- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6909

BetterLife Holding Limited (HKG:6909) Stock's 35% Dive Might Signal An Opportunity But It Requires Some Scrutiny

BetterLife Holding Limited (HKG:6909) shares have had a horrible month, losing 35% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

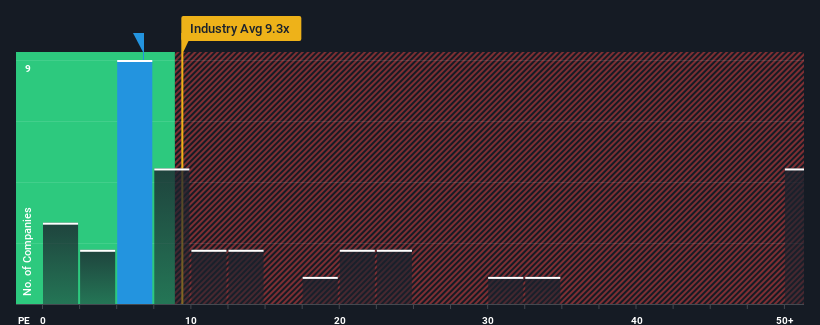

Although its price has dipped substantially, BetterLife Holding's price-to-earnings (or "P/E") ratio of 6.7x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for BetterLife Holding as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for BetterLife Holding

Does Growth Match The Low P/E?

In order to justify its P/E ratio, BetterLife Holding would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 68%. As a result, earnings from three years ago have also fallen 22% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 22% each year over the next three years. With the market predicted to deliver 21% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that BetterLife Holding's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From BetterLife Holding's P/E?

BetterLife Holding's recently weak share price has pulled its P/E below most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of BetterLife Holding's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 2 warning signs for BetterLife Holding (1 is significant!) that we have uncovered.

You might be able to find a better investment than BetterLife Holding. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade BetterLife Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BetterLife Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6909

BetterLife Holding

Provides automobile dealership services with a focus on luxury and ultra-luxury brands in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives