- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Asian Market Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals and geopolitical developments, Asian markets have shown resilience with modest gains in key indices such as Japan's Nikkei 225 and China's CSI 300. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2628.50 | ¥5113.90 | 48.6% |

| Livero (TSE:9245) | ¥1745.00 | ¥3424.61 | 49% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩143400.00 | ₩280231.16 | 48.8% |

| Hugel (KOSDAQ:A145020) | ₩351000.00 | ₩698441.84 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩41000.00 | ₩81411.93 | 49.6% |

| HDC Hyundai Development (KOSE:A294870) | ₩23150.00 | ₩45743.81 | 49.4% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥40.00 | CN¥78.34 | 48.9% |

| Finger (KOSDAQ:A163730) | ₩13800.00 | ₩27014.88 | 48.9% |

| Astroscale Holdings (TSE:186A) | ¥673.00 | ¥1323.59 | 49.2% |

| ALUX (KOSDAQ:A475580) | ₩11360.00 | ₩22615.54 | 49.8% |

Let's dive into some prime choices out of the screener.

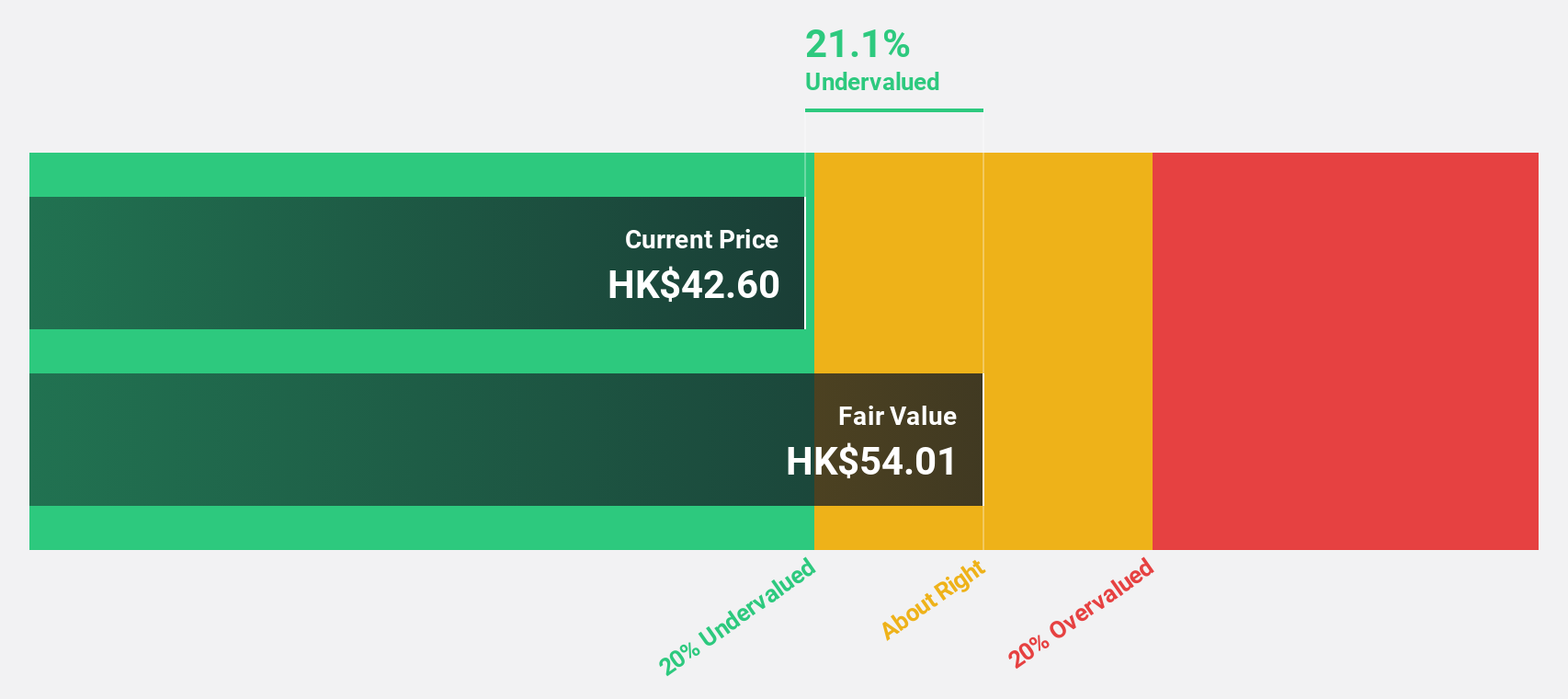

Hua Hong Semiconductor (SEHK:1347)

Overview: Hua Hong Semiconductor Limited is an investment holding company involved in the manufacture and sale of semiconductor products across China, North America, Asia, Europe, and Japan with a market cap of HK$71 billion.

Operations: The company's revenue primarily comes from its semiconductor products segment, generating $2.08 billion.

Estimated Discount To Fair Value: 32%

Hua Hong Semiconductor is trading at HK$35.85, significantly below its estimated fair value of HK$52.69, highlighting its undervaluation based on discounted cash flows. Despite a recent decline in net income to US$3.75 million from US$31.82 million, earnings are projected to grow substantially at 39.8% annually over the next three years, outpacing the Hong Kong market's growth rate of 10.5%. However, profit margins have decreased from 7.5% to 1.4%.

- Our comprehensive growth report raises the possibility that Hua Hong Semiconductor is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Hua Hong Semiconductor's balance sheet health report.

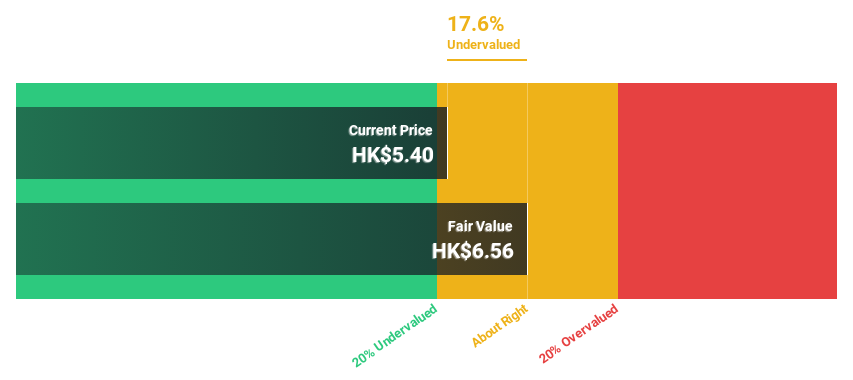

Chinasoft International (SEHK:354)

Overview: Chinasoft International Limited, along with its subsidiaries, provides IT solutions, IT outsourcing, and training services across several countries including China and the United States, with a market cap of approximately HK$13.77 billion.

Operations: The company's revenue is primarily derived from its Technology Professional Services Group, which contributed CN¥14.77 billion, and the Internet Information Technology Services Group, which generated CN¥2.18 billion.

Estimated Discount To Fair Value: 11%

Chinasoft International is trading at HK$5.53, slightly undervalued compared to its fair value of HK$6.21, suggesting potential for investment based on cash flow analysis. Despite a modest forecasted return on equity of 7.5%, the company's earnings are expected to grow significantly at 20.5% annually, surpassing market averages in Hong Kong. Recent strategic alliances and product launches in AI and operating systems enhance Chinasoft's position in digital transformation, potentially boosting revenue growth beyond the current 9.6% forecast.

- In light of our recent growth report, it seems possible that Chinasoft International's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Chinasoft International.

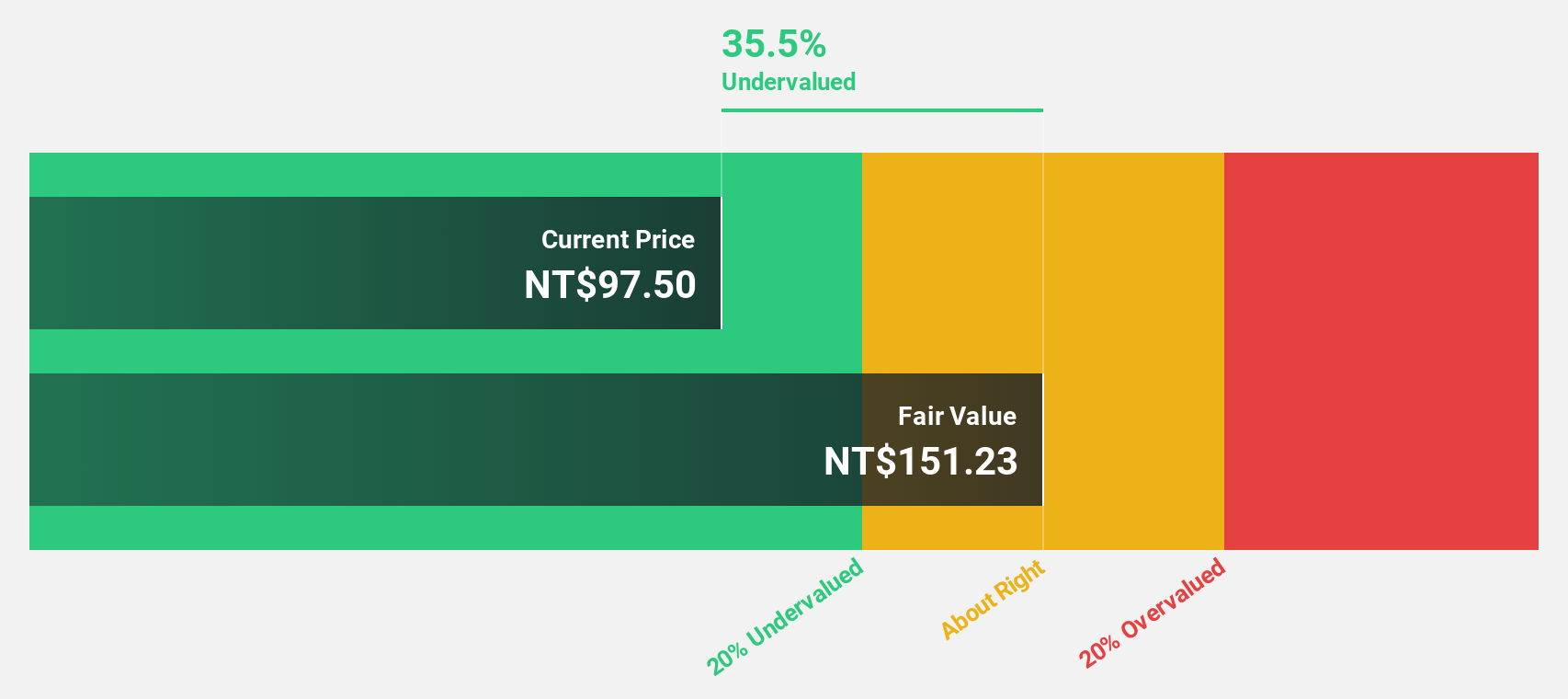

Co-Tech Development (TPEX:8358)

Overview: Co-Tech Development Corporation, with a market cap of NT$22.79 billion, produces and sells copper foil for the printed circuit board industry in Taiwan and China.

Operations: The company's revenue from its copper foil segment amounts to NT$7.04 billion.

Estimated Discount To Fair Value: 40.4%

Co-Tech Development is trading at NT$90.3, significantly undervalued compared to its fair value of NT$151.45, presenting an opportunity based on cash flow analysis. The company's earnings are forecast to grow substantially at 42.7% annually, outpacing the Taiwanese market's growth rate of 13.3%. Recent executive changes and a completed share buyback might enhance strategic direction and shareholder value, while revenue growth remains robust at 14.4% per year despite high share price volatility recently.

- Insights from our recent growth report point to a promising forecast for Co-Tech Development's business outlook.

- Dive into the specifics of Co-Tech Development here with our thorough financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 258 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives