- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8395

The Returns On Capital At Tree Holdings (HKG:8395) Don't Inspire Confidence

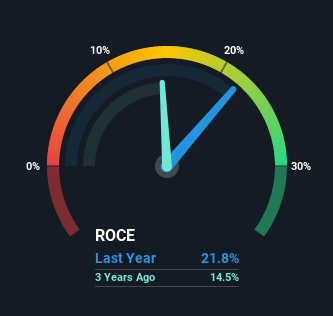

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, while the ROCE is currently high for Tree Holdings (HKG:8395), we aren't jumping out of our chairs because returns are decreasing.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Tree Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.22 = HK$17m ÷ (HK$138m - HK$59m) (Based on the trailing twelve months to March 2021).

Thus, Tree Holdings has an ROCE of 22%. In absolute terms that's a great return and it's even better than the Retail Distributors industry average of 4.5%.

See our latest analysis for Tree Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Tree Holdings, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

On the surface, the trend of ROCE at Tree Holdings doesn't inspire confidence. Historically returns on capital were even higher at 36%, but they have dropped over the last five years. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 43%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Key Takeaway

In summary, despite lower returns in the short term, we're encouraged to see that Tree Holdings is reinvesting for growth and has higher sales as a result. And long term investors must be optimistic going forward because the stock has returned a huge 517% to shareholders in the last three years. So should these growth trends continue, we'd be optimistic on the stock going forward.

One more thing, we've spotted 3 warning signs facing Tree Holdings that you might find interesting.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ZXZN Qi-House Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8395

ZXZN Qi-House Holdings

Engages in the sale, distribution, and rental of furniture and home accessories in the People’s Republic of China and Hong Kong.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026