- Hong Kong

- /

- Specialty Stores

- /

- SEHK:590

Luk Fook (SEHK:590) Valuation in Focus After Strong Second Quarter Sales Growth Announcement

Reviewed by Simply Wall St

Luk Fook Holdings (International) (SEHK:590) just reported its second quarter sales results, showing overall RSV, retailing revenue, and same-store sales all increased from the previous quarter by 18%, 15%, and 10% respectively.

See our latest analysis for Luk Fook Holdings (International).

Luk Fook Holdings (International) has seen its momentum build impressively this year, with a 1-year total shareholder return of 81.9% and a 21.7% share price return over the past 90 days. With the latest jump in both sales and revenue capturing investor attention, the stock’s upward trend suggests growing confidence in its growth potential and business outlook.

If strong sales recoveries have you looking for what else is on the move, now is the perfect moment to discover fast growing stocks with high insider ownership

With Luk Fook’s shares climbing steadily on the back of strong growth figures, investors may be asking if there is still value left to uncover or if the market is already pricing in all the good news.

Most Popular Narrative: 1.9% Undervalued

Luk Fook Holdings (International) last closed at HK$25.8, just below what the most widely followed narrative considers its fair value. The debate now centers on how future expansion and efficiency initiatives might play out for the company.

Luk Fook is enhancing operational efficiency through supply chain transformation and automation, which might improve net margins by reducing costs over time. The company is focusing on brand strengthening and expanding its multi-brand strategy to appeal to various market segments, such as middle-class weddings and Gen Z. This approach could drive revenue growth through broader consumer engagement.

Want to know the numbers fueling this modest undervaluation? The narrative weaves together a story of accelerating sales, improved margins, and a bold shift in brand strategy. Discover which forecasts are moving the needle and what this could mean for share price momentum.

Result: Fair Value of $26.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weak demand for diamond products and rising operational costs could present challenges to Luk Fook Holdings (International)’s positive outlook and future earnings growth.

Find out about the key risks to this Luk Fook Holdings (International) narrative.

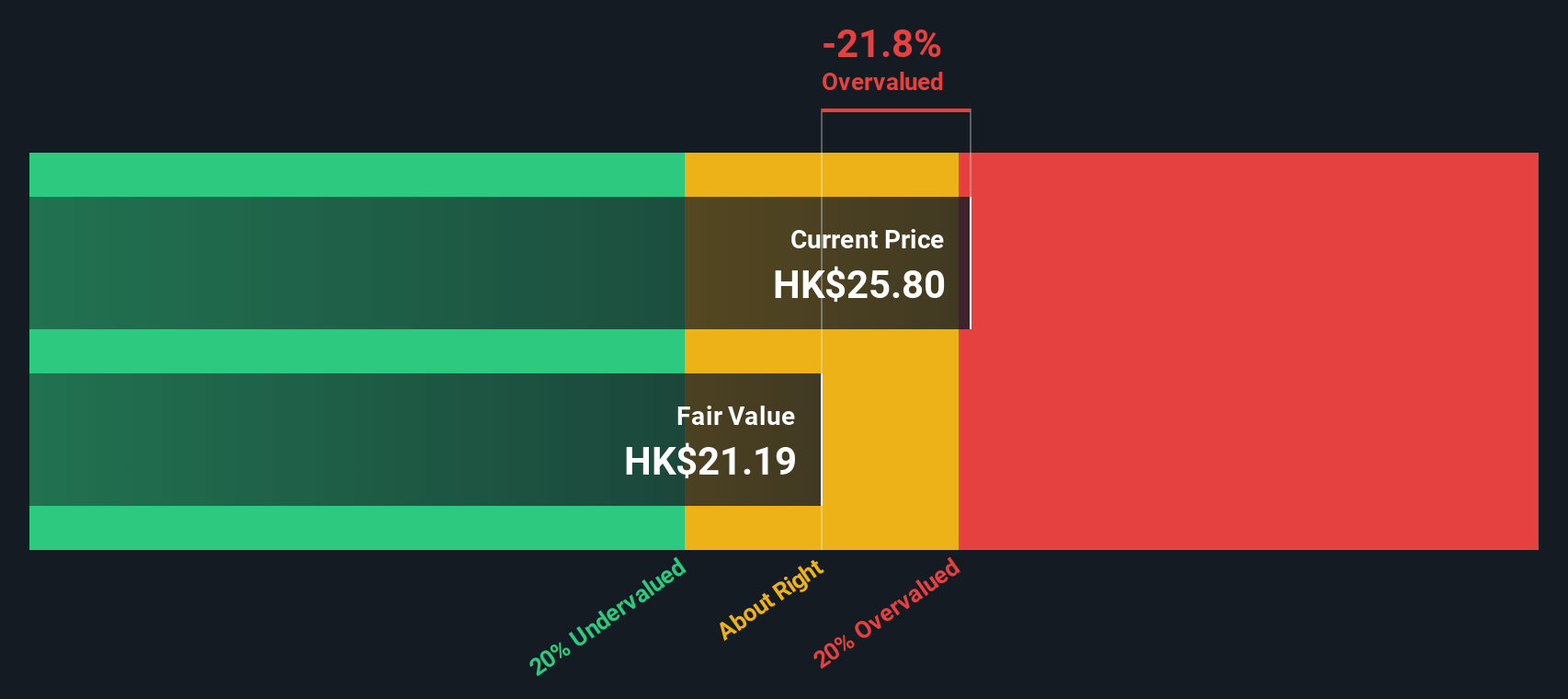

Another View: Discounted Cash Flow Perspective

While analysts see Luk Fook Holdings (International) as modestly undervalued, our SWS DCF model offers a contrasting take. According to this approach, the shares are trading above their fair value estimate of HK$21.23. This suggests the market may already be factoring in much of the positive news. Are expectations getting ahead of fundamentals, or is there more upside to come?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luk Fook Holdings (International) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luk Fook Holdings (International) Narrative

If you have your own perspective or want to dive deeper, you can craft your own Luk Fook Holdings (International) narrative in under three minutes, tailored to your insights. Do it your way

A great starting point for your Luk Fook Holdings (International) research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Missing out on tomorrow's standout stocks is never worth it. Seize your edge by tapping into hand-picked opportunities tailored for forward-thinking investors.

- Capitalize on overlooked bargains before the crowd by reviewing these 877 undervalued stocks based on cash flows, which are trading below their true worth.

- Ride the surge of innovation by targeting potential growth leaders within these 27 AI penny stocks, which are disrupting industries with advanced machine intelligence.

- Secure consistent income streams by finding these 17 dividend stocks with yields > 3%, delivering yields above 3% and rewarding shareholders even in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:590

Luk Fook Holdings (International)

An investment holding company, engages in sourcing, designing, wholesaling, trademark licensing, and retailing various gold and platinum jewelry, and gem-set jewelry products in Hong Kong and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives