- China

- /

- Auto Components

- /

- SHSE:601163

3 Reliable Dividend Stocks Offering Up To 9.5% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of fluctuating consumer confidence and economic indicators, investors are seeking stability amidst moderate gains in major stock indexes. In this environment, dividend stocks can offer a reliable income stream, especially those with strong fundamentals and attractive yields.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

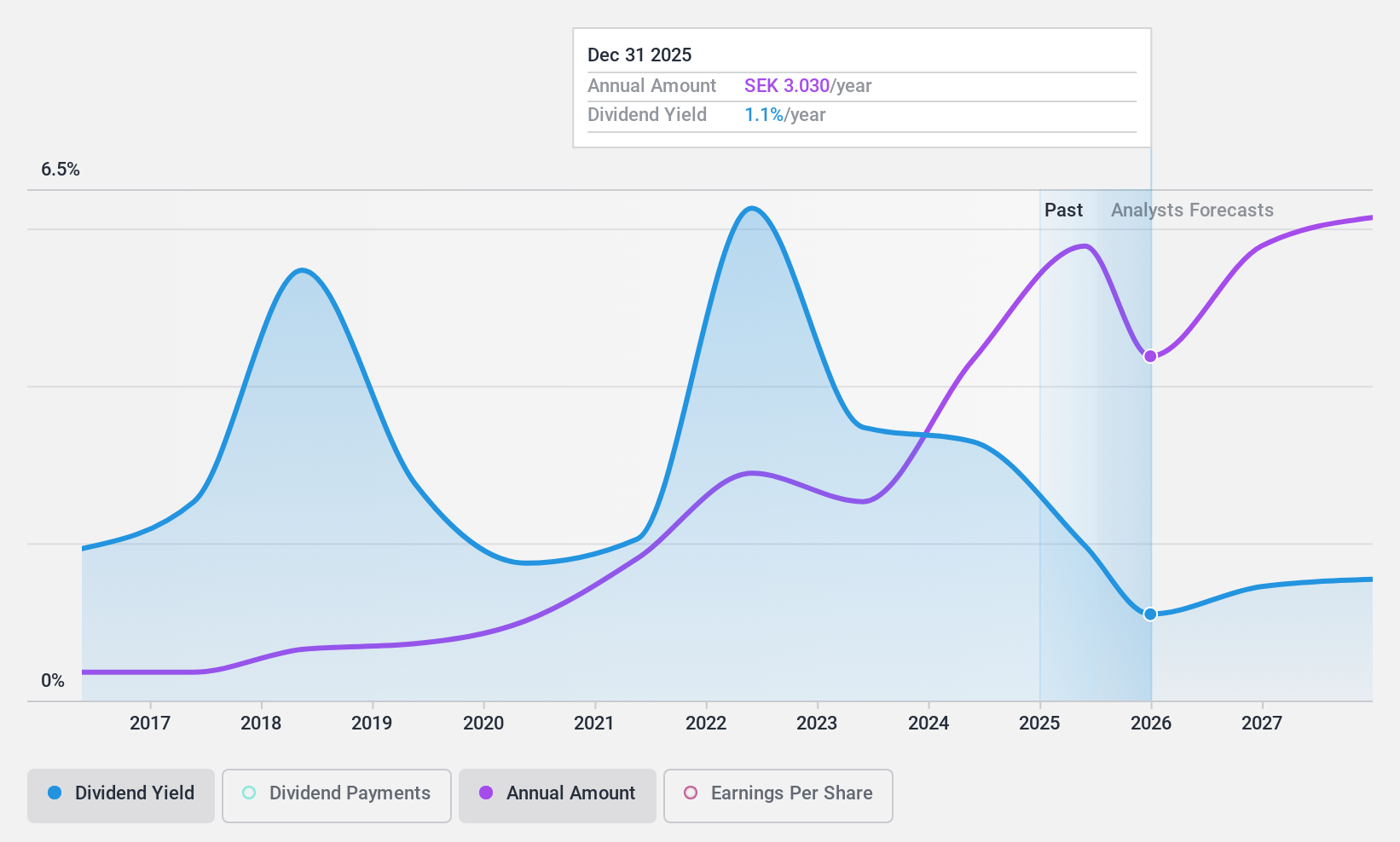

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK2.95 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino segment, including VMA Life, with SEK1.92 billion, and Faun contributing SEK177.37 million.

Dividend Yield: 3.5%

Zinzino's dividend profile is marked by a decade of stable and growing payments, supported by earnings with a payout ratio of 60.1% and cash flow coverage at 85.3%. While its dividend yield of 3.55% is below the top tier in Sweden, the company's ongoing revenue growth—evidenced by a year-to-date increase to SEK 1.96 billion—suggests potential for future dividend sustainability amid strategic international expansions like the recent launch in the Canary Islands.

- Click to explore a detailed breakdown of our findings in Zinzino's dividend report.

- Our comprehensive valuation report raises the possibility that Zinzino is priced lower than what may be justified by its financials.

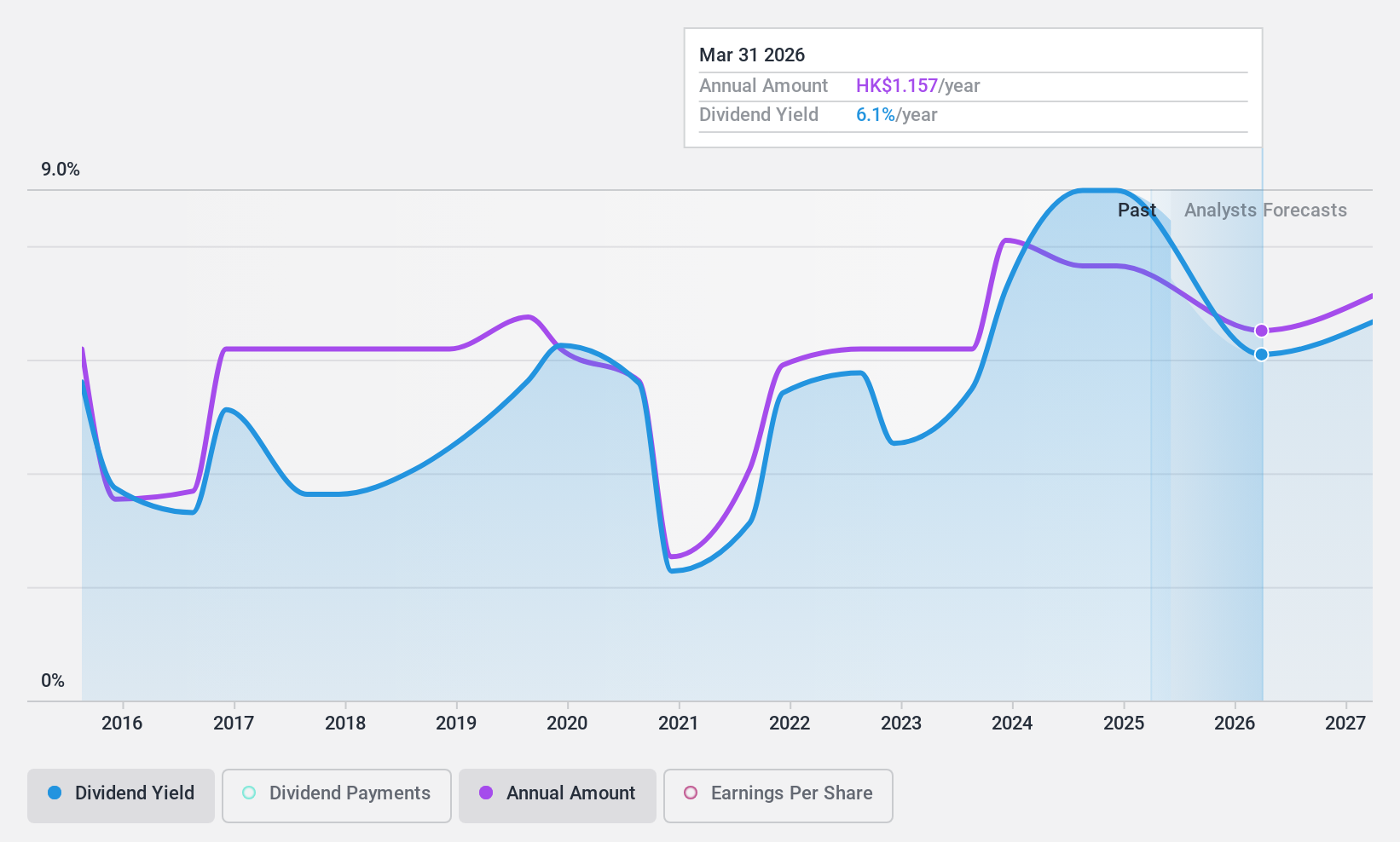

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luk Fook Holdings (International) Limited is an investment holding company involved in sourcing, designing, wholesaling, trademark licensing, and retailing gold and platinum jewelry and gem-set jewelry products, with a market cap of HK$8.40 billion.

Operations: Luk Fook Holdings (International) Limited generates revenue from various segments, including Licensing (HK$892.75 million), Retailing in Mainland China (HK$2.81 billion), Wholesaling in Hong Kong (HK$2.06 billion), Wholesaling in Mainland China (HK$1.08 billion), and Retailing in Hong Kong, Macau, and Overseas markets (HK$8.66 billion).

Dividend Yield: 9.5%

Luk Fook Holdings (International) Limited's dividend profile shows volatility, with recent decreases in payouts. The interim cash dividend of HK$0.55 per share reflects a cautious approach amid declining sales and profits, impacted by gold hedging losses. Despite this, the company's dividends are well-covered by earnings and cash flows, boasting a payout ratio of 55.5% and a cash payout ratio of 42%. Trading significantly below estimated fair value suggests potential for capital appreciation alongside its high dividend yield in Hong Kong's market.

- Get an in-depth perspective on Luk Fook Holdings (International)'s performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Luk Fook Holdings (International) shares in the market.

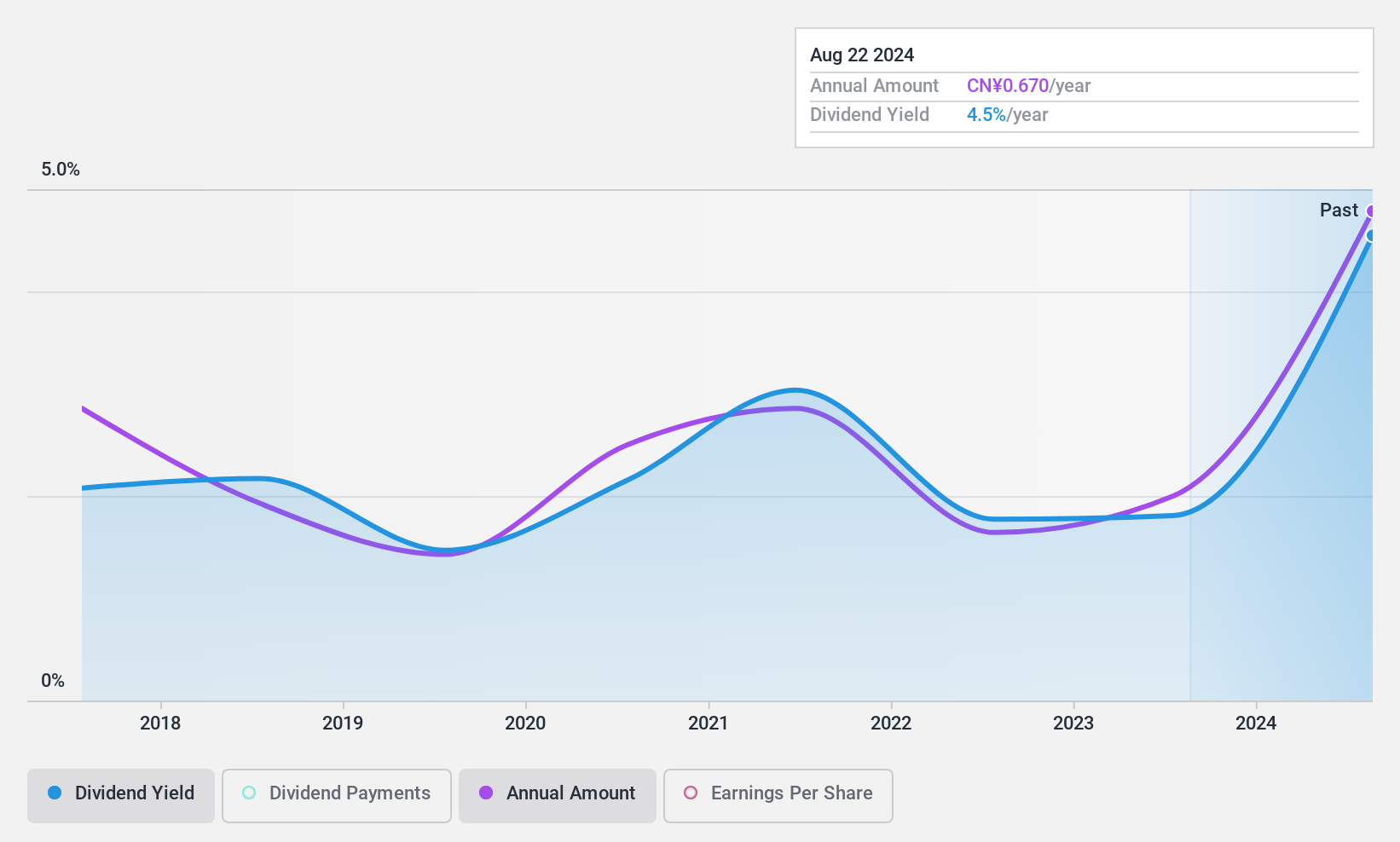

Triangle TyreLtd (SHSE:601163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Triangle Tyre Co., Ltd is involved in the research, development, design, manufacture, and marketing of tire products in China with a market cap of CN¥12.34 billion.

Operations: Triangle Tyre Co., Ltd generates revenue of CN¥10.16 billion from its tire industry segment.

Dividend Yield: 4.3%

Triangle Tyre Ltd's dividend profile is characterized by a high yield of 4.35%, placing it in the top 25% in China. While dividends are well-covered by earnings (43.8% payout ratio) and cash flows (55.6% cash payout ratio), their volatility over the past seven years raises concerns about reliability. The stock trades at a significant discount to its estimated fair value, presenting potential for capital gains despite recent declines in sales and net income for the first nine months of 2024.

- Dive into the specifics of Triangle TyreLtd here with our thorough dividend report.

- The valuation report we've compiled suggests that Triangle TyreLtd's current price could be quite moderate.

Summing It All Up

- Get an in-depth perspective on all 1943 Top Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triangle TyreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601163

Triangle TyreLtd

Engages in the research and development, design, manufacture, and marketing of tire products in China.

Flawless balance sheet, undervalued and pays a dividend.