- Hong Kong

- /

- Retail Distributors

- /

- SEHK:444

Risks Still Elevated At These Prices As Sincere Watch (Hong Kong) Limited (HKG:444) Shares Dive 29%

To the annoyance of some shareholders, Sincere Watch (Hong Kong) Limited (HKG:444) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

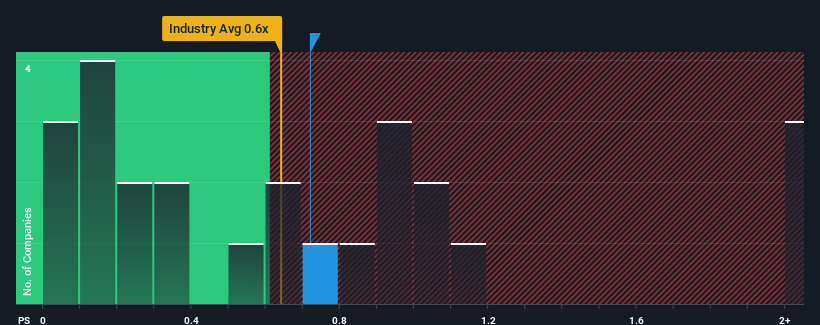

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Sincere Watch (Hong Kong)'s P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Retail Distributors industry in Hong Kong is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sincere Watch (Hong Kong)

How Sincere Watch (Hong Kong) Has Been Performing

Sincere Watch (Hong Kong) has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sincere Watch (Hong Kong) will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Sincere Watch (Hong Kong)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Still, lamentably revenue has fallen 9.1% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this information, we find it concerning that Sincere Watch (Hong Kong) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Sincere Watch (Hong Kong)'s P/S Mean For Investors?

Following Sincere Watch (Hong Kong)'s share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Sincere Watch (Hong Kong) revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Sincere Watch (Hong Kong) (of which 1 is a bit concerning!) you should know about.

If you're unsure about the strength of Sincere Watch (Hong Kong)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:444

Sincere Watch (Hong Kong)

An investment holding company, distributes branded luxury watches, timepieces, and accessories in Hong Kong, Macau, Taiwan, Korea, the People’s Republic of China, and internationally.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026