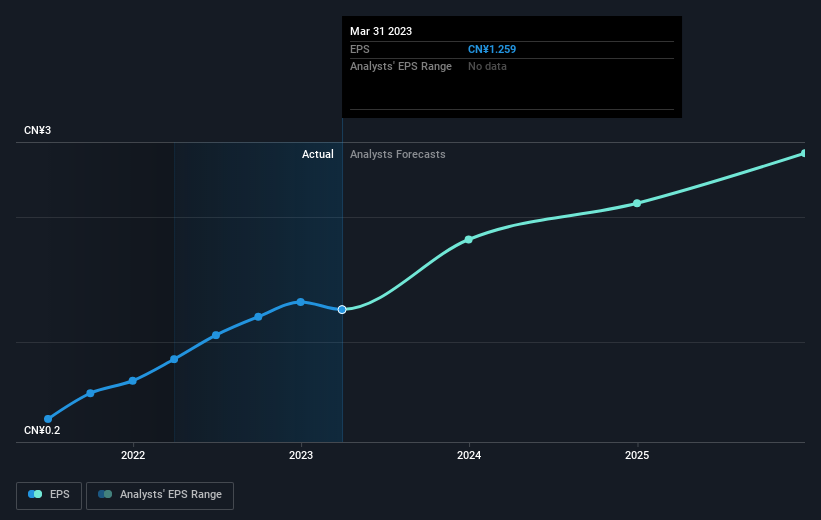

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Shanghai Fudan Microelectronics Group's earnings, revenue and cash flow.

A Different Perspective

Shanghai Fudan Microelectronics Group's TSR for the year was broadly in line with the market average, at 1.8%. We should note here that the five-year TSR is more impressive, at 26% per year. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Shanghai Fudan Microelectronics Group a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Shanghai Fudan Microelectronics Group has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1385

Shanghai Fudan Microelectronics Group

Engages in the design, development, and sale of integrated circuit products and total solutions in Mainland China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives