- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8509

Wine's Link International Holdings Limited (HKG:8509) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

The Wine's Link International Holdings Limited (HKG:8509) share price has fared very poorly over the last month, falling by a substantial 25%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 19%.

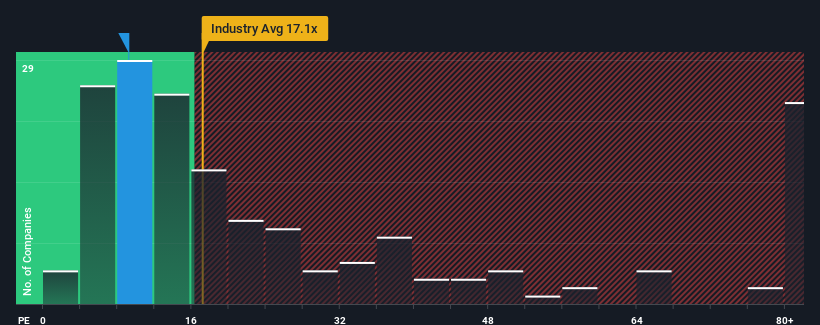

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Wine's Link International Holdings' P/E ratio of 9.2x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Wine's Link International Holdings over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Wine's Link International Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Wine's Link International Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 70% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 21% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Wine's Link International Holdings' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Wine's Link International Holdings' plummeting stock price has brought its P/E right back to the rest of the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Wine's Link International Holdings revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Wine's Link International Holdings (at least 2 which are significant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wine's Link International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8509

Wine's Link International Holdings

An investment holding company, engages in the wholesale and retail of various wine products and other alcoholic beverages in Hong Kong and the People’s Republic of China.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives