- Hong Kong

- /

- Specialty Stores

- /

- SEHK:881

Is Now The Time To Put Zhongsheng Group Holdings (HKG:881) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Zhongsheng Group Holdings (HKG:881). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Zhongsheng Group Holdings

How Fast Is Zhongsheng Group Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Zhongsheng Group Holdings has grown EPS by 19% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

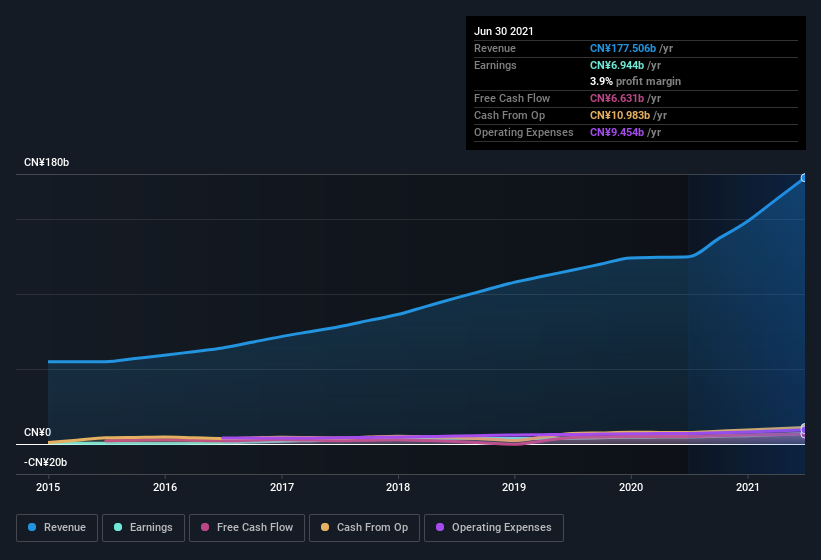

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Zhongsheng Group Holdings's EBIT margins were flat over the last year, revenue grew by a solid 42% to CN¥178b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Zhongsheng Group Holdings's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Zhongsheng Group Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Zhongsheng Group Holdings insiders reported share sales in the last twelve months. Even better, though, is that the Independent Non-Executive Director, Yanwei Li, bought a whopping CN¥3.3m worth of shares, paying about CN¥55.38 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, we can also see that Zhongsheng Group Holdings insiders own a large chunk of the company. Actually, with 47% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling CN¥80b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Zhongsheng Group Holdings To Your Watchlist?

For growth investors like me, Zhongsheng Group Holdings's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for Zhongsheng Group Holdings you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Zhongsheng Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhongsheng Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:881

Zhongsheng Group Holdings

An investment holding company, engages in the sale and service of motor vehicles in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives