- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6033

We Think Telecom Digital Holdings (HKG:6033) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Telecom Digital Holdings Limited (HKG:6033) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Telecom Digital Holdings

How Much Debt Does Telecom Digital Holdings Carry?

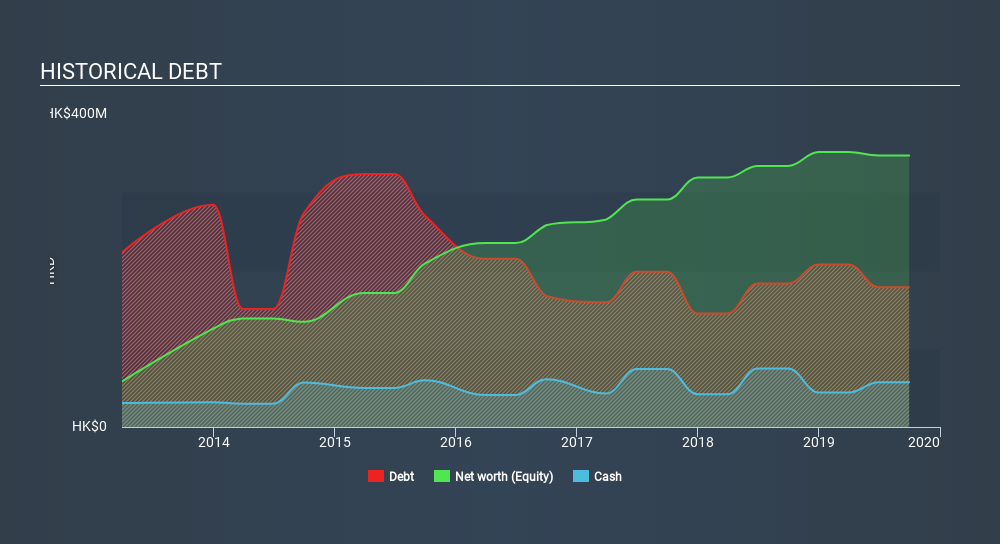

As you can see below, Telecom Digital Holdings had HK$178.6m of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, it does have HK$57.2m in cash offsetting this, leading to net debt of about HK$121.4m.

How Healthy Is Telecom Digital Holdings's Balance Sheet?

We can see from the most recent balance sheet that Telecom Digital Holdings had liabilities of HK$315.0m falling due within a year, and liabilities of HK$28.3m due beyond that. Offsetting this, it had HK$57.2m in cash and HK$32.1m in receivables that were due within 12 months. So its liabilities total HK$254.0m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Telecom Digital Holdings is worth HK$1.05b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Telecom Digital Holdings's net debt is only 0.75 times its EBITDA. And its EBIT easily covers its interest expense, being 18.4 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the other side of the story is that Telecom Digital Holdings saw its EBIT decline by 3.7% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But it is Telecom Digital Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Telecom Digital Holdings recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Telecom Digital Holdings's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But truth be told we feel its EBIT growth rate does undermine this impression a bit. When we consider the range of factors above, it looks like Telecom Digital Holdings is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Telecom Digital Holdings , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:6033

Telecom Digital Holdings

An investment holding company, engages in the telecommunications and related businesses in Hong Kong and the People’s Republic of China.

Medium-low risk established dividend payer.

Market Insights

Community Narratives