- Hong Kong

- /

- Specialty Stores

- /

- SEHK:393

Undervalued Opportunities Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed performances, with major U.S. indexes hitting record highs while others like the Russell 2000 face declines, investors are keenly observing opportunities across different sectors. Penny stocks may seem like a term from the past, but they continue to offer intriguing possibilities for growth, particularly among smaller or newer companies that are often overlooked. When these stocks demonstrate strong financial health and solid fundamentals, they can provide attractive prospects for those willing to explore this unique segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £808.16M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £159.32M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Glorious Sun Enterprises (SEHK:393)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Glorious Sun Enterprises Limited is an investment holding company involved in the interior decoration and renovation business across Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and other international markets with a market cap of HK$1.73 billion.

Operations: The company's revenue is primarily generated from its interior decoration and renovation segment at HK$390.31 million, followed by export operations at HK$303.86 million, financial investments at HK$143.19 million, and retail, franchise, and others contributing HK$59.61 million.

Market Cap: HK$1.73B

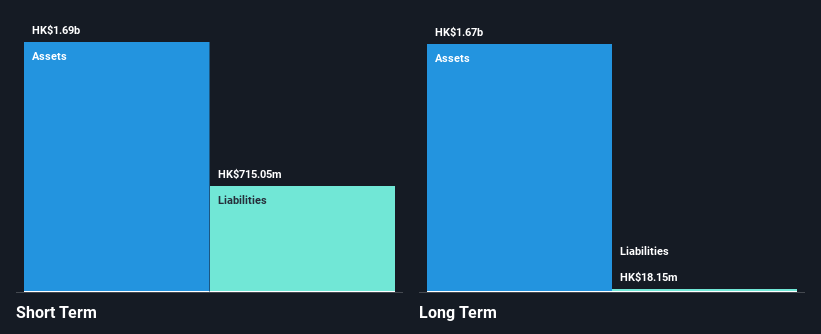

Glorious Sun Enterprises, with a market cap of HK$1.73 billion, primarily generates revenue from its interior decoration and renovation segment. The company has shown a recent earnings growth of 23.8%, surpassing the industry average, despite a significant one-off loss impacting financial results. Its debt is well covered by operating cash flow, indicating strong financial management, and it holds more cash than total debt. However, the return on equity remains low at 2%. Trading below estimated fair value suggests potential for price appreciation but dividend sustainability is questionable due to insufficient coverage by earnings or free cash flows.

- Take a closer look at Glorious Sun Enterprises' potential here in our financial health report.

- Examine Glorious Sun Enterprises' past performance report to understand how it has performed in prior years.

HG Semiconductor (SEHK:6908)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HG Semiconductor Limited is an investment holding company that designs, develops, manufactures, subcontracts, and sells semiconductor products in the People’s Republic of China with a market cap of HK$450.63 million.

Operations: The company's revenue is primarily derived from LED Products, totaling CN¥74.56 million, and GaN and Other Semiconductor Products, contributing CN¥2.39 million.

Market Cap: HK$450.63M

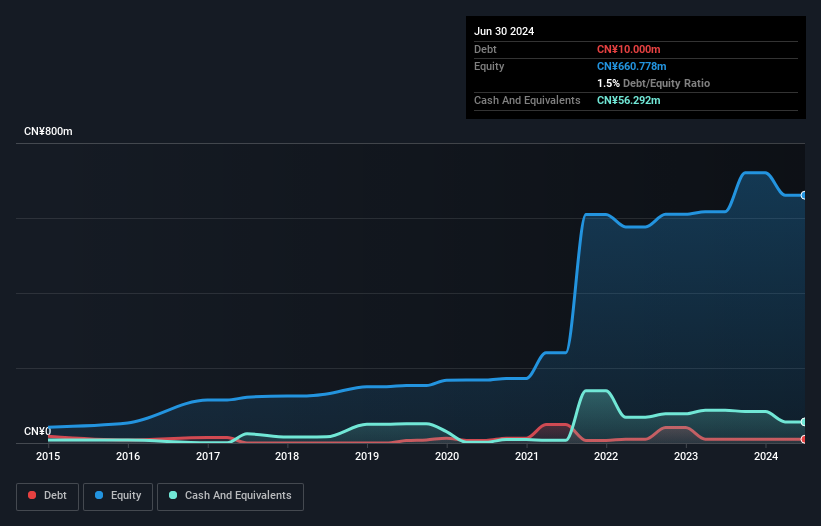

HG Semiconductor, with a market cap of HK$450.63 million, derives most of its revenue from LED products (CN¥74.56 million) and lesser from GaN and other semiconductor products (CN¥2.39 million). The company is unprofitable, with losses increasing by 34.3% annually over five years, and has a negative return on equity (-24.64%). Despite high volatility in its share price recently, it reduced its debt to equity ratio to 1.5%. Its short-term assets significantly cover liabilities, but cash runway concerns persist despite recent capital raising efforts through a HKD 90 million follow-on equity offering in November 2024.

- Click here to discover the nuances of HG Semiconductor with our detailed analytical financial health report.

- Understand HG Semiconductor's track record by examining our performance history report.

Pan Hong Holdings Group (SGX:P36)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pan Hong Holdings Group Limited is an investment holding company focused on developing residential and commercial properties in second and third-tier cities in the People’s Republic of China, with a market cap of SGD50.72 million.

Operations: The company's revenue is primarily generated from its property development segment, amounting to CN¥216.88 million.

Market Cap: SGD50.72M

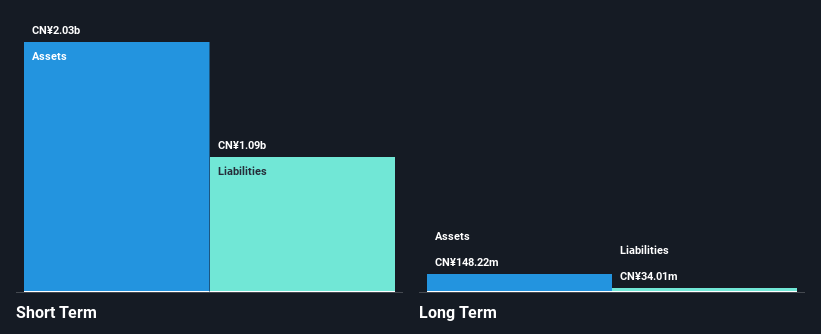

Pan Hong Holdings Group, with a market cap of SGD50.72 million, primarily generates revenue from property development in China’s second and third-tier cities. Recent earnings showed a significant decline in sales to CN¥32 million for the half year ended September 2024, compared to CN¥164.2 million the previous year, resulting in a net loss of CN¥2.19 million. The company's net debt to equity ratio stands at 2.5%, considered satisfactory, though its debt has increased over five years. Despite experienced management and adequate asset coverage for liabilities, profit margins have decreased and earnings growth remains negative over recent periods.

- Get an in-depth perspective on Pan Hong Holdings Group's performance by reading our balance sheet health report here.

- Assess Pan Hong Holdings Group's previous results with our detailed historical performance reports.

Make It Happen

- Jump into our full catalog of 5,707 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:393

Glorious Sun Enterprises

An investment holding company, engages in interior decoration and renovation business in Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives