- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6909

BetterLife Holding Limited (HKG:6909) Stock Rockets 47% As Investors Are Less Pessimistic Than Expected

BetterLife Holding Limited (HKG:6909) shareholders would be excited to see that the share price has had a great month, posting a 47% gain and recovering from prior weakness. But the last month did very little to improve the 73% share price decline over the last year.

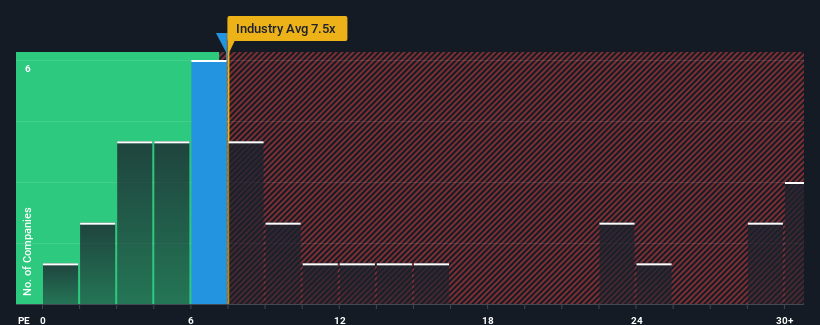

Even after such a large jump in price, there still wouldn't be many who think BetterLife Holding's price-to-earnings (or "P/E") ratio of 7.4x is worth a mention when the median P/E in Hong Kong is similar at about 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, BetterLife Holding's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for BetterLife Holding

Is There Some Growth For BetterLife Holding?

The only time you'd be comfortable seeing a P/E like BetterLife Holding's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 67% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 83% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

In light of this, it's somewhat alarming that BetterLife Holding's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From BetterLife Holding's P/E?

BetterLife Holding's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of BetterLife Holding revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for BetterLife Holding (2 are potentially serious) you should be aware of.

Of course, you might also be able to find a better stock than BetterLife Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BetterLife Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6909

BetterLife Holding

Provides automobile dealership services with a focus on luxury and ultra-luxury brands in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives