As global markets adjust to recent interest rate cuts by the ECB and SNB, investors are keenly watching the Federal Reserve's upcoming decision, with expectations of another rate cut. Amid these shifting economic conditions, penny stocks continue to attract attention for their potential to offer growth opportunities at lower price points. Although often overlooked, these smaller or newer companies can present unique investment prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £783.67M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.22M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

Click here to see the full list of 5,790 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China and has a market capitalization of approximately HK$45.04 billion.

Operations: The company's revenue is primarily derived from Down Apparels at CN¥20.66 billion, with additional contributions from Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion, Ladieswear Apparels at CN¥735.22 million, and Diversified Apparels at CN¥254.12 million.

Market Cap: HK$45.04B

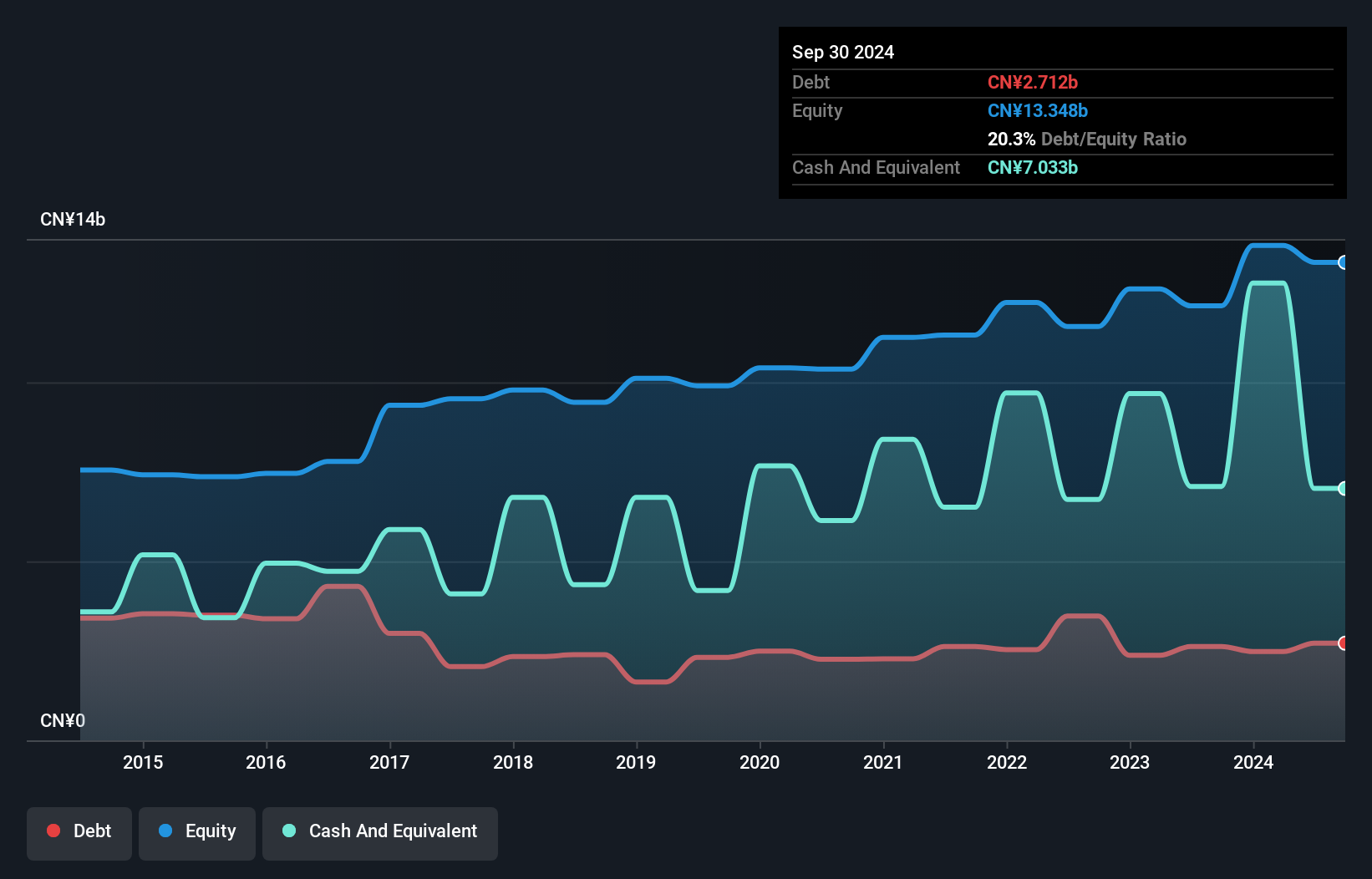

Bosideng International Holdings has shown robust financial health with short-term assets of CN¥19.6 billion exceeding both its short and long-term liabilities, indicating strong liquidity. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, reflecting prudent financial management. Recent earnings growth of 41.4% surpasses its five-year average and the luxury industry's growth rate, highlighting accelerated profit expansion. Despite trading below fair value estimates by analysts who foresee a potential price increase, Bosideng's dividend history remains unstable. The strategic partnership with Moose Knuckles supports international expansion efforts.

- Click to explore a detailed breakdown of our findings in Bosideng International Holdings' financial health report.

- Learn about Bosideng International Holdings' future growth trajectory here.

Goldlion Holdings (SEHK:533)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goldlion Holdings Limited is an investment holding company that manufactures and distributes apparel in China Mainland, Hong Kong SAR, and Singapore, with a market cap of HK$1.35 billion.

Operations: The company's revenue is primarily derived from its Apparel segment in China Mainland and Hong Kong SAR, which generated HK$969.43 million, followed by Property Investment and Development at HK$280.01 million, and Apparel in Singapore contributing HK$36.51 million.

Market Cap: HK$1.35B

Goldlion Holdings Limited, with a market cap of HK$1.35 billion, primarily generates revenue from its Apparel segment in China Mainland and Hong Kong SAR. Despite being debt-free for five years, the company faces challenges with declining earnings growth of -36.2% over the past year and reduced net profit margins from 10.3% to 7.5%. A significant one-off loss of HK$45.8 million has impacted recent financial results, contributing to increased share price volatility over the last three months. While short-term assets significantly cover liabilities, dividend sustainability is questionable due to insufficient free cash flow coverage.

- Dive into the specifics of Goldlion Holdings here with our thorough balance sheet health report.

- Examine Goldlion Holdings' past performance report to understand how it has performed in prior years.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in auto parts, Internet games, and cloud data sectors both in China and internationally, with a market cap of CN¥34.71 billion.

Operations: No specific revenue segments are reported for Zhejiang Century Huatong Group Co., Ltd.

Market Cap: CN¥34.71B

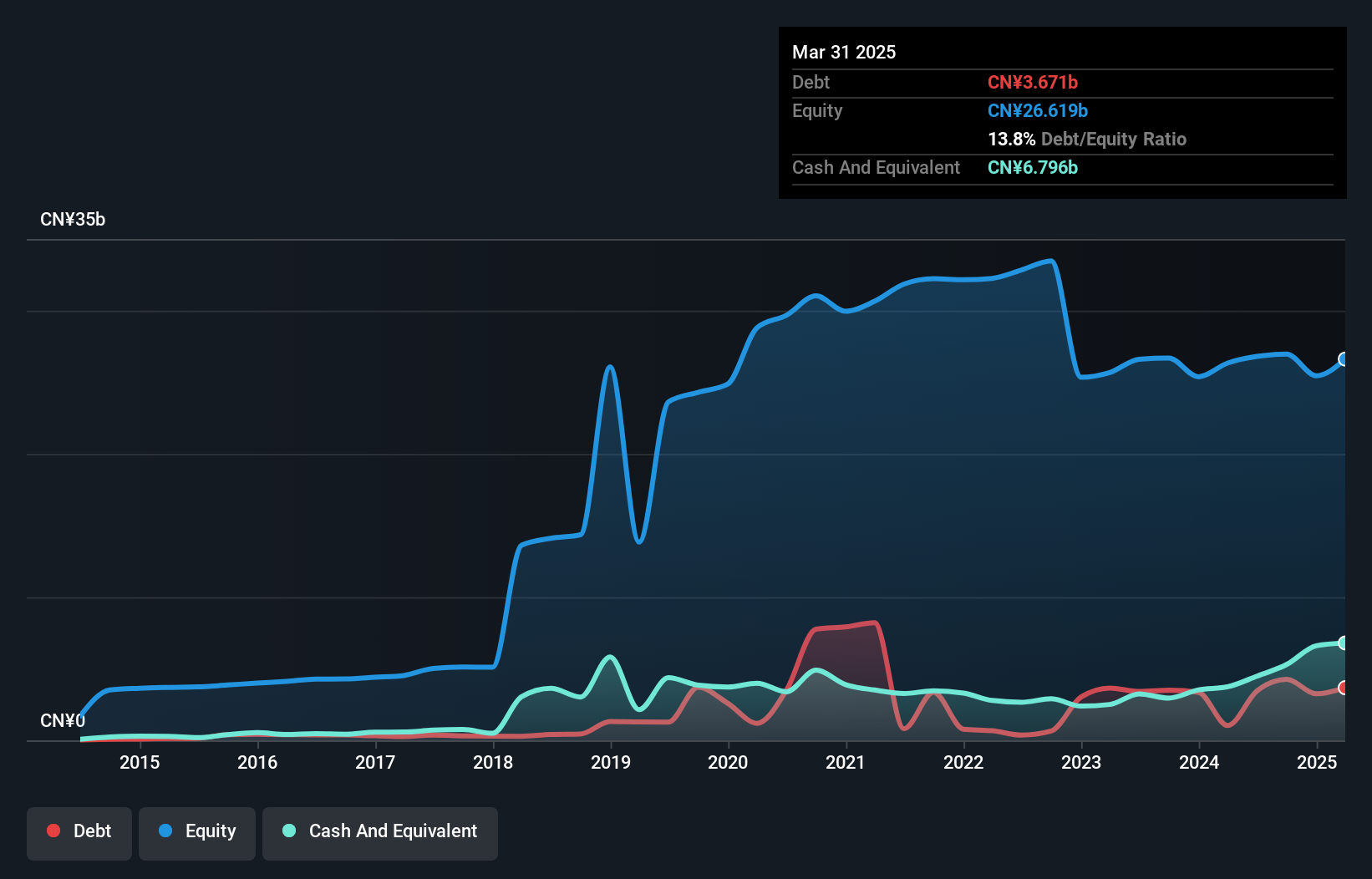

Zhejiang Century Huatong Group Co., Ltd, with a market cap of CN¥34.71 billion, has recently faced challenges as it was removed from several major indexes, including the Shenzhen Stock Exchange Component Index and FTSE All-World Index. Despite these setbacks, the company reported strong financial results for the nine months ending September 2024, with revenues reaching CN¥15.53 billion and net income at CN¥1.80 billion. The company's short-term assets exceed both its long-term and short-term liabilities, indicating solid liquidity management. Additionally, its debt is well-covered by operating cash flow, suggesting prudent financial practices amidst recent volatility in earnings growth rates.

- Unlock comprehensive insights into our analysis of Zhejiang Century Huatong GroupLtd stock in this financial health report.

- Review our growth performance report to gain insights into Zhejiang Century Huatong GroupLtd's future.

Next Steps

- Embark on your investment journey to our 5,790 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives