- Hong Kong

- /

- Specialty Stores

- /

- SEHK:8418

Optima Automobile Group Holdings (HKG:8418) shareholders are up 11% this past week, but still in the red over the last five years

While not a mind-blowing move, it is good to see that the Optima Automobile Group Holdings Limited (HKG:8418) share price has gained 21% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 64% in that time. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

On a more encouraging note the company has added HK$38m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Given that Optima Automobile Group Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, Optima Automobile Group Holdings grew its revenue at 23% per year. That's better than most loss-making companies. Unfortunately for shareholders the share price has dropped 10% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

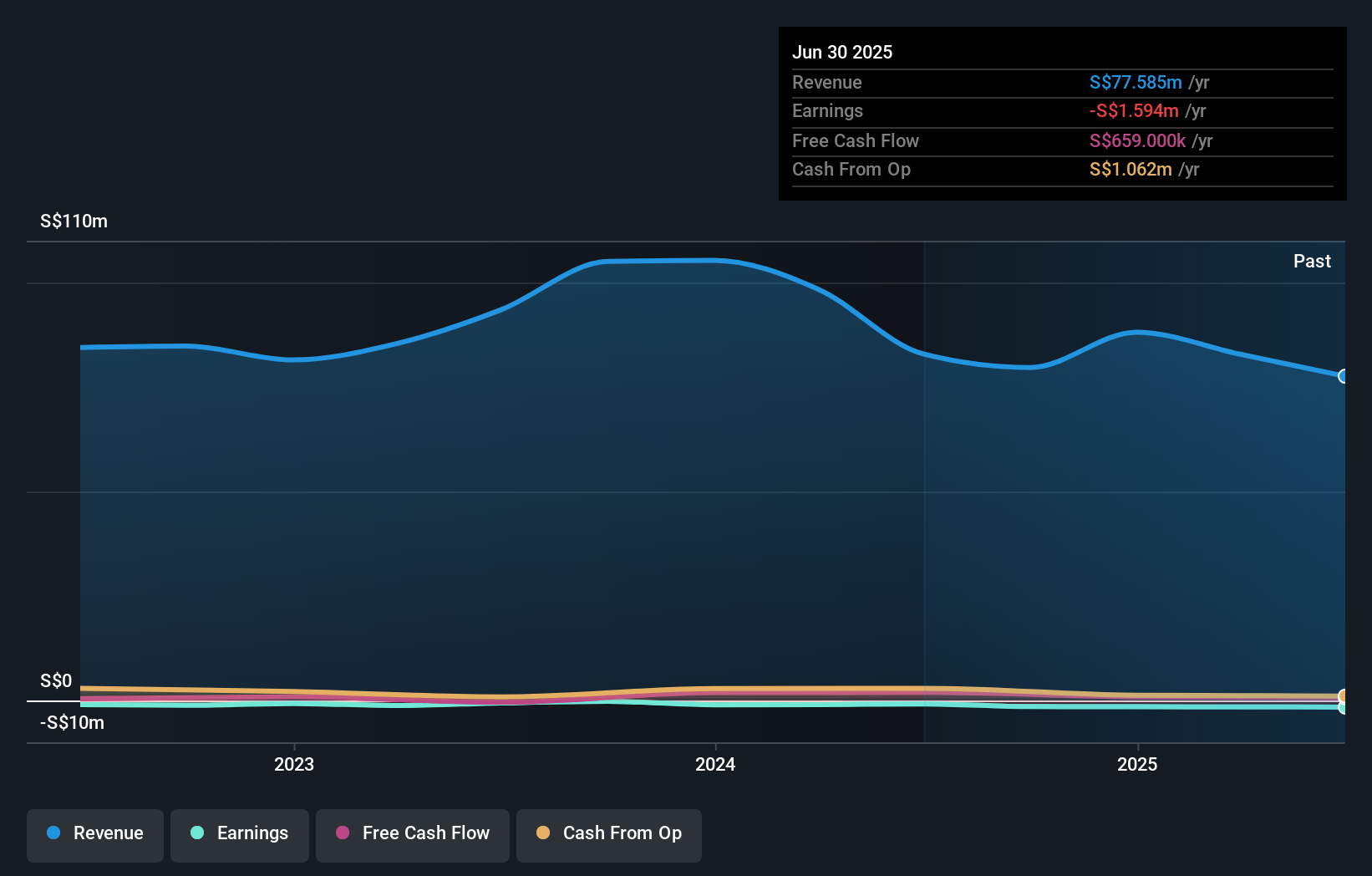

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 51% in the last year, Optima Automobile Group Holdings shareholders lost 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Optima Automobile Group Holdings that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8418

Optima Automobile Group Holdings

An investment holding company, provides after-market automotive services in Singapore and the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion