- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6110

Topsports (SEHK:6110) Margin Decline Undercuts Bullish Growth Narratives as Premium Valuation Persists

Reviewed by Simply Wall St

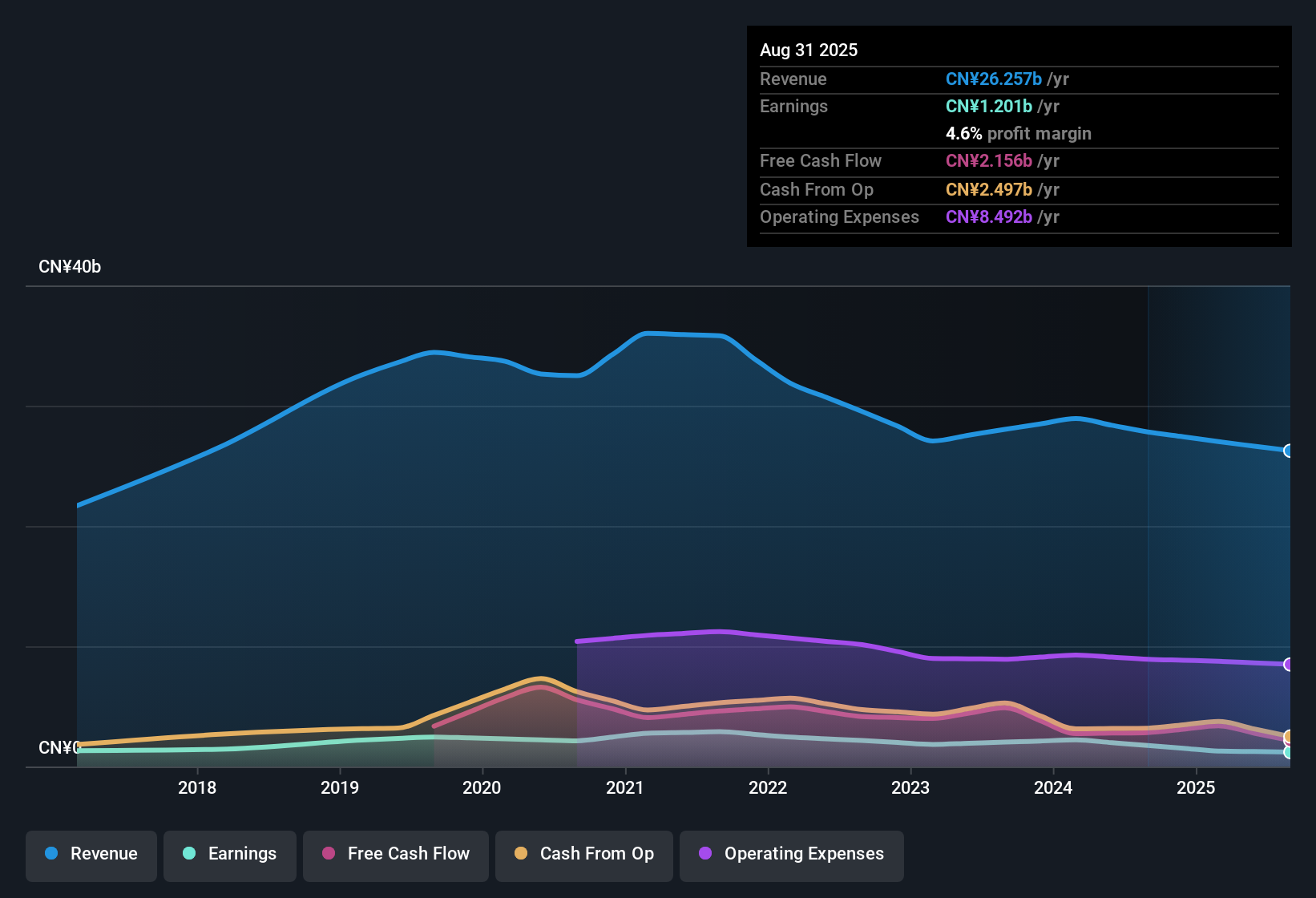

Topsports International Holdings (SEHK:6110) posted a 13.3% annual decline in earnings over the past five years, with net profit margins dipping to 4.6% from last year's 6.3%. Despite this, analysts now forecast the company to deliver 14.2% annual earnings growth going forward, even as revenue is only expected to grow at 4.1% per year, which lags behind the Hong Kong market average of 8.6%. Margin compression remains front of mind for investors as they weigh upbeat earnings forecasts against slower sales growth and premium valuation multiples.

See our full analysis for Topsports International Holdings.Next up, we will see how these headline results compare with the main narratives in the market, and whether the popular stories need to be updated in light of the latest numbers.

See what the community is saying about Topsports International Holdings

Inventory and Online Shift Shape Margins

- Online sales saw double-digit year-on-year growth while traditional offline sales declined, prompting a strategic push toward digital channels and deeper promotions to clear excess inventory.

- The analysts' consensus view emphasizes that heavy reliance on inventory clearance through deeper discounts is expected to pressure profit margins in the short term.

- Management believes improved online channel efficiency and collaboration with brand partners could help stabilize or recover margins over time.

- Still, analysts warn that if discounting persists out of necessity, the margin recovery could take longer than optimistic forecasts suggest.

Guidance Signals Caution for Profit Growth

- The company has guided for a 35% to 45% reduction in full-year profit, citing the impact of elevated discounting, weaker offline store performance, and ongoing inventory optimization measures.

- The analysts' consensus view underlines that while a medium-term margin rebound is forecast, with profit margins expected to rise from 4.8% to 6.2% by 2028,

- the near-term decline in pretax sales revenue and offline foot traffic creates significant tension with the optimistic outlook.

- Furthermore, consensus warns that continued pressure on profits may affect dividend sustainability, which is currently a key risk for long-term investors.

Premium Valuation Pricing In Recovery

- Topsports trades at a price-to-earnings ratio of 16.5x, higher than the specialty retail industry average of 13.3x and the peer average of 10.3x. Its HK$3.48 share price stands above the DCF fair value estimate of HK$3.32, though below the analyst target of HK$3.77.

- The analysts' consensus view points out that this premium valuation assumes the company will achieve revenue of CN¥28.6 billion and earnings of CN¥1.8 billion by 2028.

- Some analysts see downside risk if margin expansion and sales growth do not play out as projected, given the current reliance on aggressive discounting and sluggish offline results.

- Investors should sense-check these consensus targets with their own assumptions about how durable Topsports' recovery may truly be.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Topsports International Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your viewpoint and build your narrative in just a few minutes. Do it your way

A great starting point for your Topsports International Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Topsports is grappling with shrinking margins, declining offline sales, and an uncertain path to stable profit growth as discounting pressures mount.

If you want to focus on stocks with steadier expansion and less earnings volatility, check out stable growth stocks screener (2097 results) offering companies that consistently deliver through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topsports International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6110

Topsports International Holdings

An investment holding company, engages in the trading of sportswear products in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives