- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Does Pop Mart’s 242% Share Surge Signal Opportunity or Excess in 2025?

Reviewed by Bailey Pemberton

Wondering whether it’s the right moment to dive into Pop Mart International Group stock or hit the pause button? You’re not alone. With Pop Mart’s share price climbing an eye-popping 242.4% over the past year, and a jaw-dropping 2291.7% over three years, it’s a ticker that’s hard to ignore. Yet, recent weeks have introduced a shift in tone. After that rocket-fueled ascent, the stock has pared back 6.1% in the past seven days and is down 4.2% over the past month.

These moves come against a backdrop of heightened investor attention following Pop Mart’s expansion push into new overseas markets and some high-profile product partnerships that have kept the brand in social-media headlines. While nothing seismic has landed in the news lately, the company’s breakneck global growth and fan-driven hype continue to shape risk perceptions and investor appetite.

If you’re tracking whether Pop Mart still has room to run or if the fireworks are fizzling out, valuation is going to be front and center. Our current scorecard finds Pop Mart undervalued in just one out of six standard checks, resulting in a valuation score of 1. That tells a story, but just scratching the surface isn’t enough. Next, let’s unpack the numbers using multiple valuation methods before revealing a smarter approach that could change how you see the stock’s true worth.

Pop Mart International Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pop Mart International Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s worth by projecting its future cash flows and discounting them back to their value today. For Pop Mart International Group, the DCF model starts with the company’s latest twelve-month Free Cash Flow of CN¥4.49 billion and looks ahead, using both analyst estimates and extended forecasts to map out future cash generation.

In the first stage, analysts project Pop Mart’s Free Cash Flow to grow significantly. Projections indicate a rise to CN¥20.14 billion by 2029, with estimates continuing out to 2035. The DCF model takes these figures, discounts each year’s cash flow to reflect its present value, and totals them up to produce an intrinsic value per share.

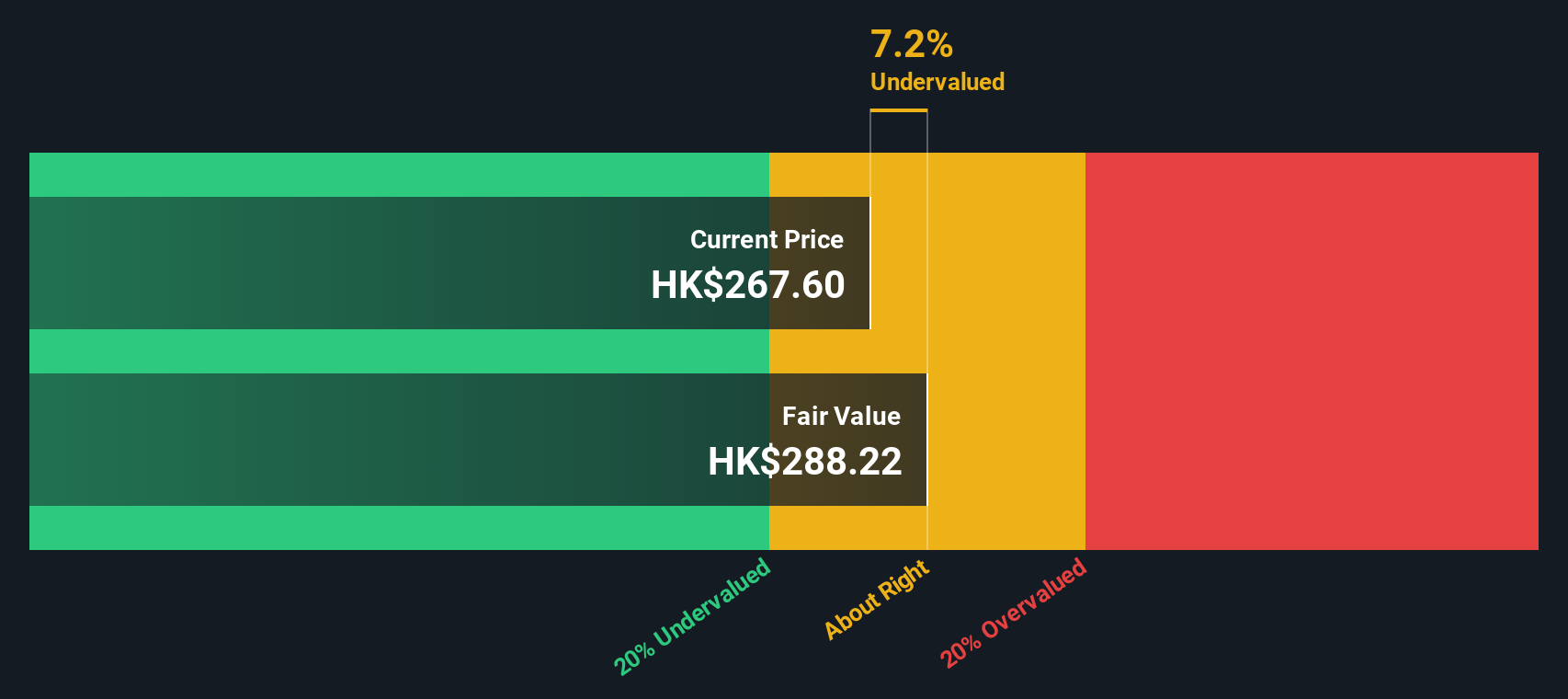

On this basis, the DCF points to a fair value of HK$286.34 per share for Pop Mart. Compared to today’s share price, this represents a 10.5% discount, indicating the stock is currently undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pop Mart International Group is undervalued by 10.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pop Mart International Group Price vs Earnings

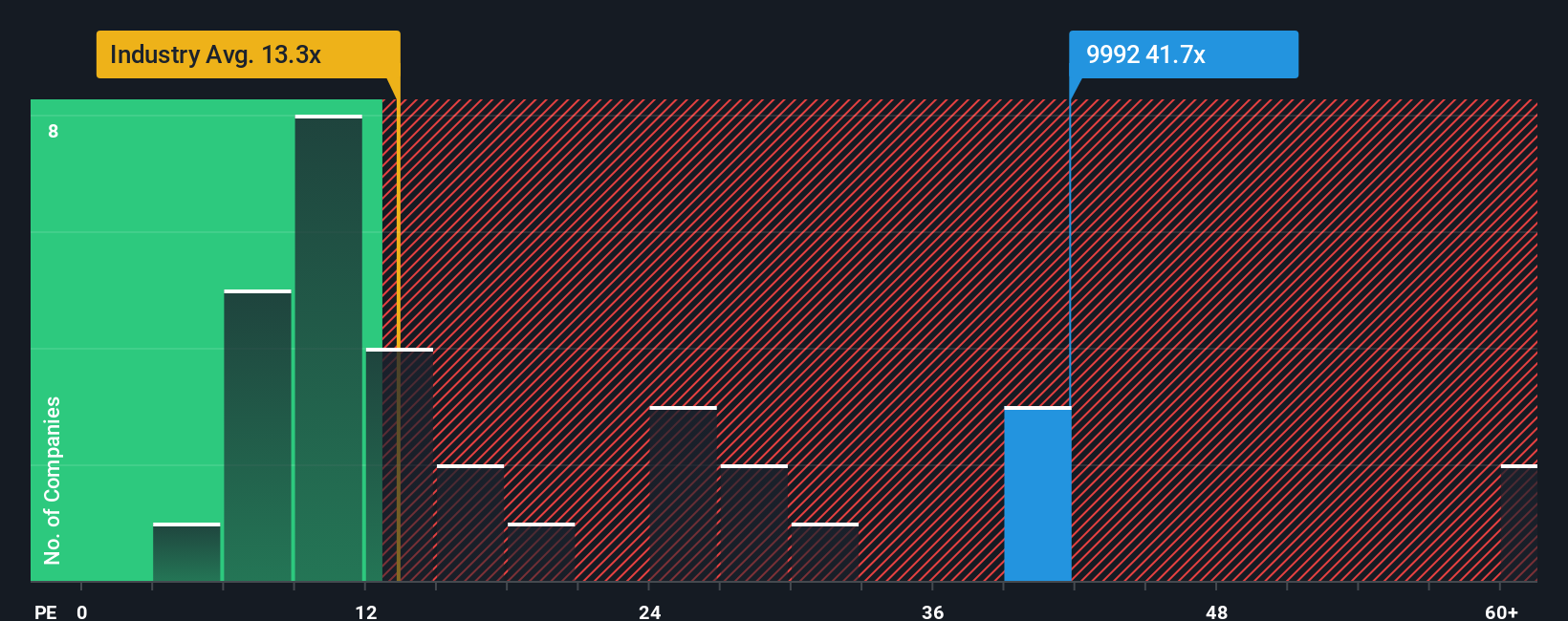

The Price-to-Earnings (PE) ratio is a well-established yardstick for valuing profitable companies like Pop Mart International Group, as it reflects how much investors are willing to pay for each dollar of the company’s earnings. The higher the growth prospects or the lower the risks, the more investors may accept a loftier PE ratio.

Looking at the numbers, Pop Mart currently trades at a PE ratio of 46.1x. This stands dramatically above the Specialty Retail industry average of 13.3x and is more than double the typical peer group, which averages 19.0x. This can be a red flag or a sign of confidence, depending on the underlying story and expected growth.

To cut through the noise, Simply Wall St calculates a proprietary “Fair Ratio.” This fair PE ratio, set at 31.1x for Pop Mart, weighs factors well beyond just peer or industry averages, such as the company’s growth trajectory, profit margins, risk profile, and market cap. This approach delivers a more nuanced benchmark for valuation that adapts to company-specific realities rather than a simple sector-wide comparison.

Comparing Pop Mart’s current 46.1x PE to its Fair Ratio of 31.1x suggests the stock is trading above what would be justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pop Mart International Group Narrative

Earlier, we mentioned an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story about a company. It’s where your perspective on Pop Mart, including your estimates for its future revenue, earnings, and margins, shapes your view of what the stock is truly worth. Narratives connect the dots from a company’s story, to your personal financial forecast, and all the way to an actionable fair value.

This approach makes investing more accessible, since Narratives are available on Simply Wall St’s Community page, where millions of investors share and compare their perspectives in real time. Narratives help you decide when to buy or sell by letting you compare what you think Pop Mart should be worth to its current price, always updating as new news or earnings releases shape the outlook.

For example, some investors think Pop Mart’s fair value is as low as HK$164, while others, factoring in more optimistic forecasts, see values as high as HK$420. This shows just how much perspectives can differ even on the same company.

Do you think there's more to the story for Pop Mart International Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives