- Hong Kong

- /

- Specialty Stores

- /

- SEHK:393

Promising Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

Global markets have been navigating a mix of tariff uncertainties and robust earnings reports, with U.S. stocks experiencing slight declines amidst these developments. As investors sift through the noise, they often seek opportunities in areas like penny stocks—an investment category that, despite its somewhat outdated label, continues to attract attention due to its potential for growth and value. These smaller or newer companies can offer unique opportunities when supported by strong financials, making them an intriguing option for those looking beyond the usual market giants.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.35B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.17 | HK$742.7M | ★★★★★★ |

Click here to see the full list of 5,700 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Keck Seng Investments (Hong Kong) (SEHK:184)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Keck Seng Investments (Hong Kong) Limited is an investment holding company involved in hotel and club operations, as well as property investment and development across Macau, Vietnam, the People's Republic of China, Japan, Canada, the United States, and Hong Kong with a market cap of HK$802.87 million.

Operations: The company generates revenue from its hotel operations in Japan (HK$28.01 million), Canada (HK$56.23 million), Vietnam (HK$687.34 million), the United States (HK$801.38 million), and the People's Republic of China (HK$41.31 million), as well as from property activities in Macau (HK$98.81 million).

Market Cap: HK$802.87M

Keck Seng Investments (Hong Kong) is trading at 66.2% below its estimated fair value, suggesting potential undervaluation. The company has demonstrated robust earnings growth of 128.4% over the past year, significantly outpacing the hospitality industry's average growth rate. Its financial health appears solid, with short-term assets exceeding both short-term and long-term liabilities and more cash than total debt. However, earnings quality is impacted by a large one-off gain of HK$224.3 million in recent results, and its dividend history remains unstable. Return on equity is relatively low at 9.7%, but interest payments are well covered by EBIT at 9.8 times coverage.

- Dive into the specifics of Keck Seng Investments (Hong Kong) here with our thorough balance sheet health report.

- Evaluate Keck Seng Investments (Hong Kong)'s historical performance by accessing our past performance report.

Glorious Sun Enterprises (SEHK:393)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Glorious Sun Enterprises Limited is an investment holding company involved in interior decoration and renovation across Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and internationally with a market cap of approximately HK$1.83 billion.

Operations: The company's revenue segments include HK$390.31 million from interior decoration and renovation, HK$303.86 million from export operations, HK$143.19 million from financial investments, and HK$59.61 million from retail, franchise, and other activities.

Market Cap: HK$1.83B

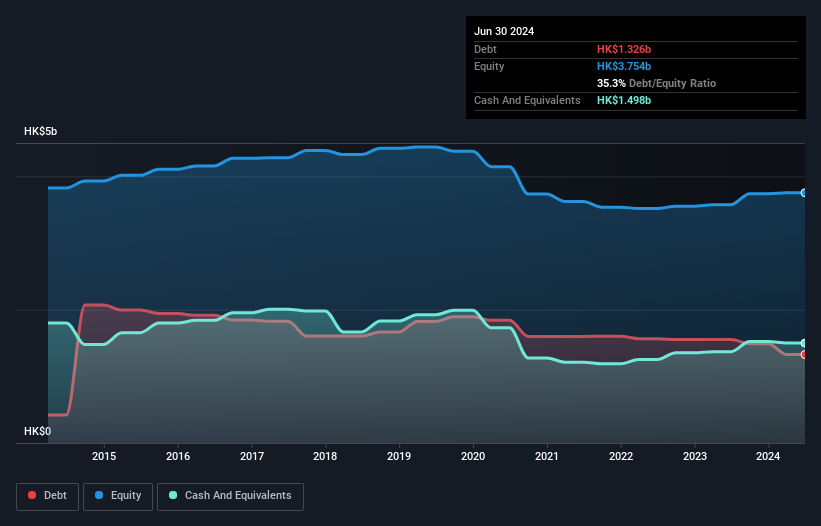

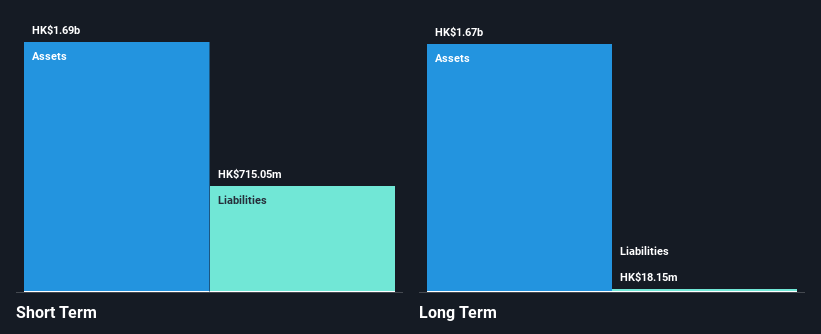

Glorious Sun Enterprises is trading at 36.2% below its estimated fair value, indicating potential undervaluation in the market. Despite a large one-off loss of HK$173.4 million impacting recent financial results, the company maintains strong financial health with short-term assets of HK$1.7 billion exceeding both short-term and long-term liabilities and more cash than total debt. Earnings growth over the past year was robust at 23.8%, surpassing industry averages, although return on equity remains low at 2%. The dividend yield of 7.21% is not well covered by earnings or free cash flow, raising sustainability concerns.

- Click to explore a detailed breakdown of our findings in Glorious Sun Enterprises' financial health report.

- Gain insights into Glorious Sun Enterprises' historical outcomes by reviewing our past performance report.

Geo Energy Resources (SGX:RE4)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geo Energy Resources Limited is an investment holding company involved in the mining, production, and trading of coal with a market capitalization of SGD381.84 million.

Operations: Geo Energy Resources Limited has not reported any specific revenue segments.

Market Cap: SGD381.84M

Geo Energy Resources, with a market cap of SGD381.84 million, is strategically expanding its infrastructure to enhance logistical efficiency and diversify revenue streams. The company is investing USD150 million in an Integrated Infrastructure project in South Sumatra, expected to boost coal transport capacity significantly by 2026. Despite stable weekly volatility and satisfactory debt levels (net debt to equity at 10.9%), challenges include negative operating cash flow and interest coverage below optimal levels (2.3x EBIT). While trading at a good value compared to peers, the dividend yield of 7.25% raises concerns about sustainability due to insufficient free cash flow coverage.

- Jump into the full analysis health report here for a deeper understanding of Geo Energy Resources.

- Gain insights into Geo Energy Resources' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Gain an insight into the universe of 5,700 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:393

Glorious Sun Enterprises

An investment holding company, engages in interior decoration and renovation business in Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives