- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

3 SEHK Stocks Estimated To Be Up To 49.9% Below Intrinsic Value

Reviewed by Simply Wall St

The Hong Kong market has recently experienced a mix of volatility and resilience, with the Hang Seng Index gaining 0.85% amidst global economic uncertainties and deflationary pressures in China. Amidst these fluctuations, identifying undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies. In this article, we explore three SEHK stocks that are estimated to be up to 49.9% below their intrinsic value, highlighting opportunities for those seeking to invest wisely in the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.17 | HK$4.33 | 49.9% |

| Bosideng International Holdings (SEHK:3998) | HK$3.89 | HK$6.74 | 42.3% |

| ANTA Sports Products (SEHK:2020) | HK$70.25 | HK$135.83 | 48.3% |

| BYD Electronic (International) (SEHK:285) | HK$29.15 | HK$53.15 | 45.2% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.45 | HK$56.08 | 49.3% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.64 | HK$2.99 | 45.1% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.27 | HK$4.22 | 46.2% |

| China Renaissance Holdings (SEHK:1911) | HK$7.27 | HK$12.30 | 40.9% |

| Weimob (SEHK:2013) | HK$1.20 | HK$2.18 | 44.9% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.75 | HK$1.38 | 45.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Hua Hong Semiconductor (SEHK:1347)

Overview: Hua Hong Semiconductor Limited, an investment holding company with a market cap of HK$38.56 billion, manufactures and sells semiconductor products.

Operations: Hua Hong Semiconductor Limited generates revenue through the manufacturing and sale of semiconductor products.

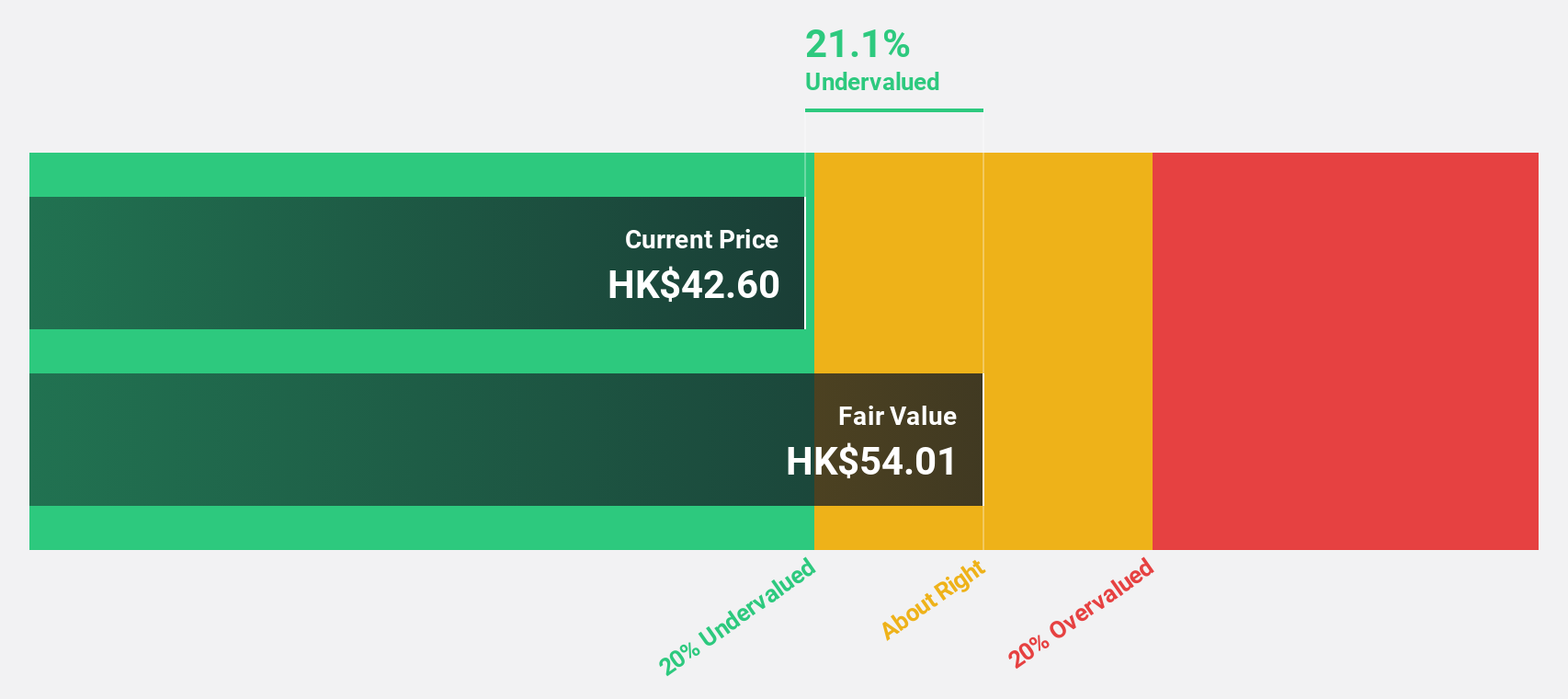

Estimated Discount To Fair Value: 32.6%

Hua Hong Semiconductor is trading at HK$18.08, significantly below its estimated fair value of HK$26.83, indicating it may be undervalued based on discounted cash flow (DCF) analysis. Despite a recent drop in quarterly sales to US$478.52 million and net income to US$6.67 million, the company's earnings are forecast to grow 31.9% per year, outpacing the Hong Kong market's 11.3%. However, profit margins have decreased from 19.6% last year to 4.5%.

- The growth report we've compiled suggests that Hua Hong Semiconductor's future prospects could be on the up.

- Take a closer look at Hua Hong Semiconductor's balance sheet health here in our report.

Best Pacific International Holdings (SEHK:2111)

Overview: Best Pacific International Holdings Limited, with a market cap of HK$2.26 billion, manufactures, trades in, and sells elastic fabric, elastic webbing, and lace through its subsidiaries.

Operations: The company's revenue segments include HK$834.34 million from the manufacturing and trading of elastic webbing and HK$3.37 billion from elastic fabric and lace.

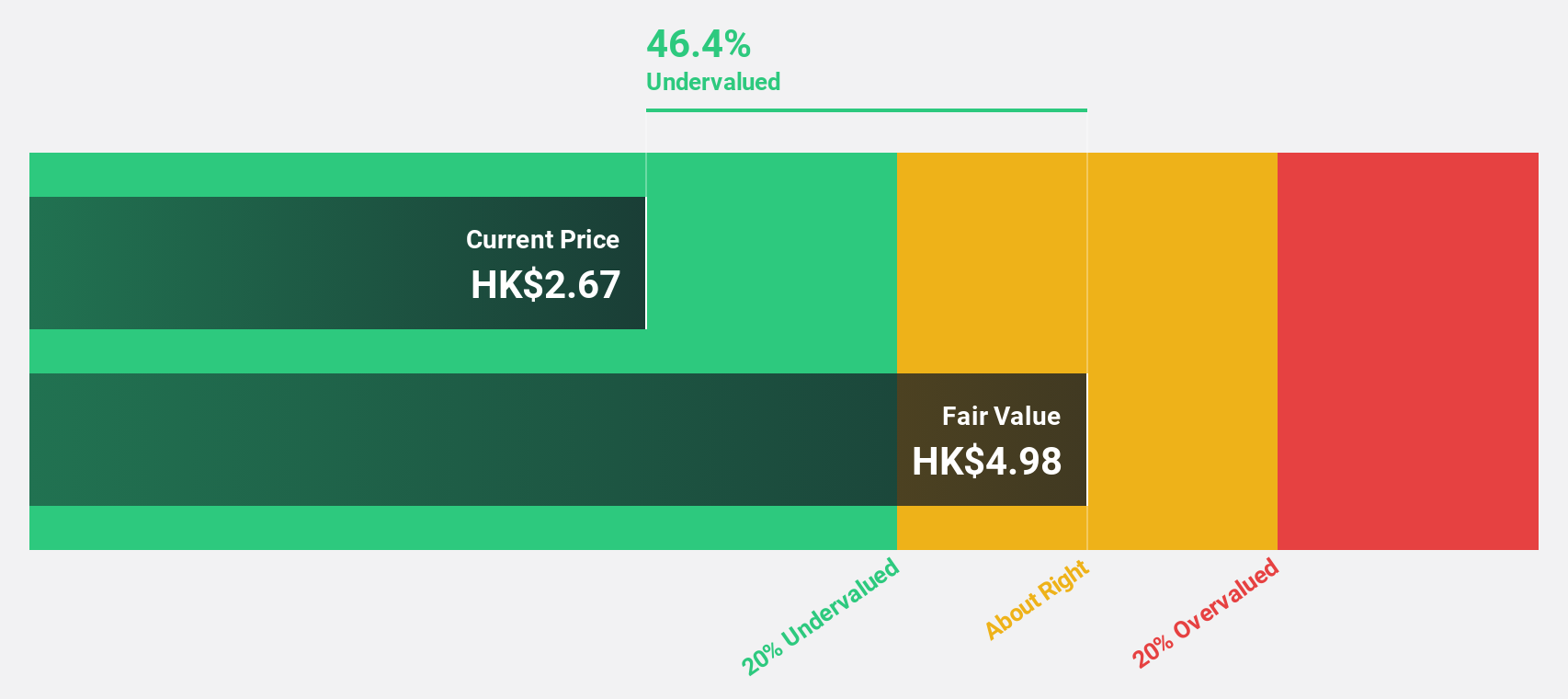

Estimated Discount To Fair Value: 49.9%

Best Pacific International Holdings is trading at HK$2.17, well below its estimated fair value of HK$4.33, suggesting significant undervaluation based on cash flows. Earnings are forecast to grow 24.3% annually over the next three years, outpacing the Hong Kong market's 11.4%. Despite a previously unstable dividend track record, recent unaudited earnings guidance indicates a net profit increase to at least HK$260 million for HY 2024 from HK$138.6 million in HY 2023.

- The analysis detailed in our Best Pacific International Holdings growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Best Pacific International Holdings.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People's Republic of China, with a market cap of approximately HK$14.92 billion.

Operations: The company's revenue comes from its intra-city on-demand delivery service business, which generated CN¥12.39 billion.

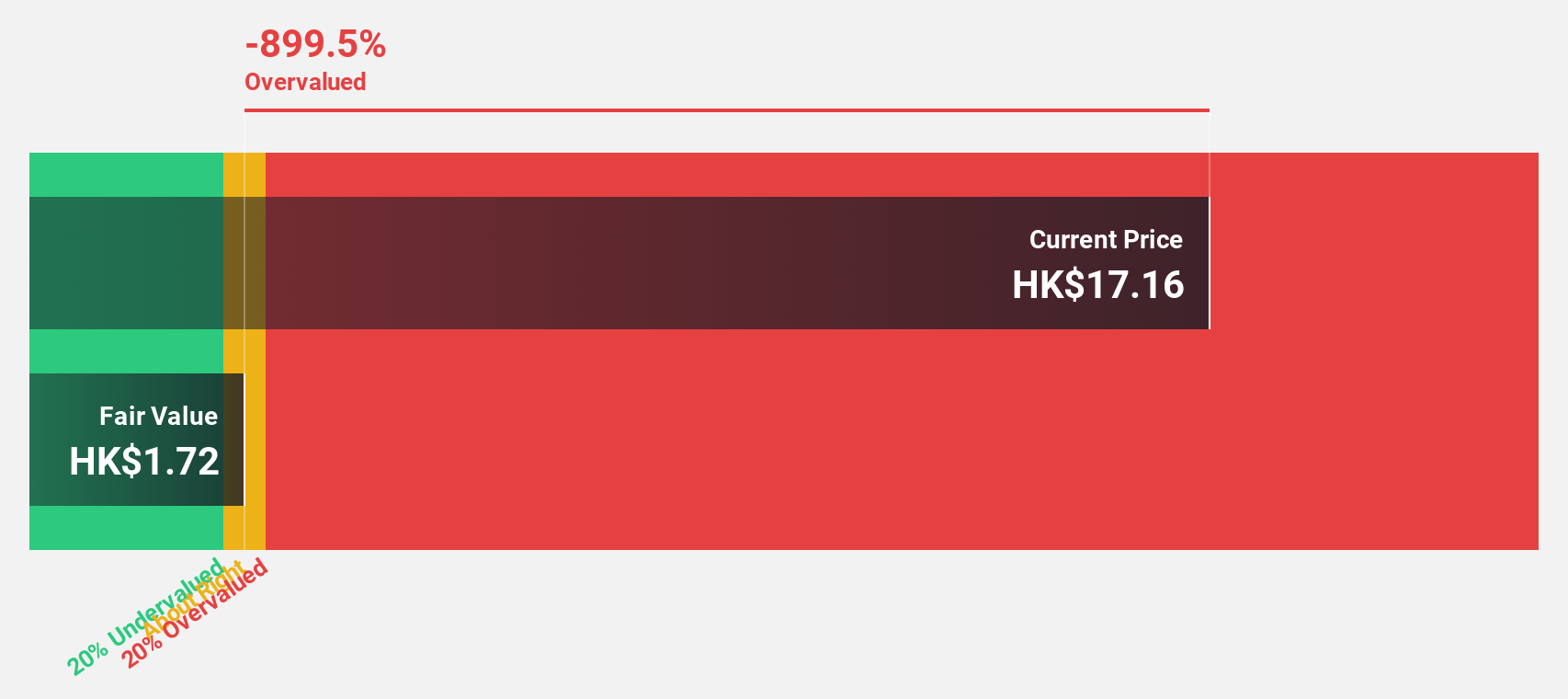

Estimated Discount To Fair Value: 28.9%

Hangzhou SF Intra-city Industrial is trading at HK$10.04, significantly below its estimated fair value of HK$14.11. Earnings are forecast to grow 50.1% annually over the next three years, surpassing the Hong Kong market's 11.4%. Recent guidance indicates a net profit increase of over 80% for HY 2024, driven by higher order volumes and improved operational efficiency. However, shareholders have faced substantial dilution in the past year despite positive growth prospects and ongoing business expansions in Hong Kong.

- Our growth report here indicates Hangzhou SF Intra-city Industrial may be poised for an improving outlook.

- Navigate through the intricacies of Hangzhou SF Intra-city Industrial with our comprehensive financial health report here.

Make It Happen

- Access the full spectrum of 34 Undervalued SEHK Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hua Hong Semiconductor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives