- Hong Kong

- /

- Specialty Stores

- /

- SEHK:881

Zhongsheng Group Holdings Limited (HKG:881) Surges 28% Yet Its Low P/E Is No Reason For Excitement

Those holding Zhongsheng Group Holdings Limited (HKG:881) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

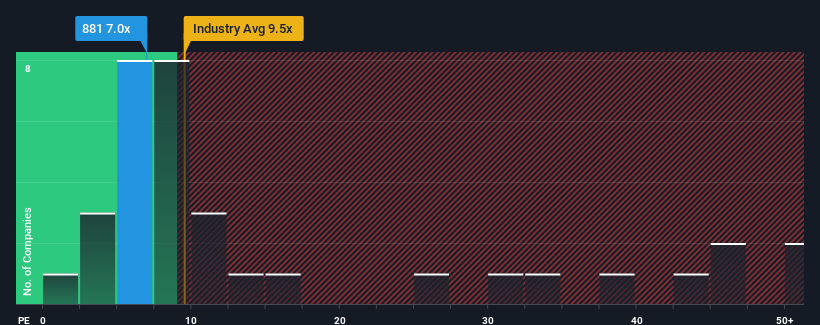

In spite of the firm bounce in price, Zhongsheng Group Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhongsheng Group Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Zhongsheng Group Holdings

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Zhongsheng Group Holdings would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. As a result, earnings from three years ago have also fallen 50% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 10% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

With this information, we can see why Zhongsheng Group Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Zhongsheng Group Holdings' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhongsheng Group Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Zhongsheng Group Holdings has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Zhongsheng Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhongsheng Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:881

Zhongsheng Group Holdings

An investment holding company, engages in the sale and service of motor vehicles in the People's Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives