- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Hua Hong Semiconductor Limited's (HKG:1347) 34% Price Boost Is Out Of Tune With Revenues

Hua Hong Semiconductor Limited (HKG:1347) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

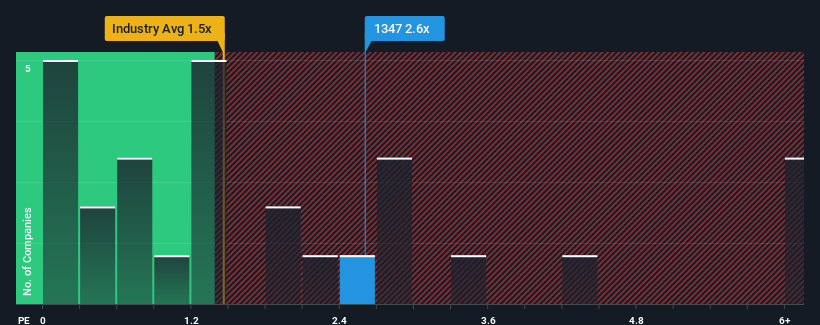

Since its price has surged higher, when almost half of the companies in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Hua Hong Semiconductor as a stock probably not worth researching with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hua Hong Semiconductor

What Does Hua Hong Semiconductor's P/S Mean For Shareholders?

Hua Hong Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hua Hong Semiconductor.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Hua Hong Semiconductor would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. Even so, admirably revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 19% each year over the next three years. That's shaping up to be similar to the 17% each year growth forecast for the broader industry.

In light of this, it's curious that Hua Hong Semiconductor's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Hua Hong Semiconductor's P/S

The large bounce in Hua Hong Semiconductor's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting Hua Hong Semiconductor's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Hua Hong Semiconductor that we have uncovered.

If you're unsure about the strength of Hua Hong Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, manufactures and sells semiconductor products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives